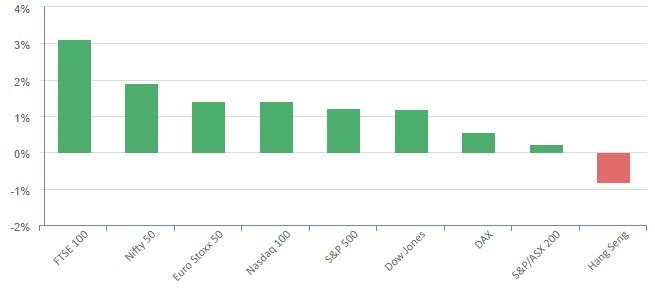

Overnight – Resilient economic numbers push equities higher, despite higher inflation

Equities were up overnight on stronger than expected retail sales pointed to a resilient economy even as inflation data came in hotter than expected.

More inflation data was released as the producer price index for August rose 1.6% on an annualized basis, beating expectations for 1.2%, and it rose 0.7% from July versus expectations for a gain of 0.4%. Additionally, retail sales rose 0.6%, versus estimates for 0.2% from the prior month, while the weekly number of Americans seeking unemployment benefits was 220,000 last week, lower than expectations. Despite the stronger economic numbers, the market is still expecting the Fed to pause interest rate hikes

Arm shares rose almost 25% in their trading debut in New York. The British chip designer priced its initial public offering at $51 apiece, touching the top end of its indicated range and securing a valuation of $54.5 billion. The listing — the largest since electric-truck maker Rivian Automotive ‘s around $12 billion debut in 2021 — was fueled by strong demand that saw the stock more than 12 times oversubscribed.

Oil prices rose Thursday as supplies are set to stay tight this year, while confidence about the demand outlook remains strong even as U.S. crude stockpiles rise. The International Energy Agency largely stuck by its estimates for demand growth this year and next in its monthly report, released Wednesday, joining the Organization of the Petroleum Exporting Countries in expecting oil markets to tighten further this year. This helped traders look past U.S. oil inventories rising by four million barrels last week, confounding expectations for a drop of around 2 million barrels.

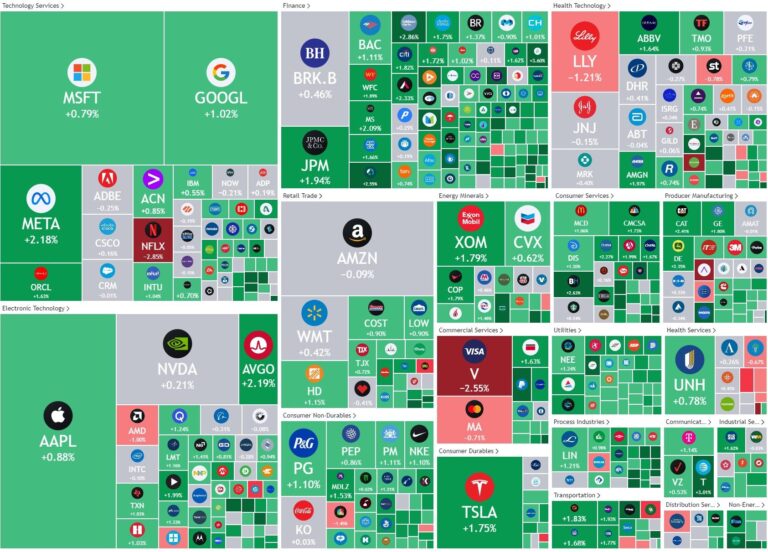

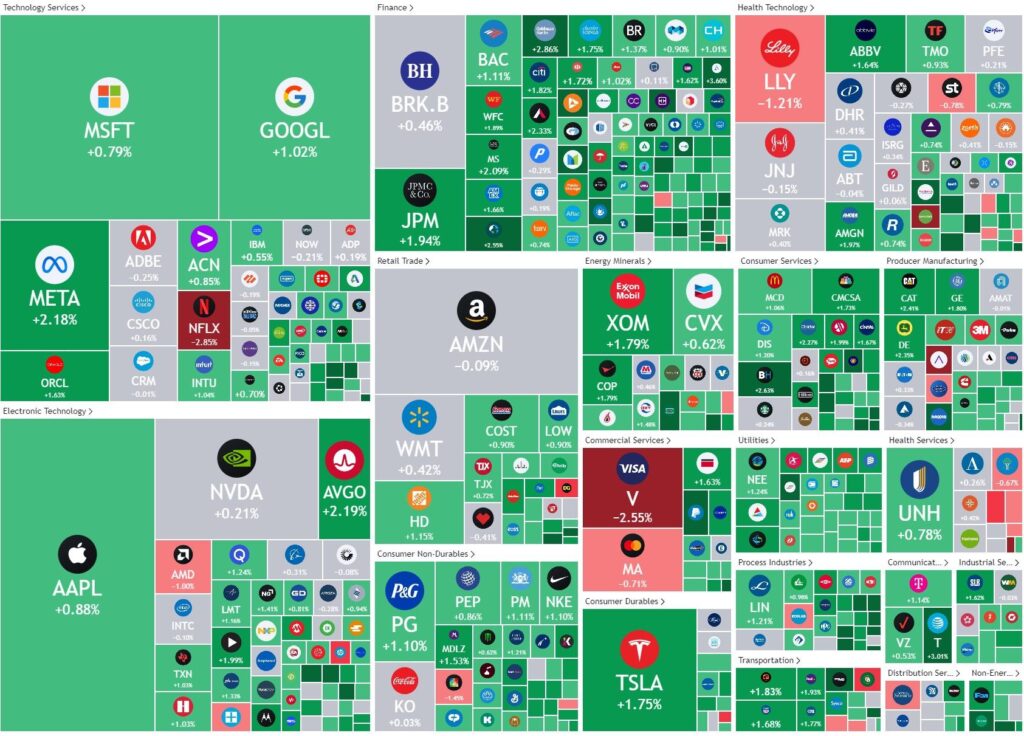

S&P 500 - Heatmap

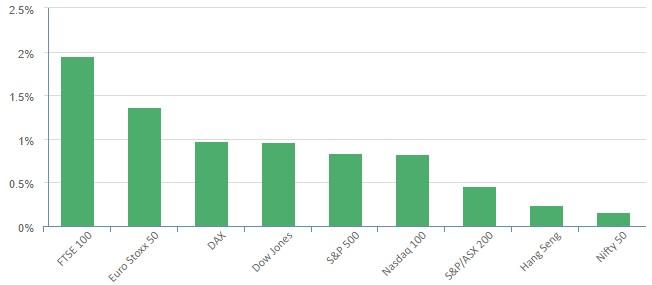

The Day Ahead

SPI Futures 7283 (+1.22%)

We should see a strong day in the material and energy sectors as China stimulus in the last 24 hours pushed oil and Iron ore higher. Like the US overnight, strong economic numbers in AU wasn’t enough to worry the markets interest rate expectations, leaving the market with clear upside until the FOMC meeting next Thursday.

CAR goes ex-dividend today