Market Summary

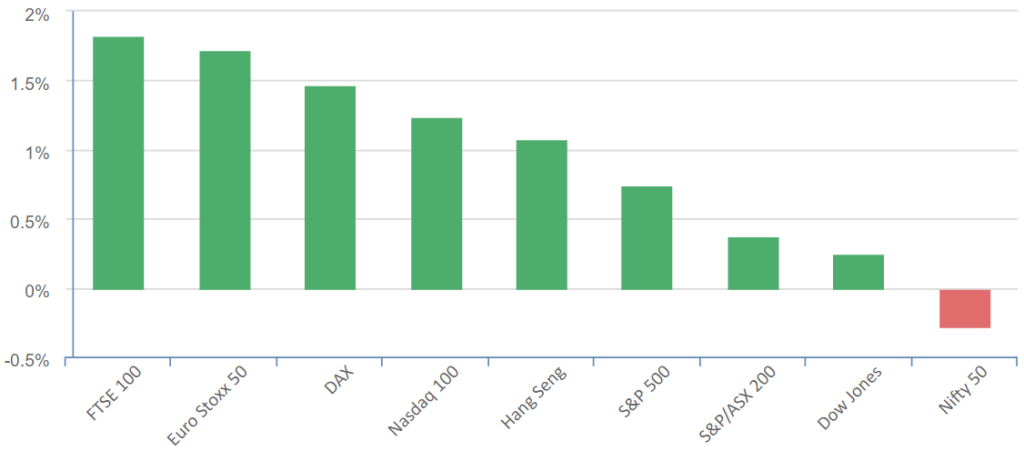

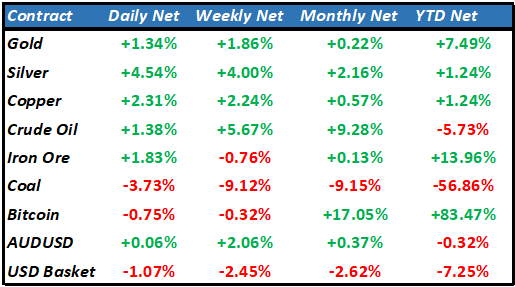

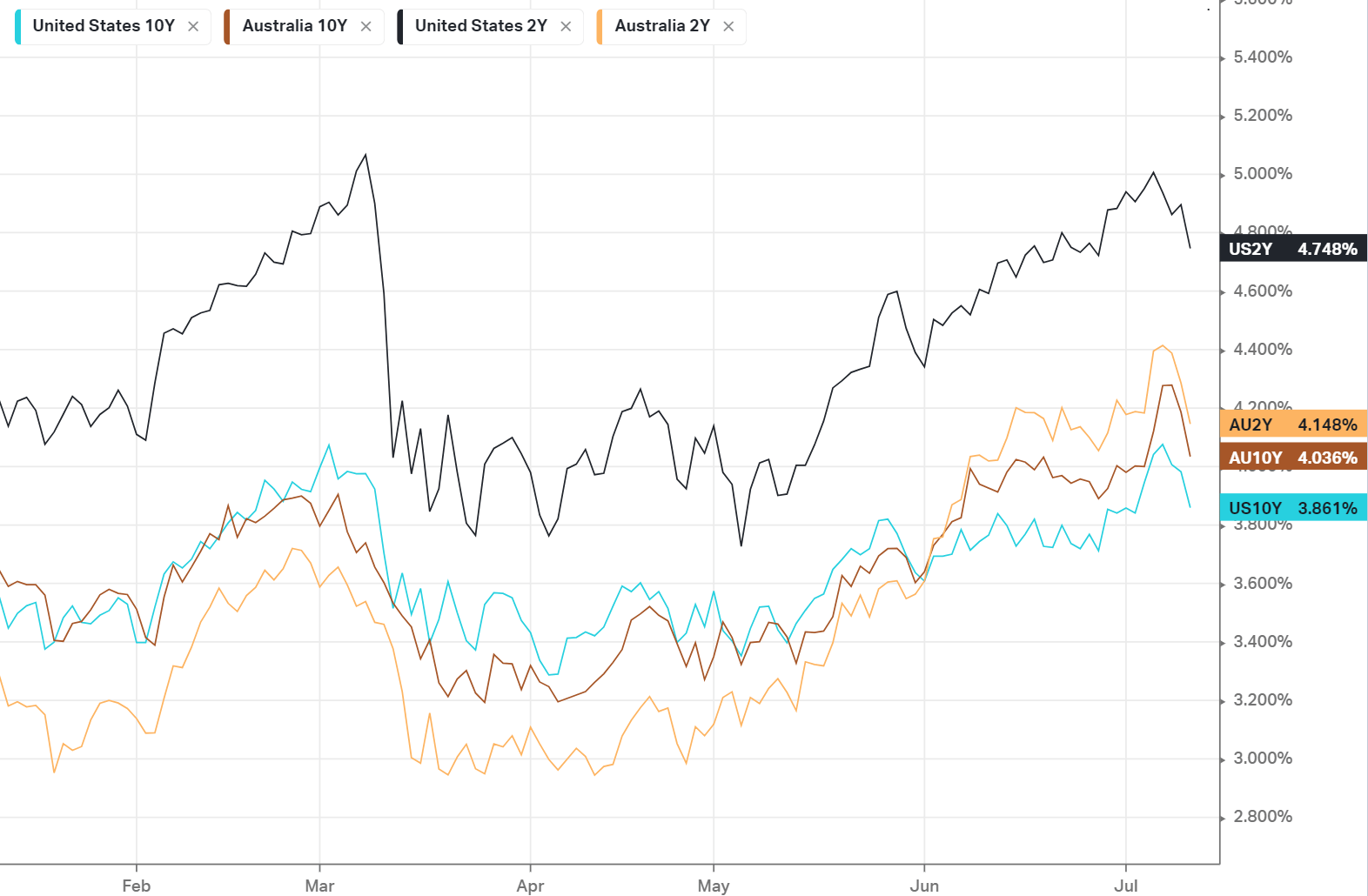

Equities closed higher overnight as data showing inflation rose by the slowest pace in more than two years pushed Treasury yields lower and tech higher amid optimism that a widely expected rate increase later this month could prove to be the final hike. The market initially spiked higher on US inflation numbers overnight but gave up gains into the close. The CPI rose 0.2% last month after edging up 0.1% in May, with 12-month inflation also slowing to a 3% pace from 4%, marking the slowest pace of price pressures since March 2021. While many still expect the Fed to resume rate hikes later this month, rate hikes beyond July will likely be thrown into further doubt should upcoming economic data signal a further slowdown in inflation. the July hike may prove to be the final move of the cycle, If economic data in the months ahead including the Employment Cost Index on July 28, and the employment and inflation data that is released in August, slow at the pace that we have seen in the CPI data of the past couple of months. This speculation dragged the USD lower to 12-month lows, helping commodities, energy and precious metals higher with silver leading the charge up 4.5%. Tech also rallied on the treasury yield fall, although the upside is limited given the once in 40 year rally is unlikely to be sustainable statistically. Pepsi Co and Delta airways will get earnings season underway tonight with the banks following up on Friday night.

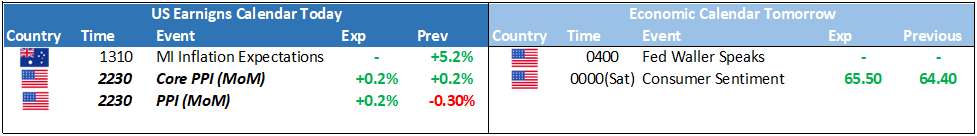

The Day Ahead

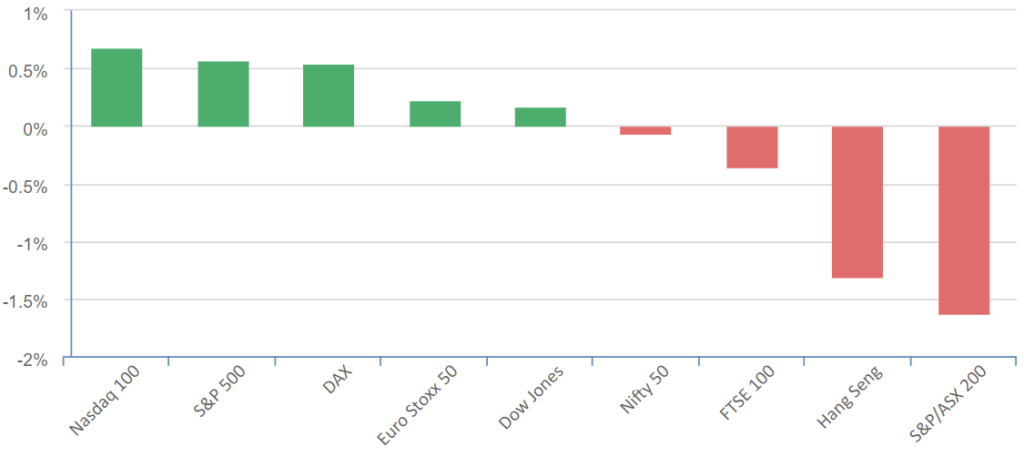

The broad-based rally in the US due to the inflation data should see the ASX have a solid day with the materials, energy and tech leading the way. The rise in the Iron Ore price on stimulus speculation from China will support the big miners while precious metals miners will also benefit from the rise in Gold and Silver along with as underlying commodities moved higher. With inflation out of the way, the focus will switch to US earnings and quarterly updates from the miners over the coming weeks.