Overnight – Stocks recover from 6-month lows ahead of “Liberation Day”

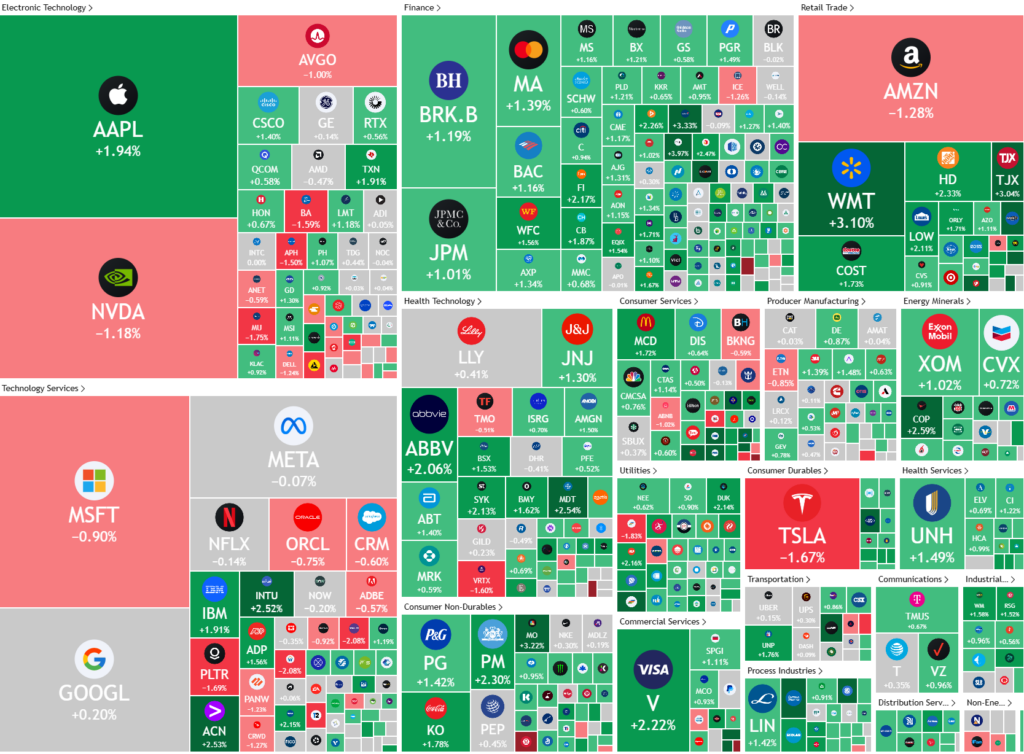

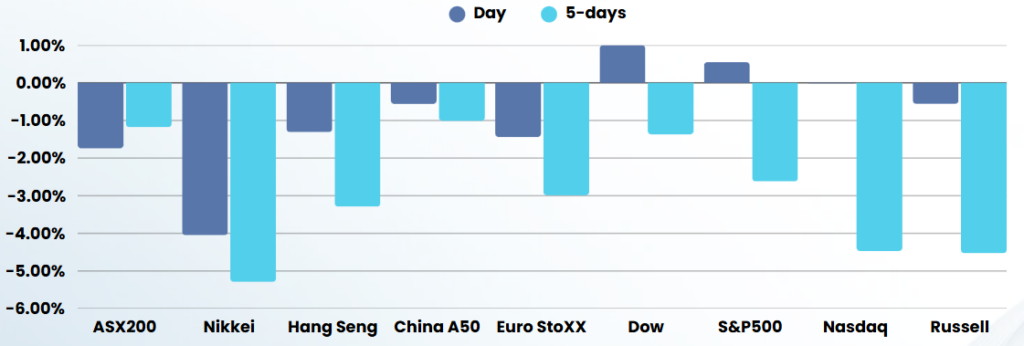

Stocks recovered from six-month lows to finish higher on the day, as quarter end buying helped minimize the damage for the first quarter of 2025.

This was surprising given President Donald Trump’s April 2 “liberation day” deadline to impose more reciprocal tariffs providing continuing uncertainty

US indices ended Q1 down 4.5% for the S&P500, 8.1% in the MAG7 heavy NASDAQ and 9.79% for the broad-cap index, the Russell2000

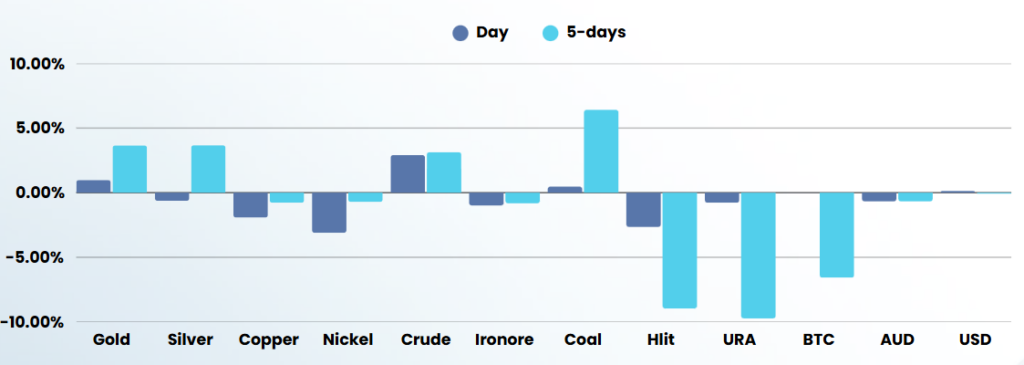

Ahead of the so-called “liberation day”, when President Trump is expected to unveil several more trade tariffs, White House press secretary Karoline Leavitt said the tariffs would be country-based rather than sector-based, though added that the president remains committed to sectorial tariffs. A WSJ report over the weekend said Trump will consider higher tariffs against a broader range of countries, as he embarks on a trade agenda aimed at correcting alleged trade imbalances against the US. Trump rattled markets last week by imposing a 25% tariff on all non-American cars. The tariff will take effect from April 2, where Trump could also announce tariffs against other sectors such as commodities, semiconductors and pharmaceuticals.

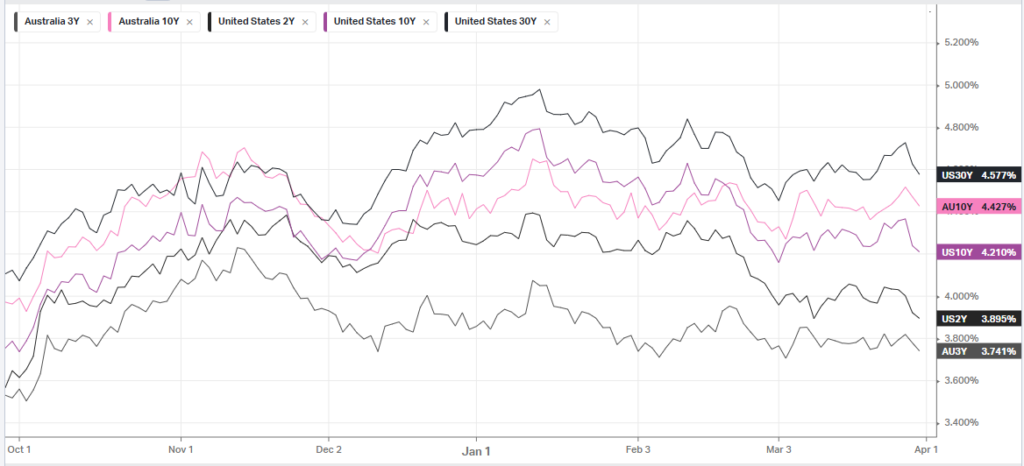

Markets fear that Trump’s tariffs, which will be borne by U.S. importers, will underpin inflation and compromise U.S. economic growth in the coming months. Goldman Sachs sees a 35% chance of a recession in the next 12 months, and also expects inflation to rise further above the Federal Reserve’s 2% target in 202

This week sees an abundance of major economic releases, including the all-important jobs report for March. The U.S. economy is tipped to have added 139,000 jobs in March at an unemployment rate of 4.1%.

Company Specific

- Tesla is expected to unveil first-quarter deliveries data this week, with analysts and investors bracing for a potential drop in the proxy for the electric vehicle maker’s sales. The numbers, which are due out on April 2, are projected to show a decline in the figure versus the year-ago period, as the company contends with a backlash to CEO Elon Musk’s political activities that have led to protests at showrooms.

- CoreWeave fell more than 7% just days after making its public debut. The Nvidia-backed company opened trading its below IPO price on Friday.

ASX SPI 7944 (+0.85%)

After a categorical rout of the ASX for quarters end yesterday, we expect some common sense to return to the market and the index head higher.

Traders will be watching the Reserve Bank of Australia’s statement this afternoon for any signs that the global trade environment and geopolitical instability are influencing its approach to monetary policy. Markets are pricing in no change to the current cash rate of 4.10 per cent.