Overnight – Tech drags down market as Apple releases more of the same

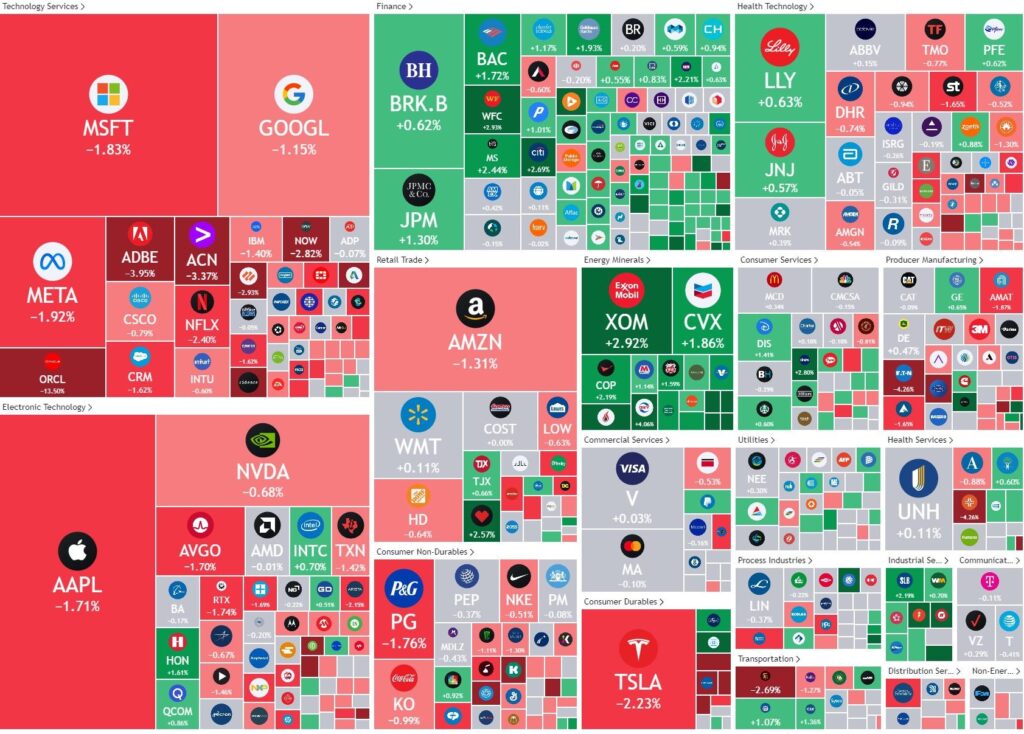

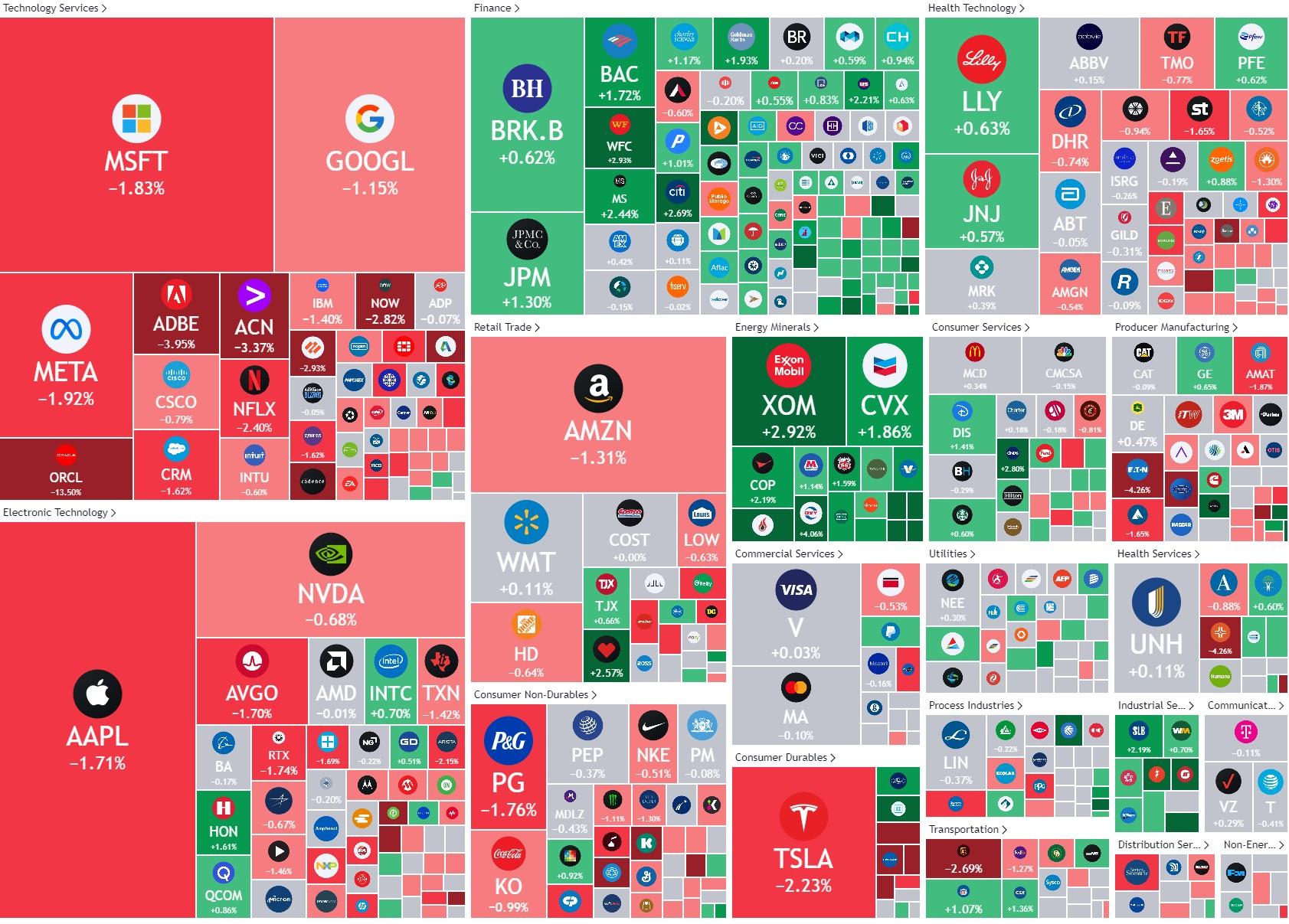

Equities gave back yesterdays gains as Apple led a stumble in tech despite unveiling its latest iPhone, but jump in energy stocks kept losses in check a day ahead of fresh inflation data.

Apple closed about 2% lower as the launch of its iPhone 15 and new Apple series 9 watch largely met Wall Street expectations, though some were surprised that the tech didn’t lift the price of its iPhone Pro model, keeping it at $999, unchanged from last year.

Cloud provider, Oracle reported fiscal first-quarter earnings that topped Wall Street estimates, but the companies current-quarter revenue guidance fell short of Wall Street estimates, overshadowing positive remarks of AI-led demand and sending its shares more than 13% lower.

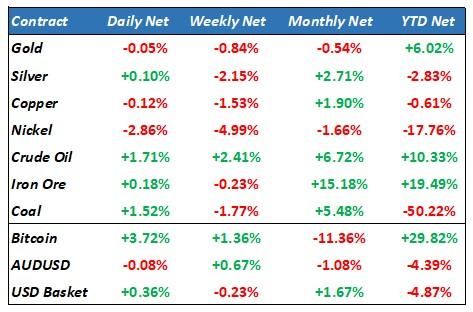

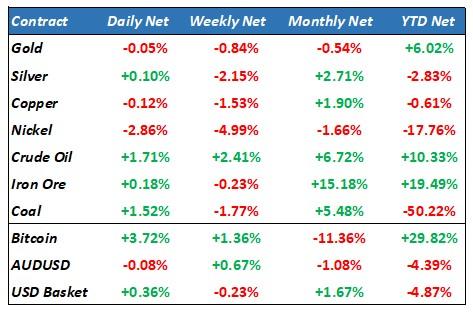

Energy stocks, with gains of more than 2% on the day, helped to keep broader market losses in check, supported by a rise in oil prices to new highs the year following recent announcements by Saudi and Russia to extend oil supply cuts through the end of the year.

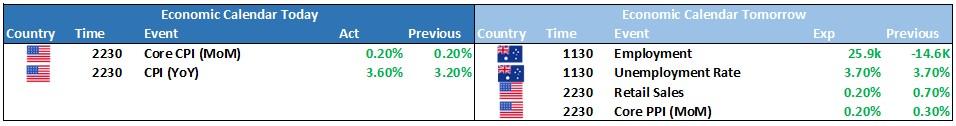

Investor attention will now switch to the consumer inflation report tonight, expected to confirm the recent signs that of slowing inflation.

Economists expect the headline consumer price index, or CPI, picked up pace in August, rising 0.6% from a 0.2% pace the prior month. But core inflation, which is more closely watched by the Fed and excludes food and energy prices, is expected to have remained steady at 2% last month but slowed to a 4.3% in the 12 months through July.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7190 (-0.29%)

its looking like another quiet day on the ASX with key inflation data tonight in the US and employment data domestically tomorrow. The move in US tech is unlikely to affect the AU market much, while commodity prices were muted. The energy sector should have a good day with Saudi cuts to production starting to cause a price squeeze in oil

AX1, BRG, BXB and IGO go ex-dividend today