Overnight – Growth stocks hit as Hawkish Fed repeats “higher for longer” message

Growth stocks took a tumble overnight as the Federal Reserve kept rates steady and maintained its forecast for one more rate hike this year. In the post announcement press conference, Fed Chair Powell reiterated the central bank would maintain a higher-for-longer rate regime by reining in the number of rate cuts for next year.

Treasury yields cut intraday losses and surged to close at fresh cycle highs after the Fed decision. The 2-year Treasury yield, which is more sensitive to interest rate decisions, closed at 5.120%, the highest level since 2006, after falling to a low of 5.049% on the day.

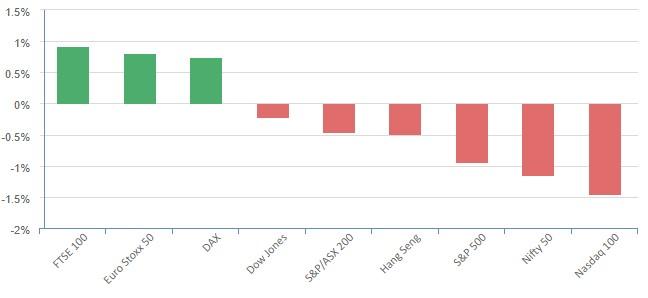

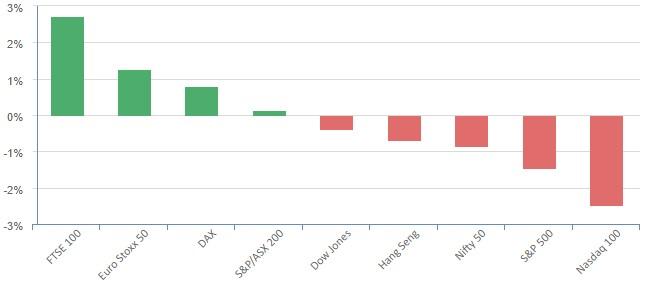

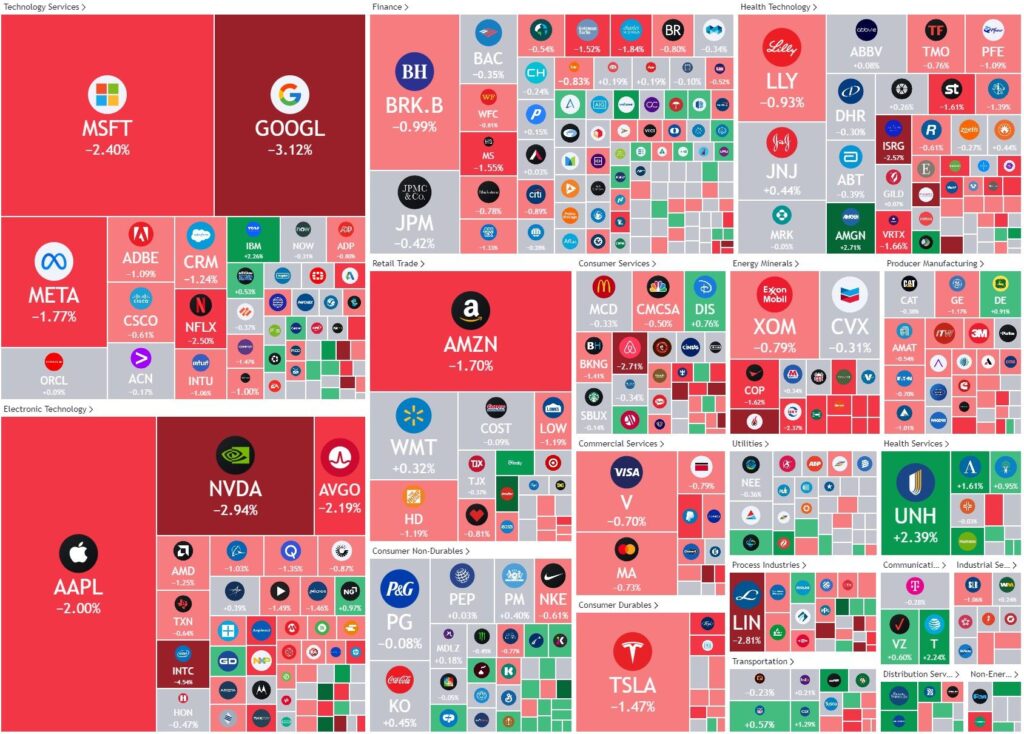

Growth sectors of the marketing including big tech came under pressure from rising Treasury yields, with a 3% fall in Google and Nvidia, a 2% drop in Meta and 1% in Apple.

The growth section of the market, particularly the “magnificent 7” have completely ignored the rise in treasury yields in the last 2 months, which historically has not ended well for investors in the overpriced stocks.

In the last month oil has seen a 25% rally, which will only add to inflation and compound consumer’s pain and diminish disposable income.

While investors have recently rejoiced in slowing economic numbers (as rates wont go any higher and rate cuts might come sooner) the reality is that if the Fed has to cut rates in the next 12-months, it will be because the economy is in trouble, turning the “rejoice” into “regret” for investors currently embracing blind optimism

S&P 500 - Heatmap

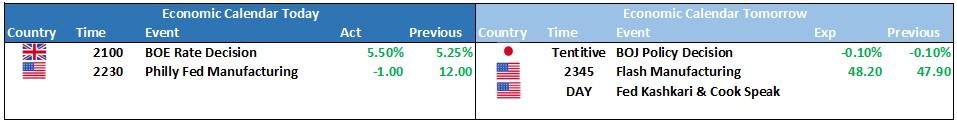

The Day Ahead

ASX SPI 7151 (-0.27%)

We are likely to be in for another heavy day on the ASX with a poor lead from the US and the “higher for longer” message ringing in the ears of investors.

Technically the index looks vulnerable below 7000 and with many highly weighted stocks drifting off peaks, the index will find it hard to hold ground if bond yields continue to rise

We maintain a cautious stance is appropriate and discipline will need to be applied in portfolios if the market gathers downside momentum