Market Summary

Equities closed higher on Tuesday, primarily driven by notable leaps in the energy and big tech sectors. This increase came as investors keenly anticipated duo of inflation reports scheduled for release over the next two nights.

-

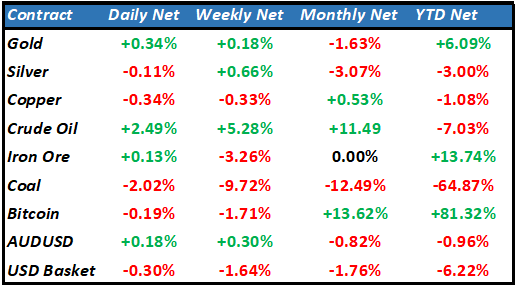

Energy Sector: The sector saw an upsurge, attributed to a positive shift in the demand outlook. This reversed prior expectations of a surplus in the oil market during the latter half of the year. The surge was buoyed by indications of a decline in crude production and recent commitments from Saudi Arabia to decrease output by one million barrels per day in July. Furthermore, an uptick in the sentiment on energy stocks was facilitated by China, the world’s largest energy importer, as it reportedly contemplates strategies to boost its economy through additional stimulus.

-

Cyclical Sectors: Other cyclical sectors, such as industrials, also experienced increased interest. The growth was driven by broker upgrades and the anticipation of major Wall Street banks commencing the earnings season on Friday.

-

JPMorgan: The banking giant led the way in the banking sector, following an upgrade spurred by the strength in its balance sheet and earnings potential.

-

Regional Banks: These entities, which faced intensive scrutiny in the aftermath of the spring banking crisis, were also on an upward trajectory. For instance, U.S. Bancorp enjoyed a rise of over 3.5% after Bank of America upgraded the stock from neutral to buy.

-

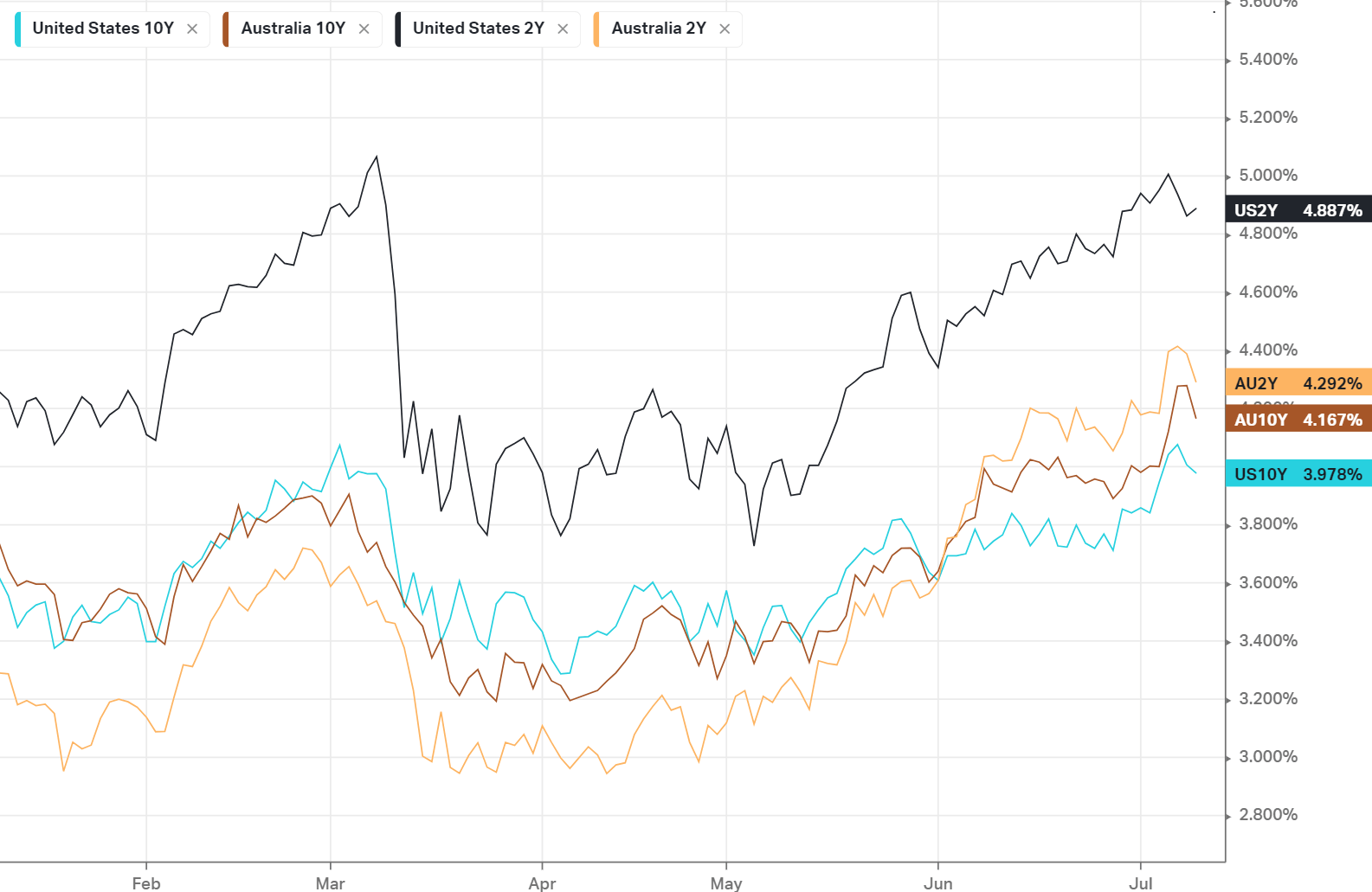

In the midst of this market activity, speculation remained somewhat constrained. However, it’s important to note that this could drastically change if the forthcoming inflation data exceeds current expectations. Such an outcome would shape the Federal Reserve’s policy and the level of peak rates.

The Day Ahead

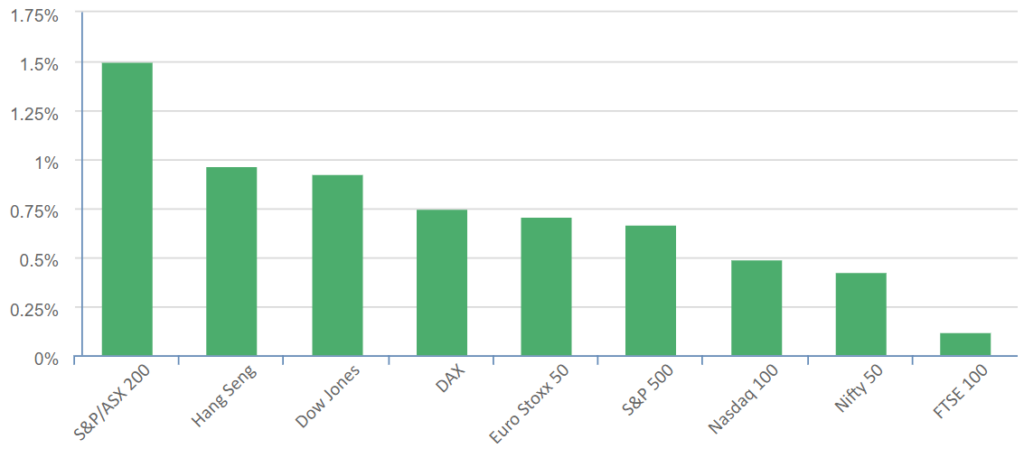

The ASX is likely to experience a robust day, thanks to the expected stimulus from China and an upturn in the cyclical and banking sectors in the US, which are key components of the ASX200 index.

Market Sentiment: The overall mood in Asia this week has been increasingly positive, influenced by a growing consensus that the U.S. central bank is nearing the conclusion of its policy tightening cycle. This perception is having multiple effects, including a depreciation in the dollar, an improvement in market sentiment, and an increase in asset prices.

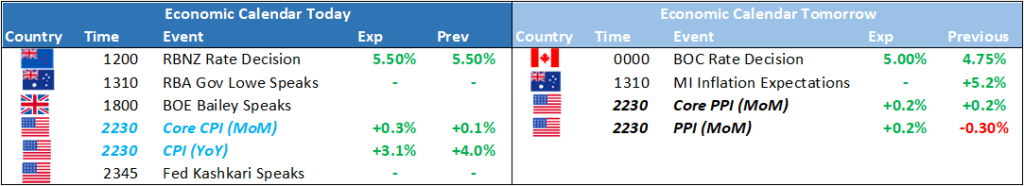

Economic Developments: On the economic front, a couple of key events are set to take place which could impact the markets:

- The Reserve Bank of New Zealand’s latest interest rate decision is due at midday.

- Reserve Bank of Australia’s Governor, Lowe, is scheduled to speak at 1pm.

Investors are expected to engage in some profit-taking ahead of the release of tonight’s CPI data later in the session. This behavior could add another dynamic to the market’s performance.