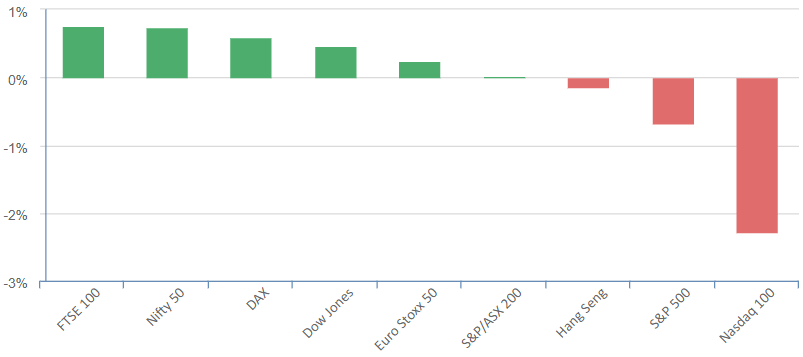

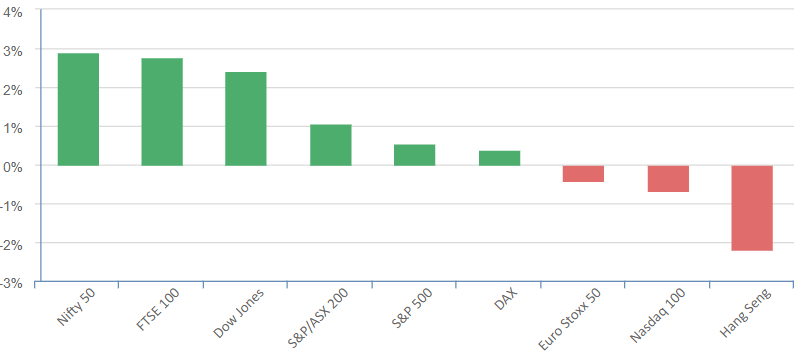

Value-based stocks played a pivotal role in the Dow’s positive performance, with it closing higher overnight. This success marks its ninth consecutive day of gains, a streak unmatched since 2017. Two major contributors to this outcome were Johnson and Johnson and IBM, which counterbalanced the repercussions from a tech stock reality check. Significant sell-offs were seen in Tesla and Netflix, triggered by their respective earnings reports.

To delve further into the individual stock performances:

Tesla exceeded Wall Street’s estimates for their second-quarter results. However, renewed concerns over shrinking margins arose when CEO Elon Musk indicated a willingness to reduce prices again, should economic conditions worsen.

Netflix experienced an over 8% drop following a reported second-quarter revenue miss. That said, the company did add more subscribers than expected for the quarter. A slow adoption of paid sharing – a feature prohibiting members from sharing subscriptions with individuals outside their household – took Wall Street by surprise.

Interestingly, these earnings reports typically wouldn’t result in such severe stock price declines. The recent rally has inflated company valuations to such an extent that justifying them is becoming increasingly difficult. This is not necessarily the fault of the companies, but instead, it’s due to stock speculators. This could imply a sharp reversal for the Nasdaq as the earnings season progresses.

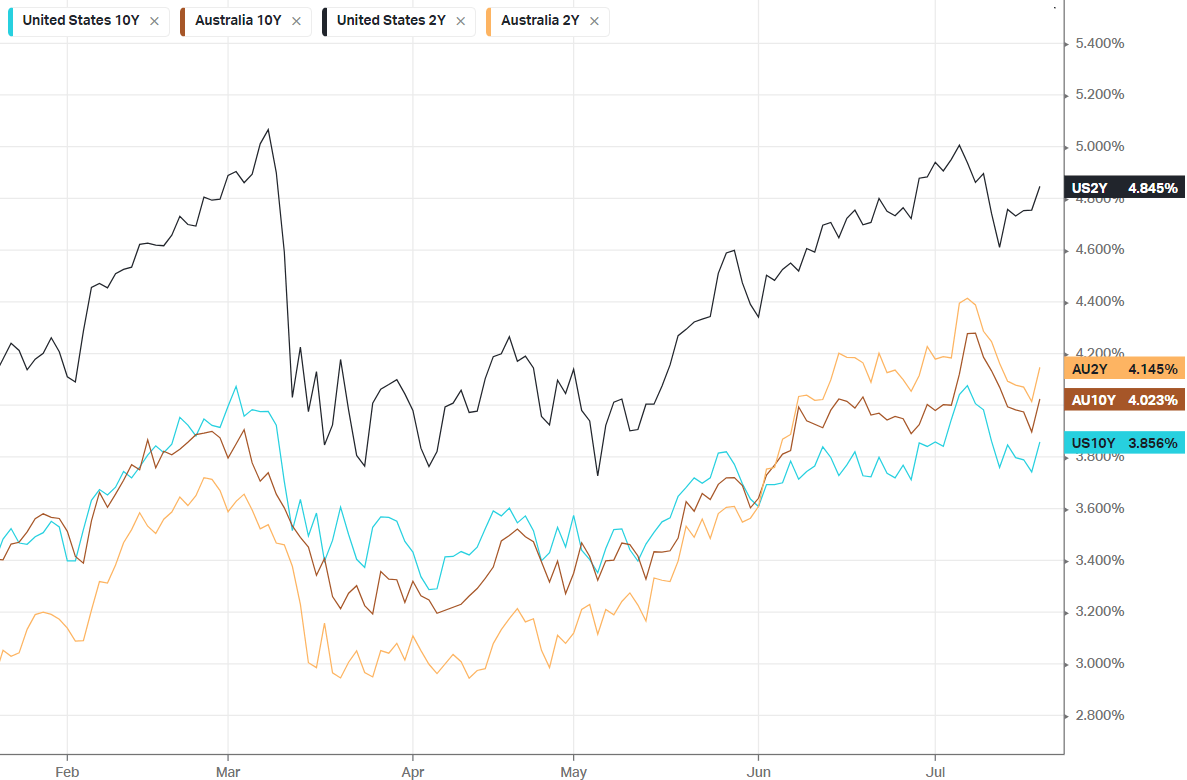

On the economic front, developments were less notable. However, initial jobless claims did unexpectedly drop by 9,000 to 228,000 – the lowest figure since May. This suggests a tight labor market which could pose a threat of wage inflation. This significant economic indicator arrives just before the Federal Reserve’s monetary policy decision.

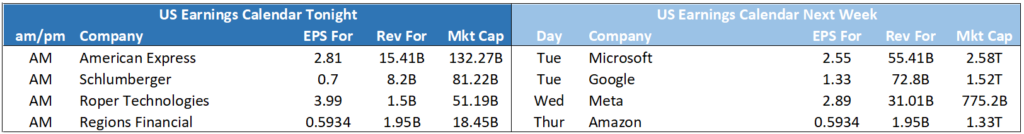

The Federal Reserve is anticipated to announce a 0.25% rate hike on July 26, which will be a critical event in the coming week. The upcoming week will likely be defining for equity markets. The mega-cap companies will start reporting, with over 35% of the S&P500 market cap delivering reports in just four days. The Fed’s rate decision will be a significant event during the week.

Given these circumstances, it’s advisable to limit risk exposure, particularly in the tech sector. The current risk-reward balance appears to heavily favor the downside.

S&P 500 - Heatmap

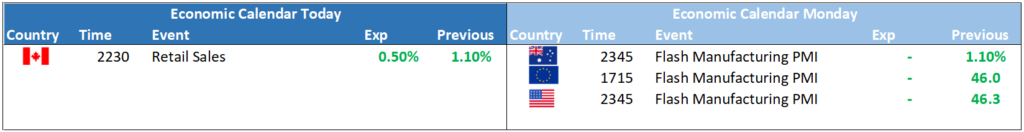

The Day Ahead

SPI Futures 7282 (+0.08%)

Although the Nasdaq’s decline is likely to dominate headlines, its impact on the ASX is projected to be minimal. This is because the losses are primarily concentrated around the “Magnificent 7” stocks, which currently exhibit the most overbought levels in history.

Domestic news is more likely to highlight the recent record-low unemployment figures. These numbers could compel economists to reevaluate their predictions for peak rates in Australia, as the economy appears resilient against higher rates up to this point.

In particular, NSW reported a stunningly low unemployment rate of 2.9%. This may result in productivity and wage inflation complications, given the increasing demand for staff among employers.

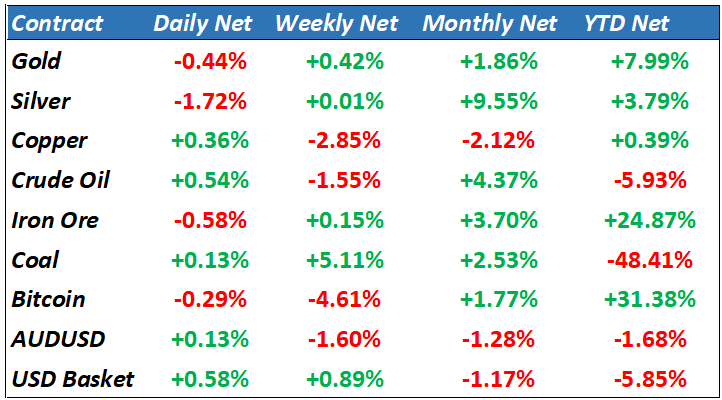

Commodity performance has been relatively mixed. The People’s Bank of China’s (PBoC) recent decision to maintain steady rates could lead investors in the materials sector to reconsider their bullish attitudes, potentially tempering the recent optimism.

In conclusion, we remain prudently conservative due to the ambiguous nature of the economic and rates outlook.