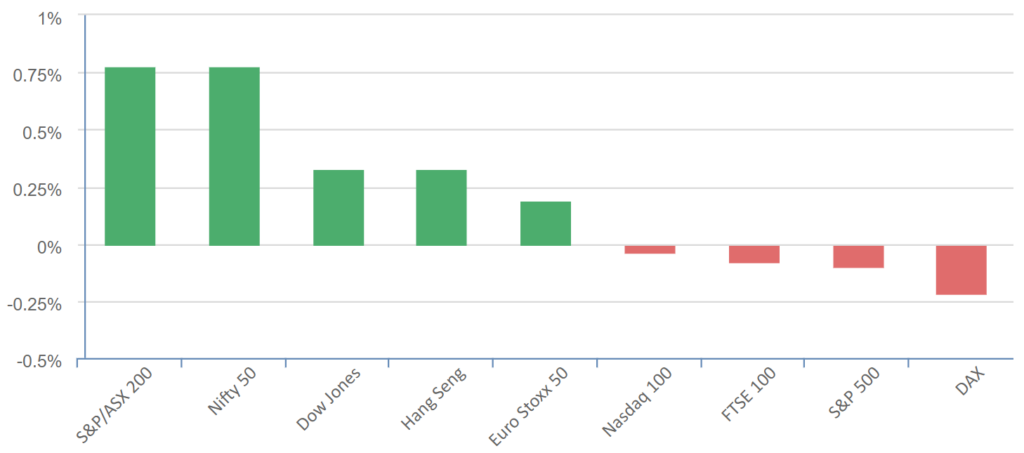

The equities market presented a mixed picture this past week. While the Dow ended on a positive note on Friday, securing its best weekly gain since March, the NASDAQ and S&P experienced a slight dip.

- Notably, the Wall Street banks set the tone for the quarterly earnings season, albeit with varied results. Here are some key highlights:

- JPMorgan and Wells Fargo outperformed expectations, reporting stronger than anticipated top and bottom lines. However, their shares saw a drawback from session highs as both banks increased bad loan provisions and anticipated a further decline in customer deposits.

- The much-anticipated revival in investment banking failed to materialize, leading to a disappointing quarter overall.

- Citigroup’s shares declined by 4% following their earnings falling short of Wall Street estimates, mainly attributed to a weak performance in its investment banking division.

- State Street shares tumbled more than 12% after its quarterly revenue fell short, triggered by a decrease in net interest income and a drop in deposits.

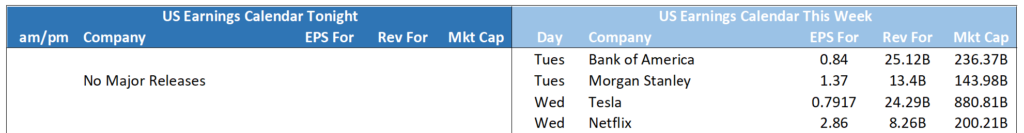

- In the coming week, Morgan Stanley, Bank of America, and Goldman Sachs are poised to report their quarterly results.

In the healthcare sector, UnitedHealth, a major Dow component, witnessed a surge of more than 7%. This boost came after the health insurer increased its full-year profit forecast, following second-quarter results that exceeded Wall Street estimates, driven by cost reductions.

The tech sector showed resilience with Microsoft closing nearly 1% higher, defying the general weakness in tech stocks. This rise came on the heels of UBS upgrading its rating on the stock from ‘Hold’ to ‘Buy’ due to anticipated benefits from AI advancements and a recovering demand in the cloud sector.

Despite these positive indicators, concerns over the ability of the “Magnificent 7” to justify their recent rally have started to unsettle investors, leading to an emerging trend of profit-taking.

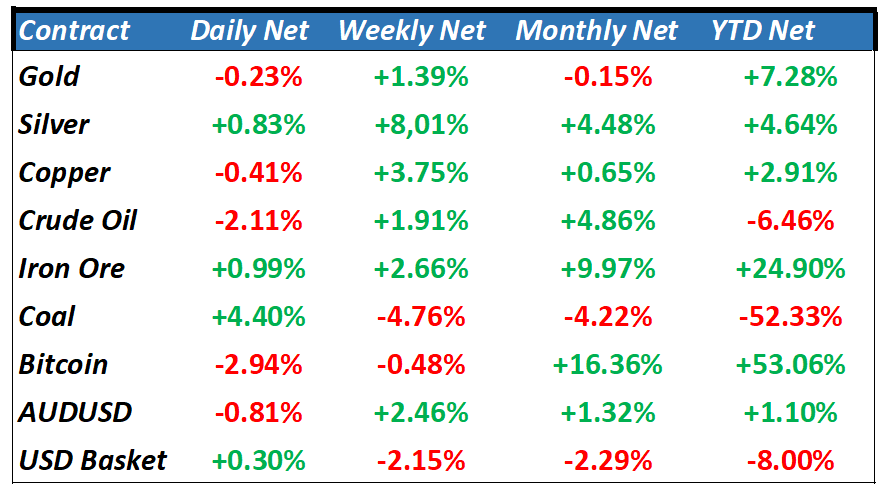

The commodities market also saw a shift with the USD stabilizing, momentarily stalling the commodities rally. Oil prices fell 2% after a strong week, leading into the upcoming announcement of China’s GDP numbers.

S&P 500 - Heatmap

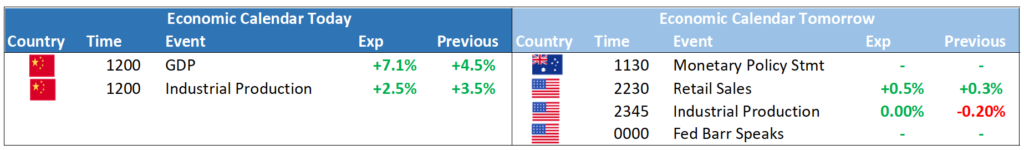

The Day Ahead

The market anticipates a mixed day ahead, with a spotlight on Chinese GDP and Industrial Production numbers at midday. The energy and tech sectors may initially pose a slight drag on the market, while the performance of the materials sector is likely to be shaped by the midday figures. The financial sector is set to benefit from reasonable US bank earnings posted on Friday.

In the coming week, US earnings reports are expected to take center stage in the news, with prominent companies such as Tesla, Netflix, and Goldman Sachs delivering updates.