Market Summary

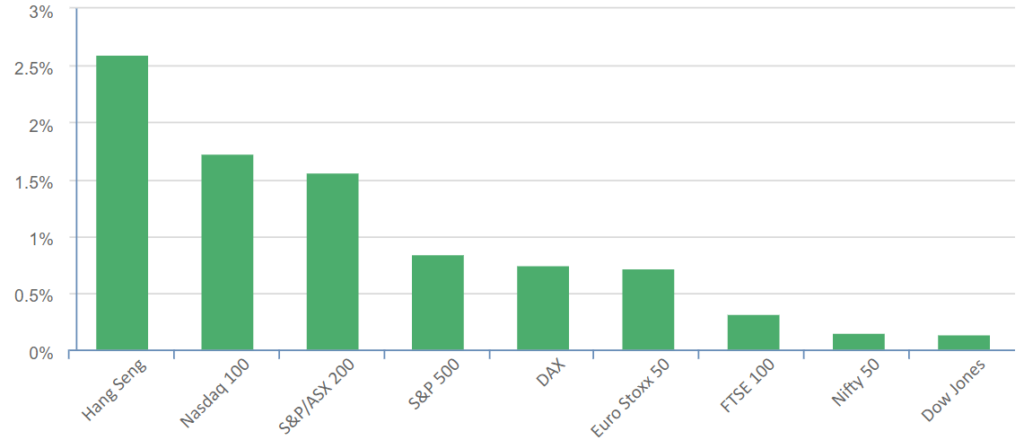

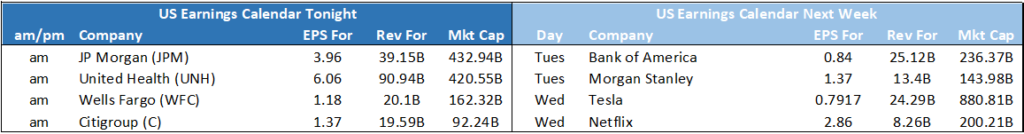

Equities finished higher Thursday as a surge in Google underpinned a sea of green in tech just as investors digested better-than-expected quarterly results from Pepsico and Delta, a day ahead of results from major Wall Street banks. PepsiCo reported better-than-expected second-quarter results and lifted its full outlook as price hikes helped offset higher input costs. Its shares rose more than 2%. Delta Air Lines reported record quarter results that topped Wall Street estimates, though sentiment on the stock cooled somewhat after the airline said capacity constraints were expected to remain for an “extended period.”

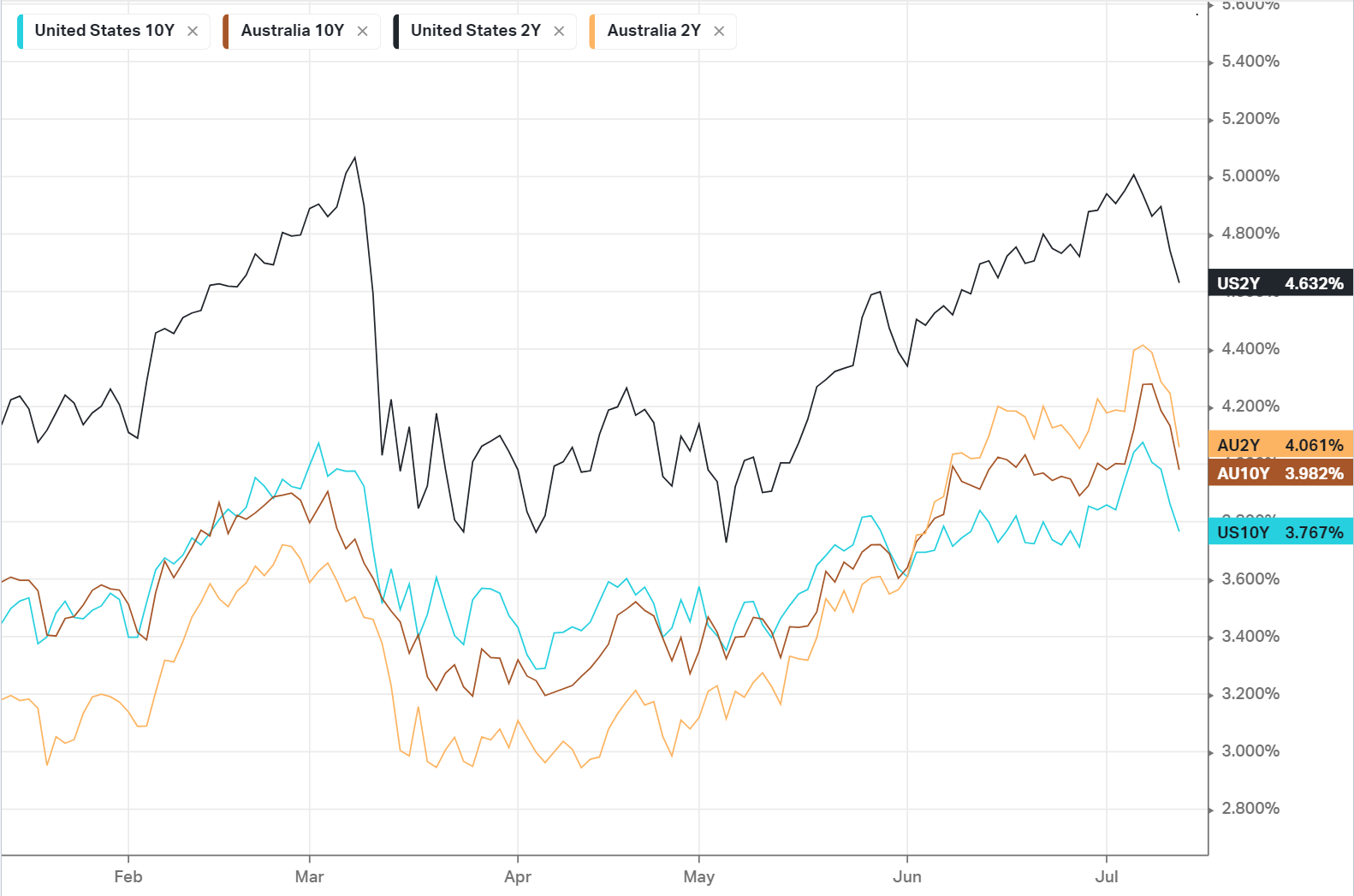

The AI frenzy continued as Google rose more than 4% after launching Bard AI, in Brazil and the European Union, as the tech giant looks to take the AI fight to rival ChatGPT. Google Search, which still makes up the bulk of Alphabet’s revenue, will likely become “more personalized” and develop “critical competitive moats” as the tech giant invests further in AI, Morgan Stanley said in a note. Meta meanwhile, was also riding the AI wave as the social media giant is set to release a commercial version of its AI large learning model, which was made available to researchers and academics earlier this year. On the economic front, Producer Prices in June also slowed more than expected, supporting the thesis inflation is cooling, however the job market remained hot as weekly jobless claims fell which will be of concern to the Fed. On balance, the optimism on company profits and the labour market holding strong, the Fed is likely to have to keep raising rates if they are not keep a second wave of inflation at bay. We remain very cautious at these levels and have a “wait and see” attitude while we get paid to sit in high yield bonds.

The Day Ahead

SPI Futures 7243 (+0.54%)

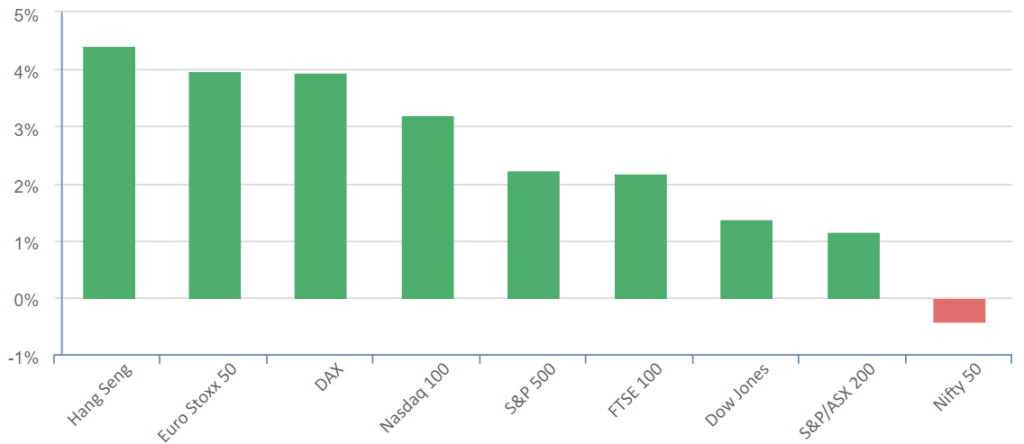

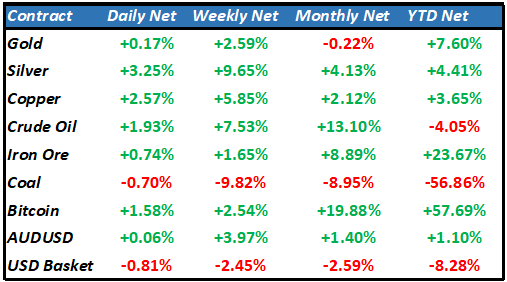

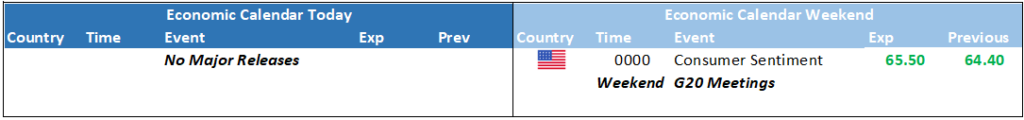

We are expecting a strong finish to the week as commodity prices continue to benefit from a weakening USD due to cooling inflation. The cyclical stocks have made a huge comeback in the second half of the week as concerns over China became optimism of stimulus and worries of inflation became speculation of “peak rates”. While central banks have continually emphasised that the fight against inflation is not over, investors have found any reason to get bullish. The ASX is likely to still have upside here, however the lofty valuations in the US market may come back down to earth with earnings reality coming over the next few weeks.