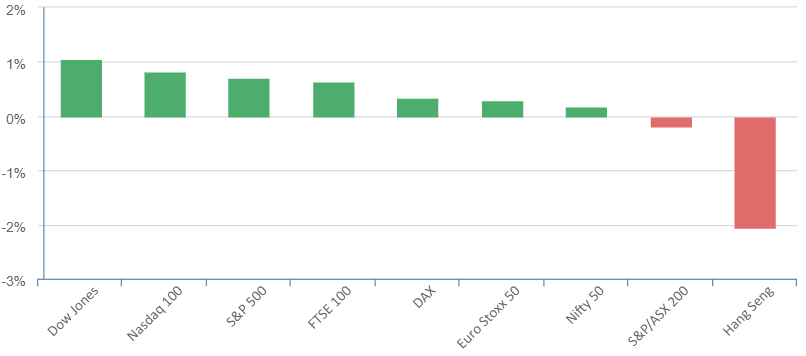

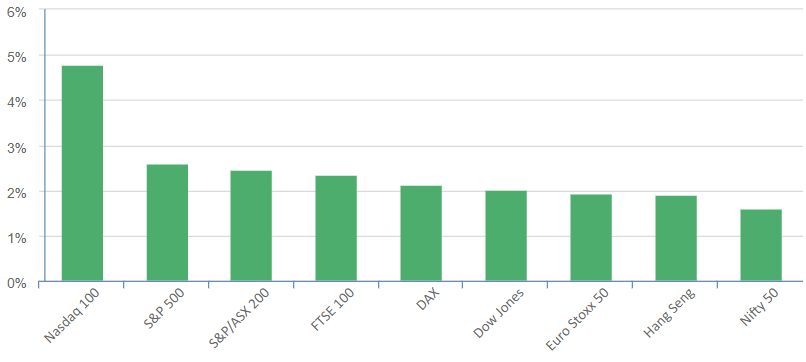

Equities continued their upward trend with investors expressing enthusiasm over better-than-expected quarterly results. This included Wall Street banks and tech behemoth, Microsoft, which reached a record high driven by artificial intelligence optimism.

Several earnings releases that contributed to the market surge included:

Bank of America: The banking institution led the rally among banking stocks, rising over 4%. This growth came on the back of second-quarter earnings that exceeded analyst estimates. A significant factor in this success was higher interest rates, which effectively amplified loan income.

Morgan Stanley: The financial powerhouse rallied 6% after its second-quarter results outperformed estimates on both the top and bottom lines. This was largely due to the strong performance of its wealth management business, which balanced out weaknesses in its trading business, caused by a decrease in equity and fixed-income revenue.

Charles Schwab: This company topped the list of gainers, with a 12% increase following better-than-expected quarterly results.

Microsoft: Microsoft shares rose 4% as investors, motivated by AI optimism, flocked to the stock. The tech giant announced it would charge businesses $30 per user to access its suite of artificial intelligence tools. Analysts view the initial pricing as bullish, predicting it could expand Microsoft’s total addressable cloud AI market opportunity. They forecast an annual increase in cloud revenue by 20% by 2025.

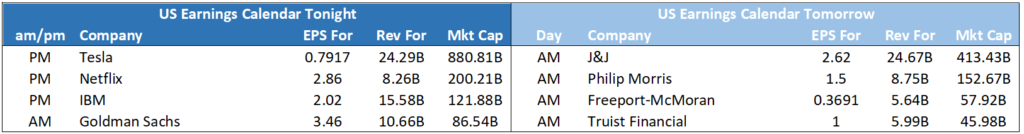

Both Tesla and Netflix were also on the rise in anticipation of their quarterly results, due Wednesday after market close. The key focuses for these companies will be:

Tesla: Investors will likely pay attention to margins in the wake of recent price cuts by the electric vehicle manufacturer.

Netflix: Market analysts will be scrutinizing subscriber numbers and future guidance, particularly in light of the streaming giant’s recent crackdown on password sharing.

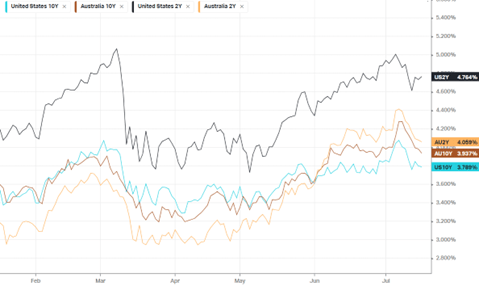

Finally, on the economic front, June retail sales saw a 0.2% increase, following a 0.5% gain in May. This missed economists’ predictions for a rise of 0.5%, indicating optimism that the Federal Reserve’s rate hikes are beginning to slow the economy. Economists still expect the Fed to lift rates for one final time next week, although with corporate earnings defying the move in monetary policy over the last year, it is unlikely the Fed will have finished hiking.

S&P 500 - Heatmap

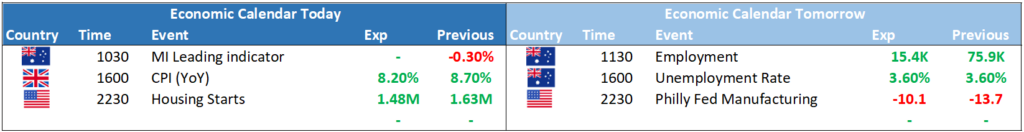

The Day Ahead

SPI Futures 7278 (+0.53%)

The Australian Stock Exchange (ASX) is set for a positive day, spurred by promising performances in the banking, energy, and technology sectors. This follows better-than-expected performances by U.S. banking stocks, which should give a boost to the Australian financial sector.

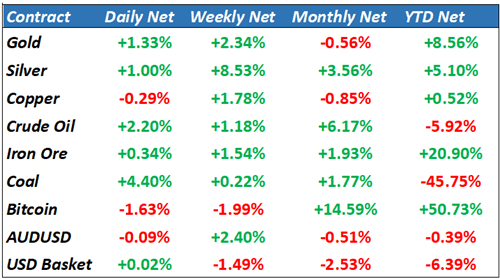

Despite concerns around regional banks, stricter Australian regulation should shield smaller banks from potential U.S. liquidity issues. The coal sector has also seen significant growth, with prices up by nearly 8% in the past week and broker upgrades expected for WHC.

In corporate news, companies WDS and NST will be releasing their quarterly updates today. Investors are also looking to the People’s Bank of China (PBoC) for possible hints about stimulus measures.