Overnight – Bond yields break to fresh 16 year highs ahead of Fed decision

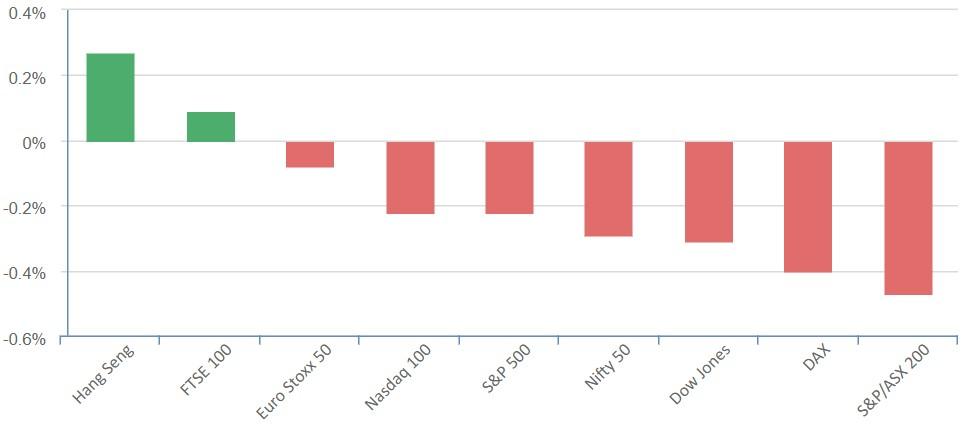

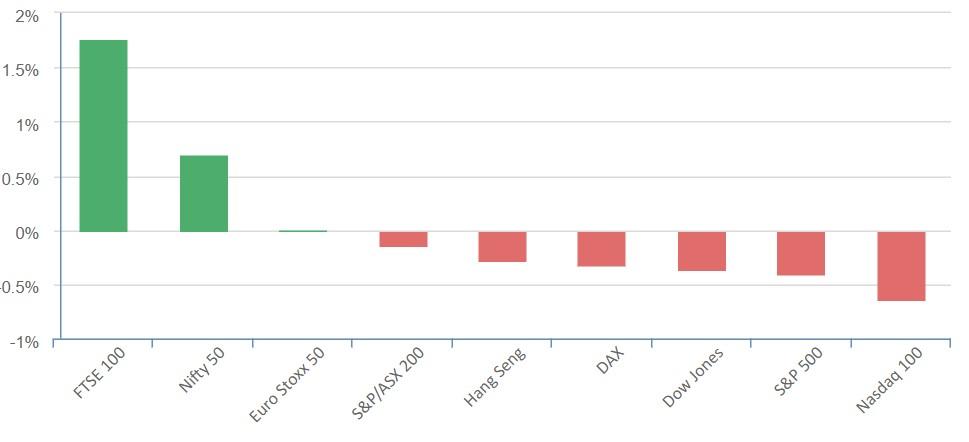

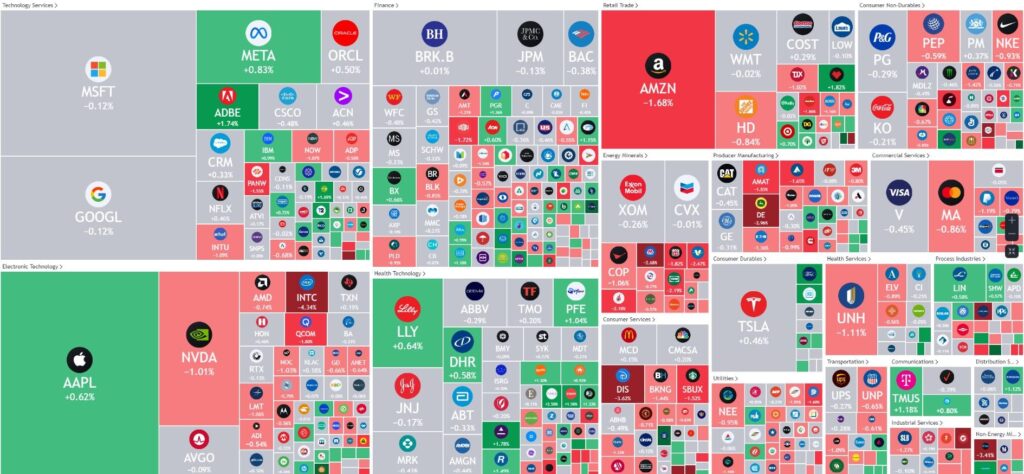

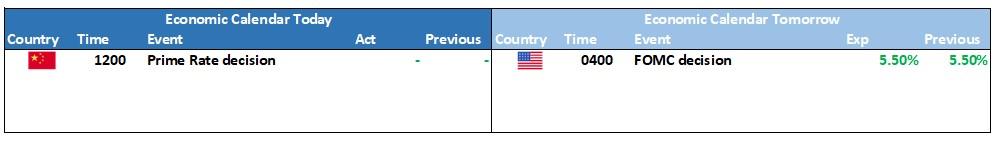

Stocks edged lower overnight as Treasury yields rose to their highest level in more than a decade on fresh inflation concerns as investors awaited the Federal Reserve monetary policy update due Wednesday.

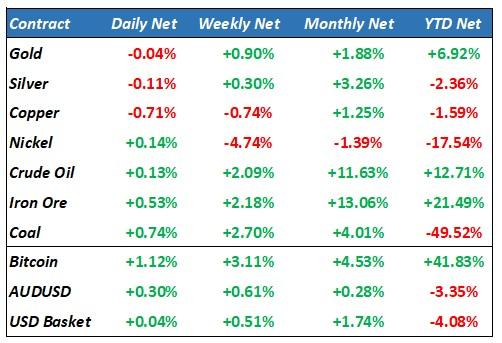

Treasury yields closed at their highest levels since 2006 and 2007, respectively, amid ongoing signs of economic growth and fresh inflationary fears following the recent spike in oil prices.

The recent climb in the oil prices comes just as the Federal Reserve kicked off its two-day meeting that is expected to culminate in unchanged rate decision on Wednesday.

But the updated summary of economic projections, which will accompany the decision, and Fed chairman Jerome Powell’s comments will dominate investor attention amid expectations that the Fed is unlikely to hike rates again.

Concerns over a second wave of inflation, a typical pattern in economic cycles, is weighing on investor sentiment at these levels as a pick up in medical costs, a potential easing in rent deflation and ongoing increase in energy prices could rejuvenate inflation early next year, increasing the risk of a further Fed tightening in the first quarter

Amazon detailed plans to Tuesday to hire 250,000 employees in the U.S. to meet demand ahead of the usual shopping spree into the holiday season a move that will not help the Fed deal with an extremely tight labour market

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7186 (-0.22%)

The ASX is likely to have another soft session with a weak offshore lead and concerns over an oil driven second wave of inflation. with large contributors to the ASX200 like the banks sitting at the top of ranges and the likes of BHP, RIO and FMG recently downgraded after strong runs, the index will find it very difficult to find base

Clues from the Fed tonight on the fate of interest rates r the rest of the year will be key to any rebound.

At MPC we suspect the Fed will deliver a more hawkish than expected statement but press pause on the hiking cycle