Overnight – Quiet session as markets eye Fed decision

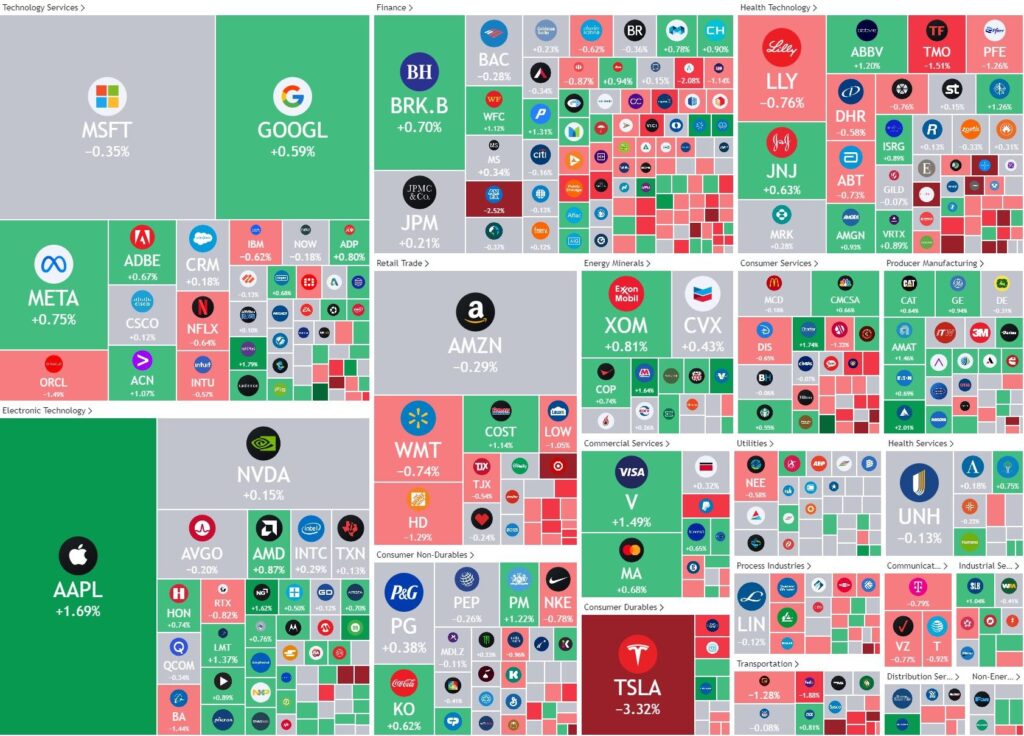

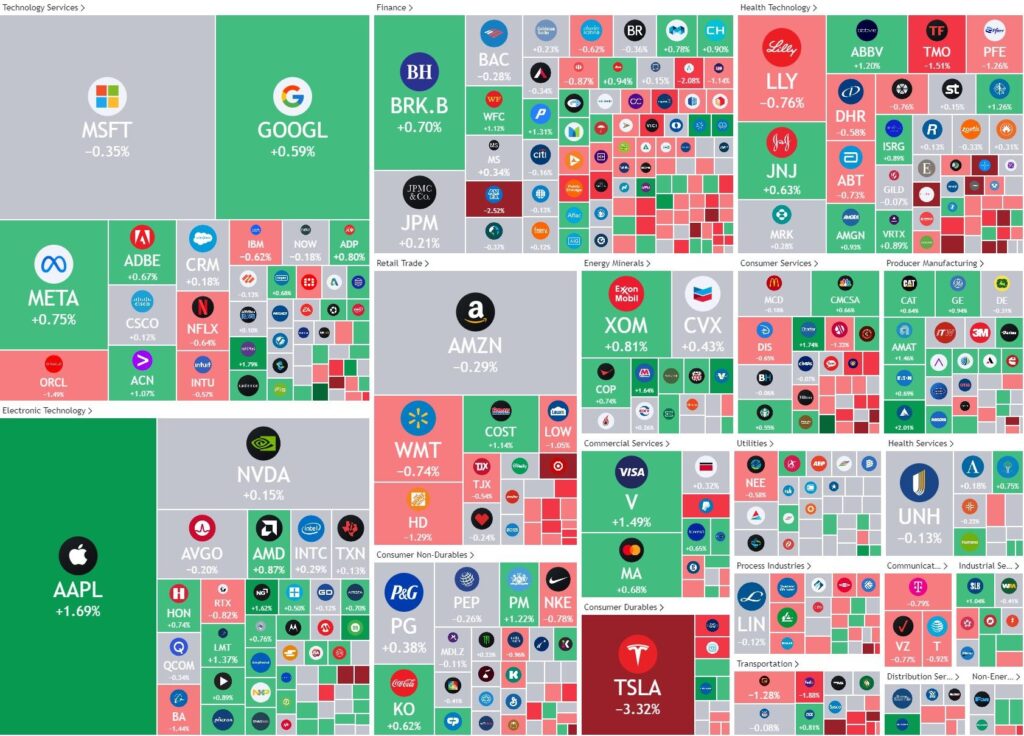

Stocks were flat overnight as gains in tech and energy helped offset Tesla-led weakness in consumer stocks just a day ahead of the Federal Reserve’s two-day meeting.

Apple rose more than 1% as some Wall Street cheered signs of stronger demand for the tech giant’s newly launched iPhone 15, particularly for the higher-priced iPhone Pro and Pro Max models, compared with initial demand for the iPhone 14. iPhone 15 pre-orders began this Friday and so far are tracking much stronger than we and the Street expected and up roughly 10%-12%

Energy stocks, which are up about 20% since July, continued to add to recent gains underpinned by a climb in oil prices to November 2022 highs amid ongoing optimism following recent supply cuts extensions by Saudi Arabia and Russia.

Arm Holdings fell more than 4% as the chip designer lost some momentum following its stock market debut last week.

Despite the slip, shares of ARM remained well above its IPO price of $51 following a 25% on its debut on Nasdaq on Sept. 15.

PayPal and Telsa were both downgraded on growth worries with Goldmans having additional worries around margins for Tesla

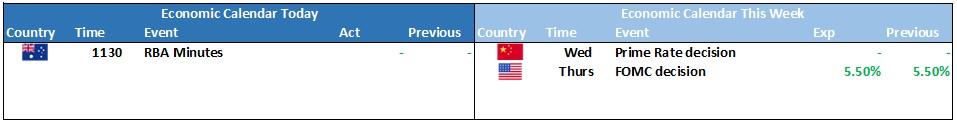

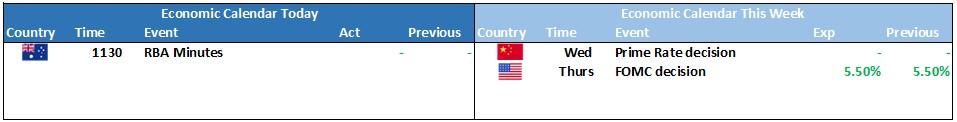

The US10Y briefly tested recent highs of around 4.4% before giving up gains, ahead the Federal Reserve’s two-day meeting on Tuesday, that many expected will end in a decision to hold rates steady. With a skip for September almost fully priced in, many will be watching the projections and commentary from Fed chairman Jerome Powell for clues on the Fed’s next move after the September meeting.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7214 (-0.29%)

With little lead from global markets overnight the ASX is likely to be fairly quiet until the RBA minutes at 1130 as investors look for clues on the future of rates in AU. Commodities remain firm which should help the materials sector.

Markets are likely to remain quiet until the FOMC meeting on Thursday morning (AU time) where commentary from Jerome Powell will be key for equities looking forward