Overnight – Markets drift in quiet trade ahead of key data late in the week

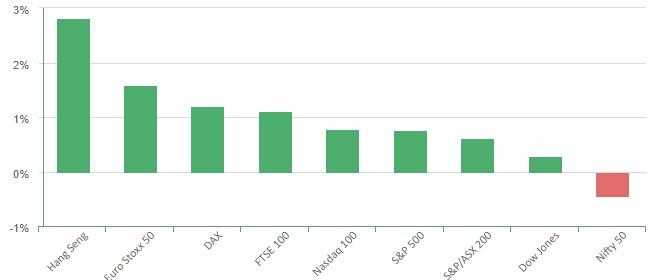

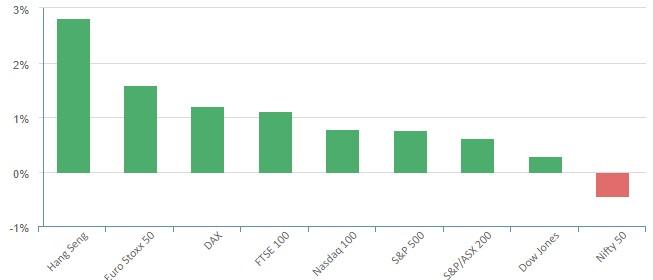

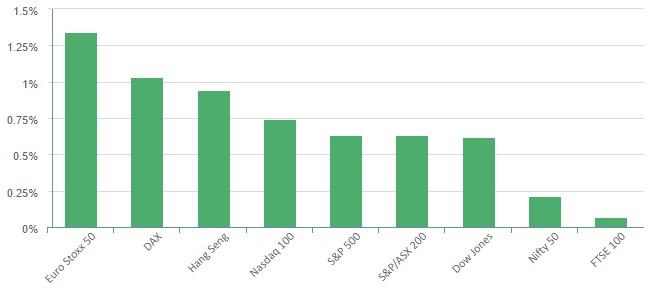

Equities ended higher Monday, underpinned by a 3M-led surge in industrials ahead of a flurry of data this week that will play into the Federal Reserve’s policy decision next month.

3M Company closed more than 5% as it closes in on a more than $5.5 billion deal to settle over 300 lawsuits, alleging that the company sold the U.S. military defective earplugs, Bloomberg reported Sunday, citing sources familiar with the deal. Boston Scientific reported positive results from a clinical trial for its pulsed field ablation system — used to remove heart tissue that causes abnormal heartbeats – to treat patients with atrial fibrillation, sending its shares up 6%.

Market direction will be dominated by top-tier economic data this week including the fresh inflation data and the July monthly jobs report slightly for Thursday and Friday. The key economic data releases this week are JOLTS job openings on Tuesday, the Q2 GDP revision on Wednesday, core PCE on Thursday, and the employment and ISM reports on Friday. The data will likely filter into the Fed’s thinking on monetary policy ahead of its Sept 19-20 meeting, and are set to arrive following fresh signs that the Fed is likely to keep rates higher for longer.

As expected, Powell’s remarks on Friday were “relatively hawkish in nature as the Committee continues to grapple with higher-than-expected inflation amid a stronger-than-expected economy

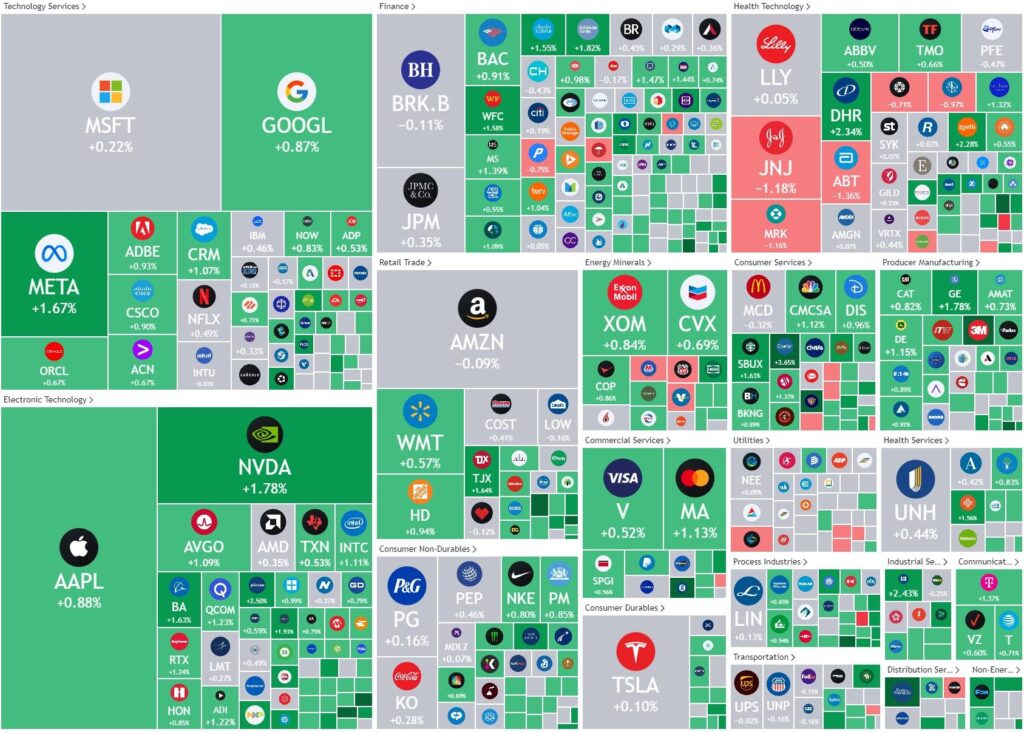

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7137 (+0.35%)

The ASX should see some buoyancy as commodity prices held up overnight despite a firmer USD. As earnings draw to an end, the erratic movement on the ASX will hopefully normalize with many stocks having surprise movements on even the smallest triggers which suggests a lack of volume. RBA bullock this evening could provide clues on the RBAs future policy direction, while JOLT job ads in the US tonight may trigger a reaction leading into payrolls on Friday night