Overnight – “Higher for longer” fears weigh on Investor optimism

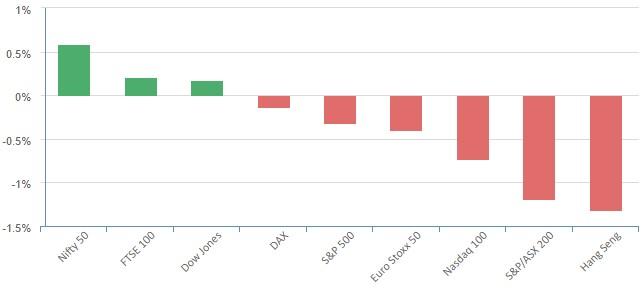

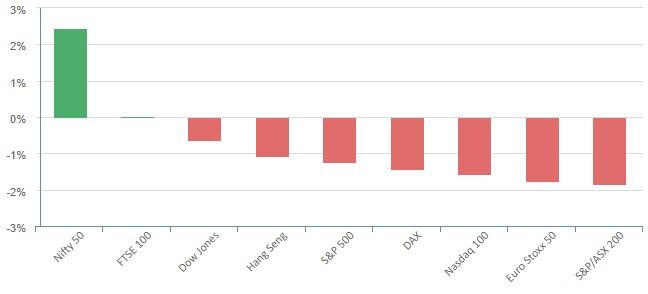

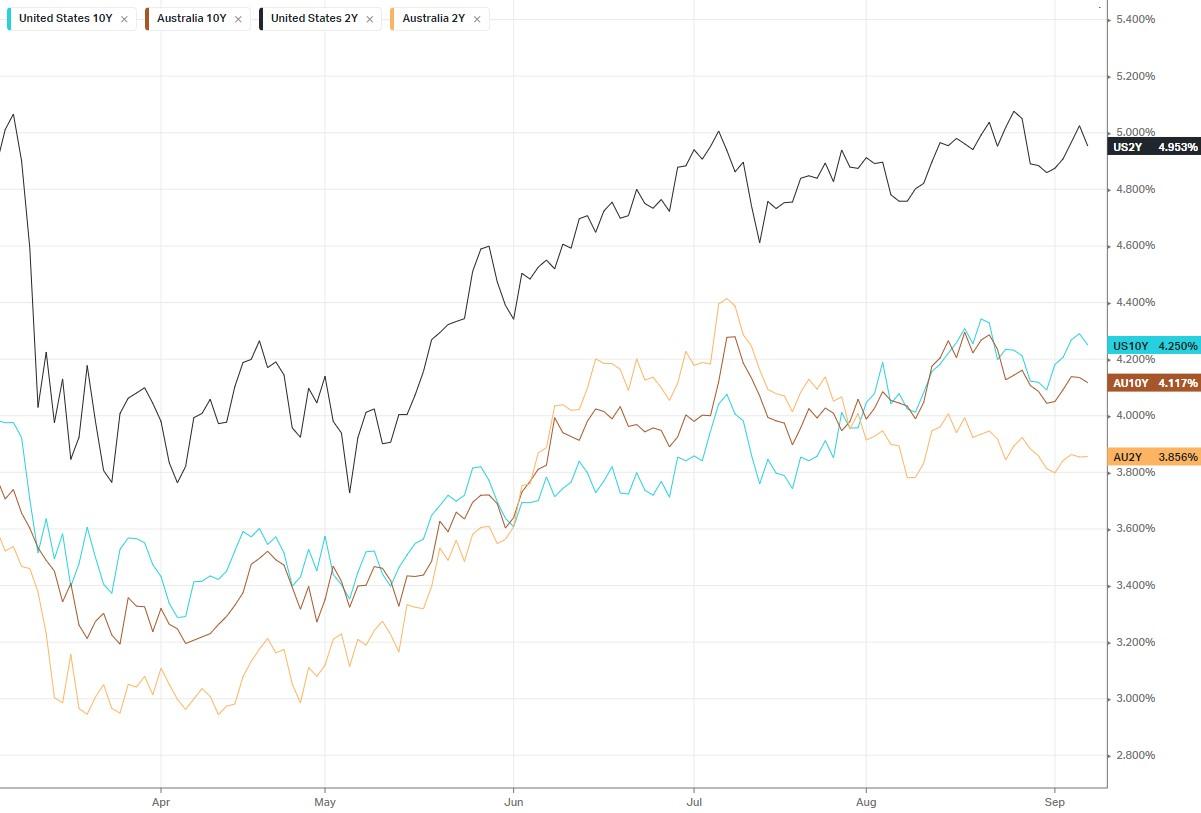

Equities were mixed overnight with the market being weighed down by tech stocks, as investors continued to worry about interest rates remaining higher for longer.

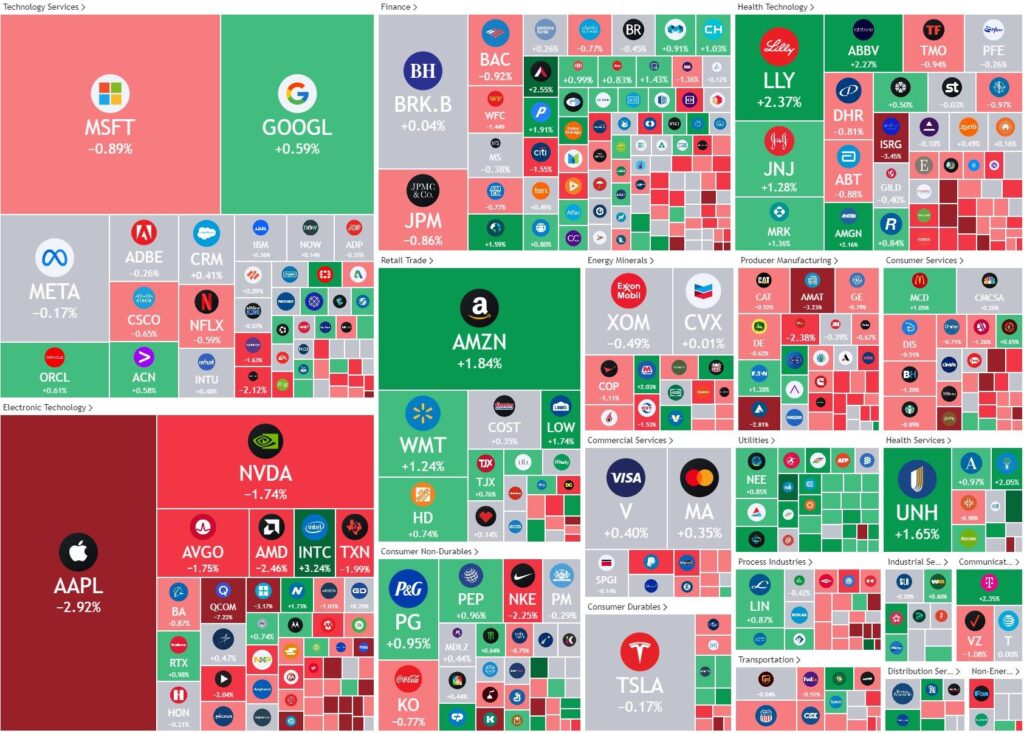

A string of stronger-than-expected economic data and rising oil prices will prompt the U.S. Federal Reserve to keep interest rates higher for longer which is unfavorable for growth focused tech stocks. The Fed has been closely watching the labor market for signs that the tight conditions are easing, something it wants to see to prove its inflation fighting efforts are working. Adding to techs woes was Apple, losing 2.8% after reports officials in China banned iPhone use at work for government officials.

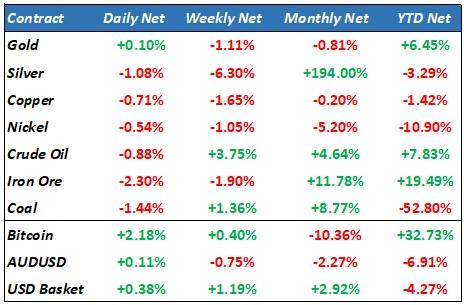

Oil prices fell Thursday, edging back from 10-month peaks after the release of weak Chinese trade data overshadowed another draw in U.S. inventories, signaling tightening supplies.

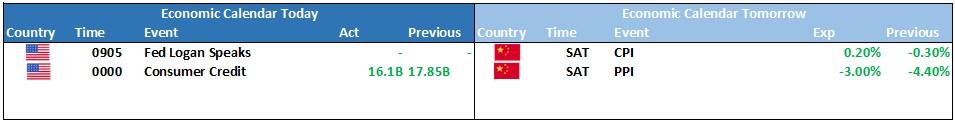

There are also a number of Federal Reserve officials due to speak on Thursday at a fintech conference hosted by the Philly Fed, and their comments are bound to be studied for monetary policy clues ahead of entering the blackout period that precedes each policy meeting.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7168 (+0.09%)

We are likely to see another mixed day on the ASX, although the sharp selloff yesterday may have already done some damage. Iron ore has fallen over 2% on China growth concerns which will weigh on the materials sector, particularly with CH inflation data being released over the weekend.

Investors are increasingly paying attention to cracks in the economy against the current optimistic market valuation, we see a potential correction to the downside if any further catalysts pile up

Ex-dividend of note today are MIN, WTC and NEC