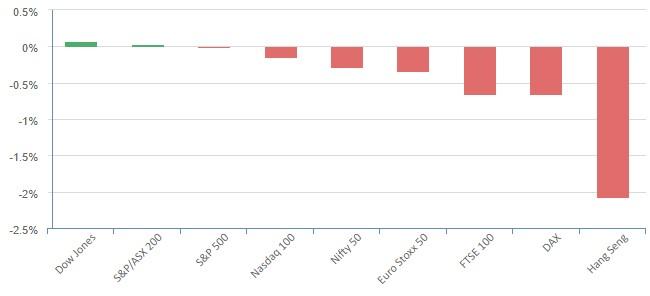

Overnight – Equites finish broadly lower as Bonds take a breather

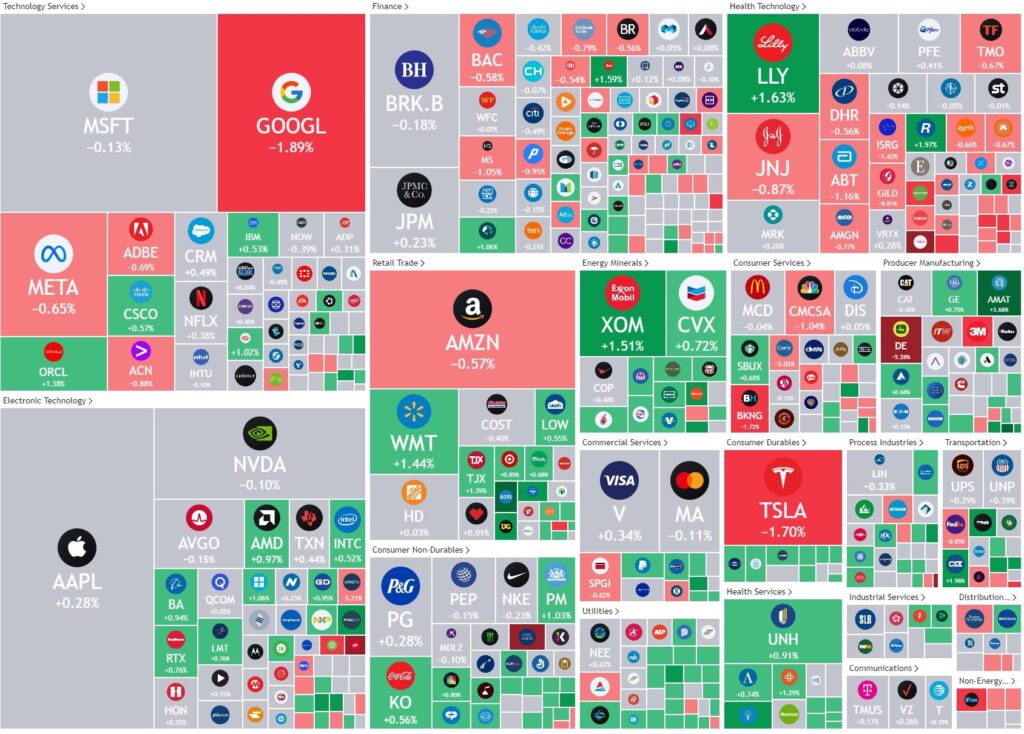

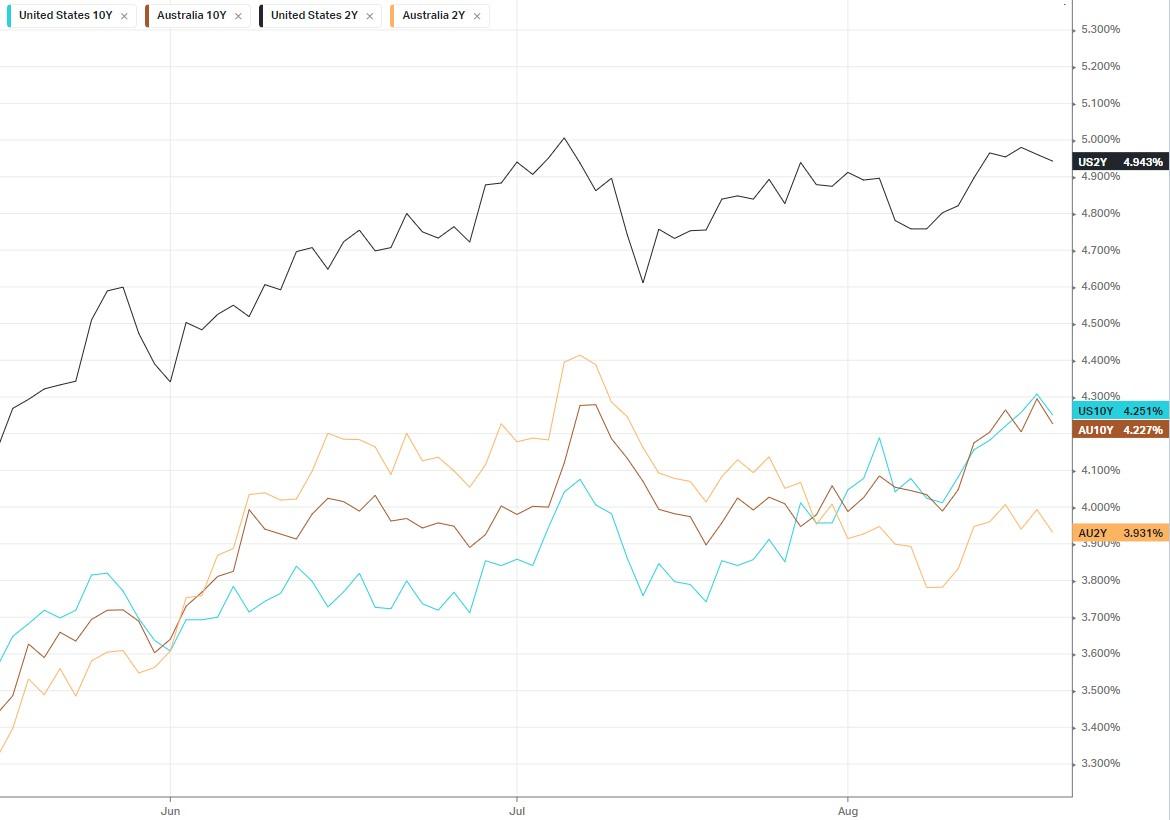

Equities closed broadly lower with just the Dow eking out a win, but that was of mere consolation as stocks posted their worst weekly loss since March ahead of the Fed chair Jerome Powell’s appearance at the Jackson Hole economic policy symposium next week. Tech added to losses led by weakness in seen so far this week, pressured by worries that rising Treasury yields, the enemy of growth sectors like tech, could continue to advance as Powell will likely reiterate the need for higher for longer rate environment at the Jackson Hole symposium next week. Treasury yields took a breather on Friday just a day after the US10Y closed at its highest level since 2007. Further upside could see the 10-year Treasury yield move break out to near 5%, a death nell for growth tech stocks.

Deere & Company fell more than 5% as fears grow that the boom in sales of tractors and other machinery last have peaked amid falling crop prices offset a quarterly beat and raise.

Chip stocks inched higher, but continue to stare down the barrel of a third weekly loss as investors appear to continue taking profit of gains ahead of Nvidia’s results due Wednesday. Tech bulls on Wall Street are optimistic that the chipmaker will deliver quarterly results that top estimates, and suggest that Nvidia may not have delivered blowout guidance on its data center business as it will likely continue to ride the AI wave of demand.

S&P 500 - Heatmap

The Day Ahead

SPI Futures 7070 (-0.32%)

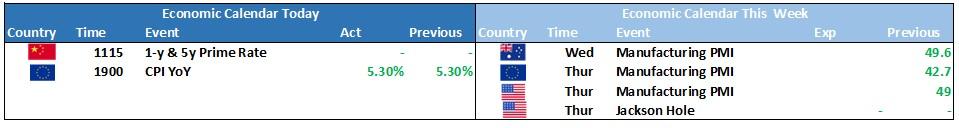

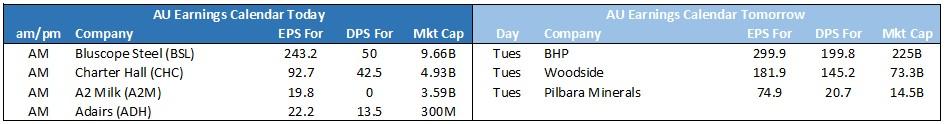

This week earnings season puts the pedal to the metal with over 40% of the ASX companies delivering results. The flood of earnings will likely dominate the headlines as the global macro waits for the Jackson Hole Symposium later in the week for cues on interest rates. Until then we will have one eye on China and the other firmly on company results.

The headliners report tomorrow with BHP, WDS, COL and WOW, while many sector leaders make up the rest of the week.