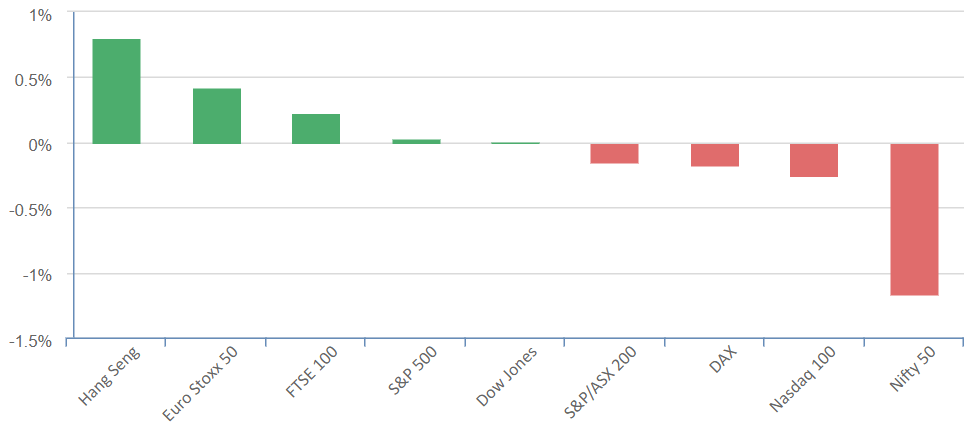

Equities ended mixed on Friday, with the DOW rising marginally to notch its 10th straight day of advances, its longest rally in almost six years. For the week, the S&P 500 added 0.7%, the Nasdaq fell 0.6% and the Dow rose 2.1%. Volume on U.S. exchanges was relatively light, with 10.4 billion shares traded, compared to an average of 10.6 billion shares over the previous 20 sessions. The blue-chip index was lifted by gains of more than 1% each in Procter & Gamble and Chevron. It is now up over 6% in 2023, compared to the S&P500 18% rise. The Dow playing catch-up shows there is a rotation into other sectors, like healthcare and financials is a reflection that tech has reached overbought territory and not even the Bulls are having to look elsewhere for value. Further evidence of this was Nvidia and Meta Platforms losing more than 2% each in a choppy trading session, while the S&P 500 utilities sector jumped 1.5%, followed by a 1% rise in the healthcare sector index. Netflix dipped 2.3%, down for a second straight day after the video streaming company’s quarterly results this week failed to impress. American Express fell 3.9% after the credit card giant missed quarterly revenue estimates and affirmed its full-year profit forecast. The

S&P 500 - Heatmap

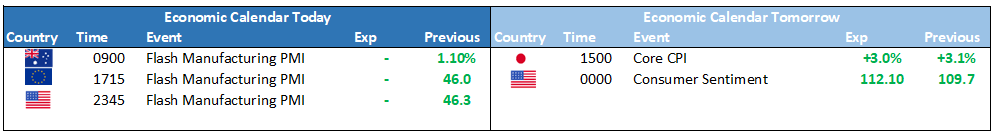

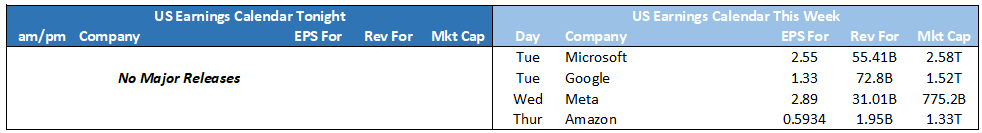

The Day Ahead

SPI Futures 7300 (+0.39%)

The ASX is likely to have an initial surge from the offshore lead and drift for the remainder of the day due to key Central Bank meetings and a huge amount of US earnings in the middle of the week. PLS and S32 give quarterly updates today which could see some action in both stocks. We remain cautious due to possible hawkishness from the Fed and the unlikelihood that earnings from the Mega-caps can justify their current high valuations