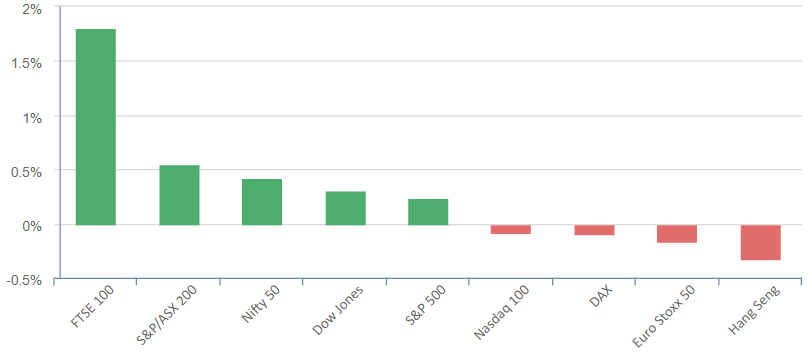

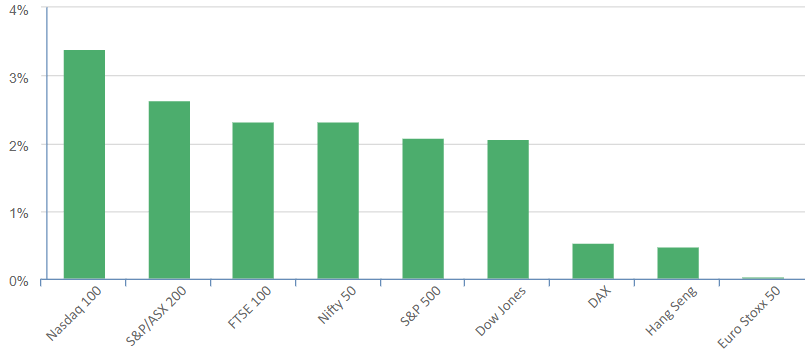

Equities finished higher on Wednesday, marking an eighth consecutive session of gains. This came as investors continued to assimilate the most recent quarterly results. Remarkably, this positive trend occurred even as Goldman Sachs reported disappointing second-quarter earnings, which were affected by underperformance in its consumer and investment banking sectors.

However, Goldman Sachs’ stock climbed by 1% as Chief Executive David Solomon expressed optimism about revitalizing signs in the investment banking business, particularly given a resurgence in deal activity.

On the other hand, Netflix reported its second-quarter results, surpassing bottom line expectations. However, it fell short of Wall Street’s revenue projections. Despite this, the streaming giant added a significant 5.89 million new subscribers in the quarter, a number well above the anticipated 2.07 million. Surprisingly, this news prompted a 4% decline in Netflix’s value during post-market trade.

Meanwhile, Tesla’s first-quarter results outperformed both the top and bottom line expectations. The electric vehicle (EV) maker’s margins weren’t as poor as feared, even amidst recent price cuts. Tesla stock initially rallied by 1% following the announcement, but later retreated during after-hours trading. Notably, the company assured that it remains on schedule for initial deliveries of its much-anticipated Cybertruck this year. Earlier in the week, Tesla confirmed that it had commenced Cybertruck production in Texas, with an expected shipment of around 2,000 units this year. Tesla’s stock has seen a considerable surge of 169% year to date, partly due to optimism surrounding demand for the company’s supercharger network.

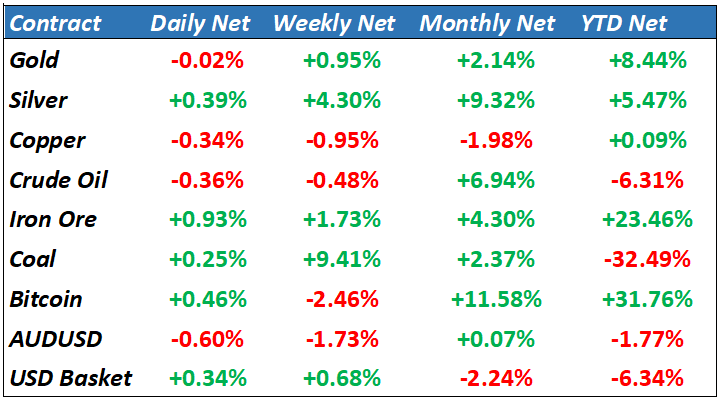

In the energy sector:

- Kinder Morgan, a pipeline and terminal operator, announced its second-quarter revenue on Wednesday. Unfortunately, the figures were lower than expected, affected by decreasing commodity prices.

- Oil and gas prices faced difficulties during the April-June quarter. This downturn was primarily due to increasing interest rates in key economies and slower-than-expected recovery in manufacturing and consumption in China, both factors that negatively impacted fuel demand.

S&P 500 - Heatmap

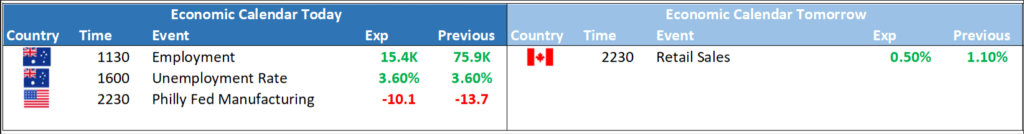

The Day Ahead

SPI Futures 7286 (+0.02%)

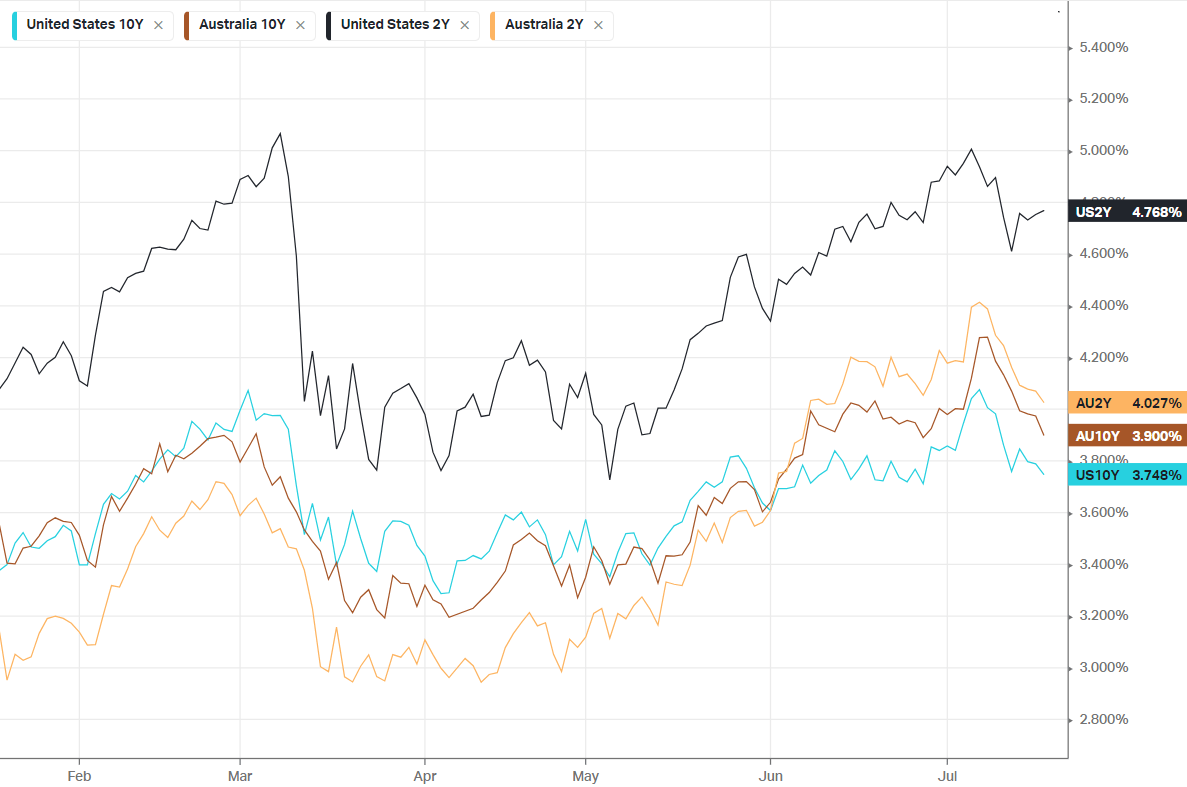

We are likely to see a mixed day on the ASX as a few key pieces of corporate and economic data are released over the day with BHP, EVN and STO giving quarterly updates and AU Employment data out at 1130 which will be key for the RBA’s future direction on monetary policy. Employment data was extremely strong last month with 75k jobs being added, we are likely to see a pull back after such a huge number with economists expecting the economy to add 15.4K jobs and the unemployment rate to remain at 3.6% close to record lows.

US equities have reversed overnight gains with the Nasdaq falling 0.30% in after-market trade due to Netflix and Tesla earnings (at 8am)