Overnight – Equities ride big tech higher

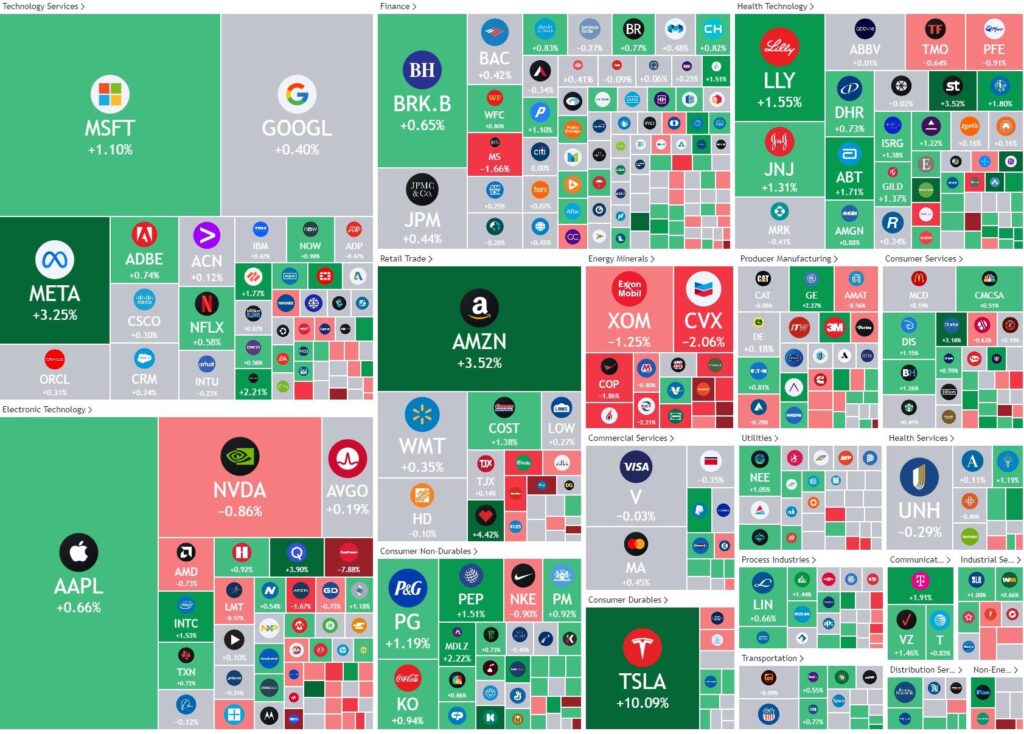

Equities rode tesla and big tech higher at the start of the week ahead of Apple’s eagerly anticipated iPhone 15 launch due Tuesday and inflation data later this week.

Tesla rose more than 10% after Morgan Stanley upgraded the electrical vehicle maker to overweight from equal weight, on optimism that its supercomputer Dojo (which can process data from Tesla vehicles on the road to train AI models for self-driving cars) could boost adoption of ‘robo-taxis’ and network services, boosting Tesla’s market value by as much as $500 billion. This is despite an impending legal action against Tesla’s self-driving software which caused a fatality. The case will provide an important precedent for the future of automated transport.

Optimism around Apple’s launch event tomorrow, where the company is expected to unveil the new the iPhone 15 that some on Wall Street expect spur a slew of upgrades from customers. Estimates are that about 25% of Apple’s 1.2 billion installed base has not upgraded their iPhone in 4 years, paving the way for Apple to capitalize on the opportunity by raising prices for the iPhone 15 pro and max models, setting up for a new “mini super cycle.”

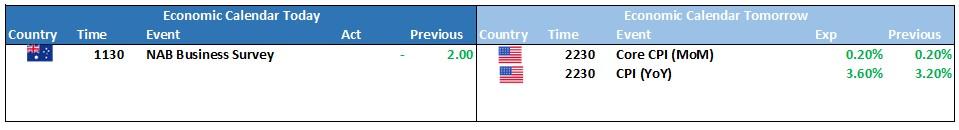

Despite the company specific news, the focus will definitely be on US inflation numbers on Wednesday, which may see a lift due to rising energy prices.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7199 (+0.09%)

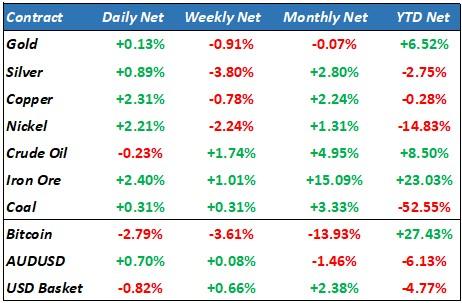

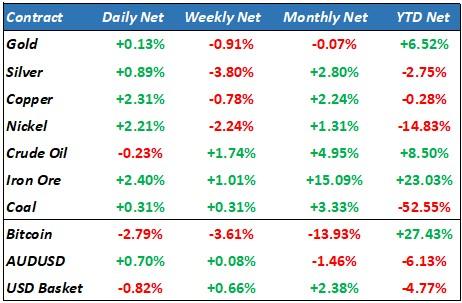

Weakness in the USD and optimism around Chinese inflation data over the weekend should see the materials sector buoy the market, however the late rally yesterday may have already done most of the heavy lifting. The banks were also strong yesterday, bouncing out of recent lows, a pattern that may continue. Aside from that, we will still be watching bond yields as the US10Y and AU10Y are just 5-10bps from multi year highs on the BOJ comments of a potential pivot later this year.

BSL, LOV, NWS and TPG go ex-dividend today