Overnight – Tech ignores Inflation data to salvage a positive day for equities

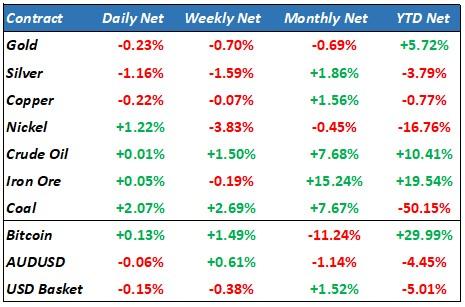

Equities advanced and U.S. Treasuries oscillated within a tight range on Wednesday after data showed underlying inflation remained on its slow, downward trajectory, boosting expectations that the Federal Reserve will let interest rates stand, for now.

The S&P 500 gained modestly and interest-rate sensitive mega caps, led by Microsoft gave the tech-heavy Nasdaq the edge.

The focus Wednesday was the U.S. consumer price index, which investors are using gauge the likely path of U.S. interest rates over the rest of the year. The annual headline inflation in the world’s largest economy rose 3.7%, slightly higher than the expected 3.6% during the month of August, as energy prices soared, but the core reading, which strips out volatile items like food and fuel, rose 4.3%, as expected.

Oil prices edged higher Wednesday, near their highest levels since November 2022, boosted by ongoing supply concerns as well as a bullish demand outlook from the OPEC monthly report. The Organization of the Petroleum Exporting Countries, in a report released on Tuesday, said that oil markets will tighten further this year amid robust demand and lower production. Additionally, the Energy Information Administration said global oil inventories were expected to fall by almost a half million barrels per day in the second half of 2023.

While the US inflation data triggered a fall in expectations of further rate hikes, inflation still remains nearly double the target range of the Fed. Concerningly, it is consumer “needs” like oil, housing/shelter, cars and insurance prices that are rising and figures this week in the UK pointed to wages growth at historical highs, the job looks no where near over for central banks

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7153 (-0.02%)

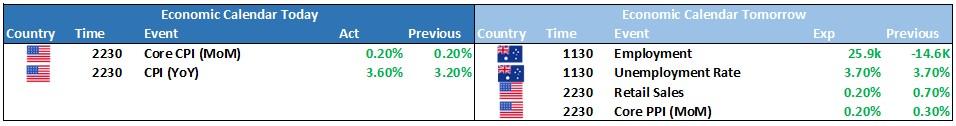

The focus today will be on AU employment numbers with another strong number expected from economists. The AU economy is expected to add 26,000 jobs and the unemployment rate to remain near historical lows at 3.7%, half the 25 year average of 6.5%. the resilience in the labour market may push the RBA to continue to hike rates, however concerns over mortgage stress will likely contain the need for more moves.

CCV, ING, S32 and SVW go ex-dividend today