Overnight – Tech sharply lower as semiconductors get reality check

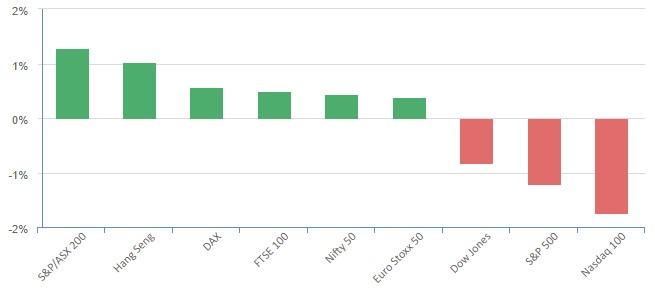

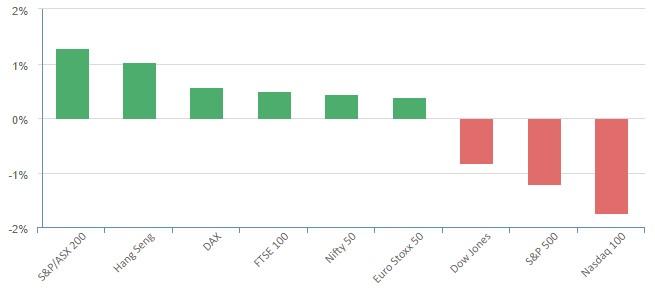

Equities ended sharply lower and Treasury yields headed higher on Friday as plunging chip stocks and mixed economic data dampened investors’ risk appetite, providing a downbeat ending to a tumultuous week.

All three major U.S. stock indexes closed deep in red territory, with chipmakers weighing on the tech-laden Nasdaq.

The Philadelphia SE Semiconductor index slid 3.0% in the wake of a Reuters report that Taiwan’s TSMC asked major suppliers to delay delivery of high-end chipmaking equipment.

US semiconductor stocks have been the center of the FOMO fuelled AI rally that has been served a dose of reality by TSMC’s realistic outlook on chip demand, adding to this, the CEO of NVDA has reportedly sold $300m of his own stock over the last few weeks, a clear sign the market has lost touch with reality

On the economic front, data released on Friday was mixed, with import prices jumping, industrial production beating expectations and University of Michigan consumer inflation expectations cooling.

Economic indicators this week have cemented expectations that the Federal Reserve will leave its key interest rate unchanged at the conclusion of next week’s monetary policy meeting, and fueled hopes that the central bank’s tightening cycle might have run its course.

Financial markets have priced in a 97% likelihood that the central bank will hold the Fed funds target rate at 5.25%-5.00% when it announces its decision next Wednesday, and a 68.5% likelihood of it doing the same at the conclusion of its November meeting, according to CME’s FedWatch tool.

Oil prices continued to climb, notching their third consecutive weekly gain on supply tightness and optimism that the Chinese economy is gaining strength.

Gold prices surged, bouncing off three-week lows in opposition to softness in the greenback.

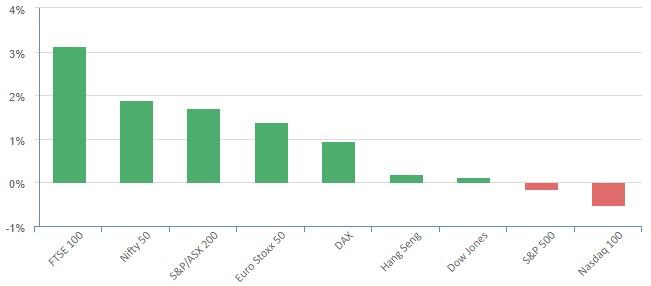

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7250 (-0.56%)

The fall in the US market will likely have an initial drag on the market and grind higher over the day as investors realise the fall in semiconductors has little influence on the ASX200 and optimism on China will be far larger influence, flowing through to iron ore, gold and oil stocks.