Overnight – Tesla drives stocks higher as investors sweat on Nvidia results

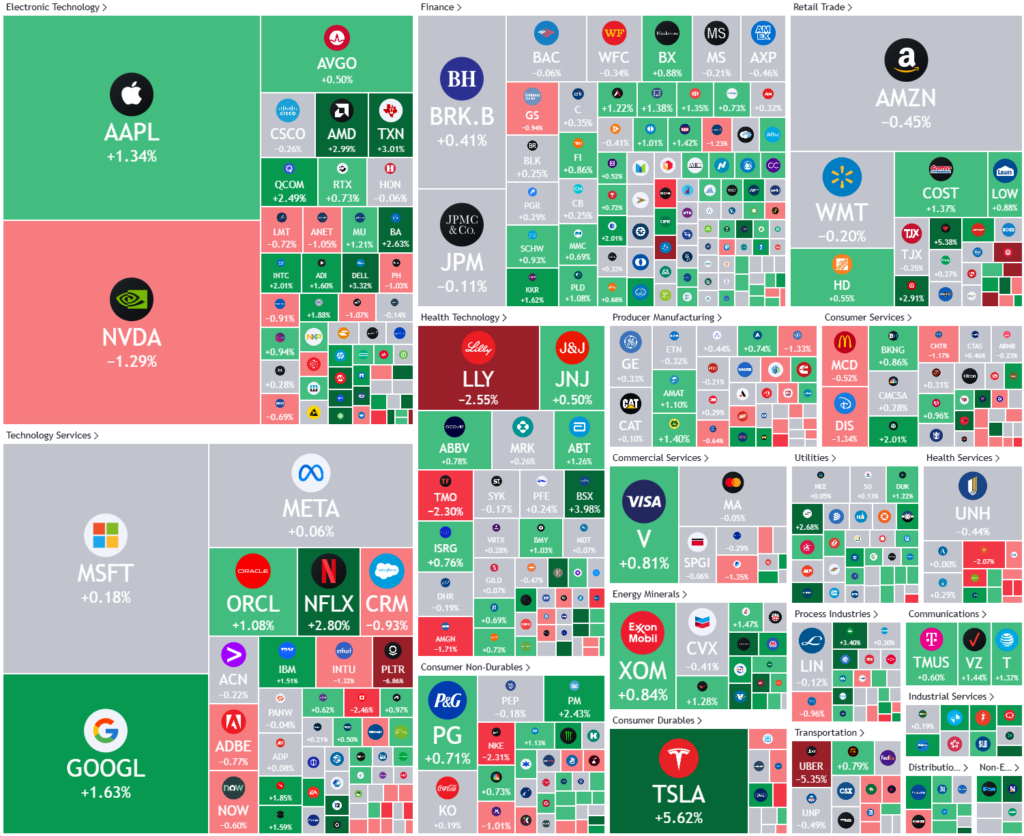

Stocks closed higher overnight, driven by a rally in big tech and Tesla ahead of key earnings from Nvidia and comments from Federal Reserve officials.

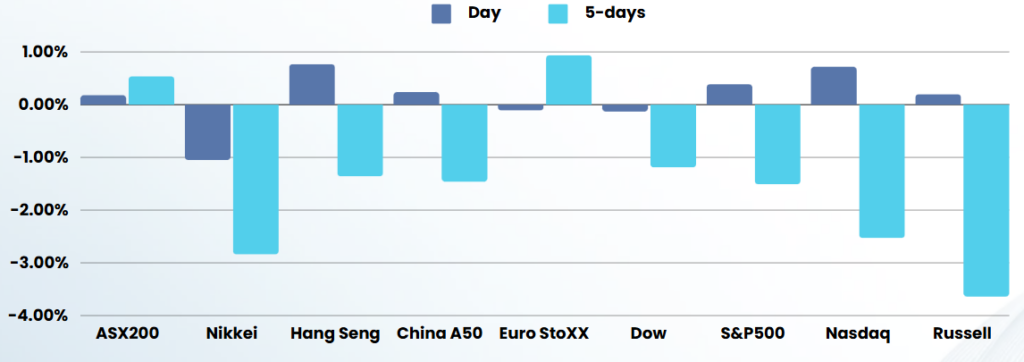

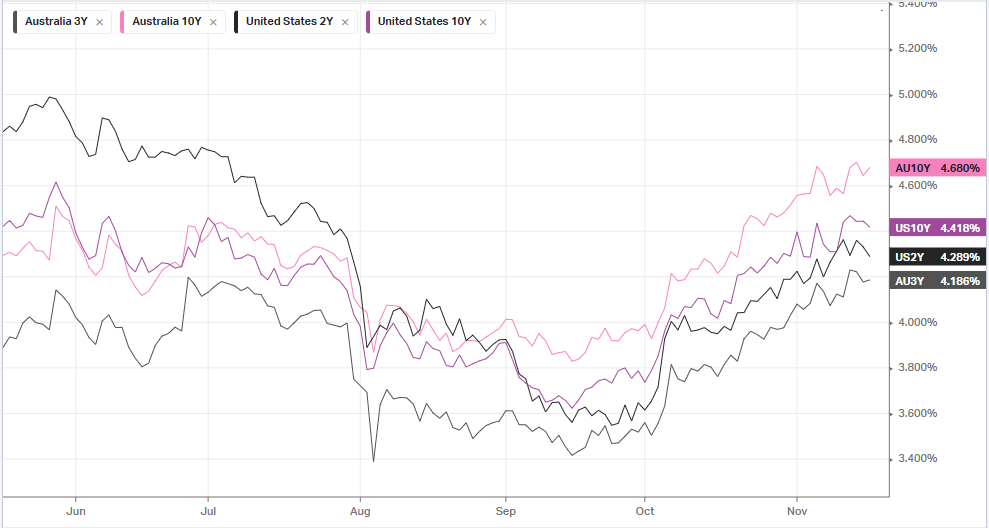

The Nasdaq and S&P 500 rebounded after recent losses as investors anticipated quarterly earnings from Nvidia, a leader in AI, while Tesla surged on expectations of favorable policy changes from the incoming Trump administration. Last week, the major indices retreated from recent highs following Fed Chief Jerome Powell’s caution that the central bank was not rushing to cut interest rates further.

Tesla’s stock soared over 5% after reports suggested the Trump administration would prioritize establishing a federal framework for self-driving vehicles. Meanwhile, big tech companies like Apple and Alphabet also performed well, each closing over 1% higher. However, Nvidia’s shares slipped 1% due to reports of overheating issues with its new Blackwell AI chips, just days before its third-quarter earnings release. These results are expected to be a significant indicator of investor sentiment towards tech stocks and the broader market following a stalled post-election rally.

As Nvidia prepares to report its third-quarter earnings, investors will scrutinize demand for its chips and the sustainability of AI-driven market enthusiasm. Despite Nvidia’s significant contribution to the S&P 500’s returns over the past year, expectations have tempered compared to previous quarters. In addition to Nvidia, results from major retailers like Walmart and Lowe’s will provide insights into consumer spending strength as the holiday shopping season approaches.

The U.S. economic calendar is quieter this week, with a focus on PMI data and comments from Federal Reserve officials, which could influence market reactions amid ongoing uncertainties regarding Trump’s policy impacts and cabinet appointments

ASX SPI 8345(0.10%)

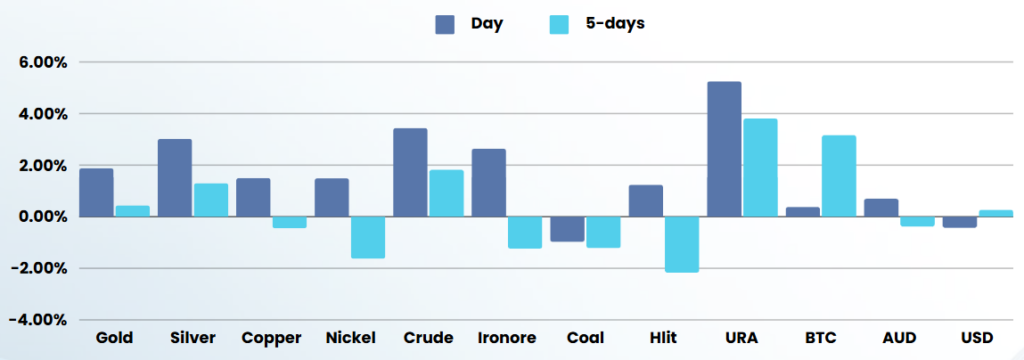

The ASX should head slightly higher on improving commodity prices and offshore lead. The banks may still see some hangover selling from the NAB/ASIC suit and the $350m levy on banks to hold open regional branches

Today – ALS and Technology One release earnings. BlueScope Steel, SEEK and Sonic Healthcare host AGMs. Santos holds an investor briefing.