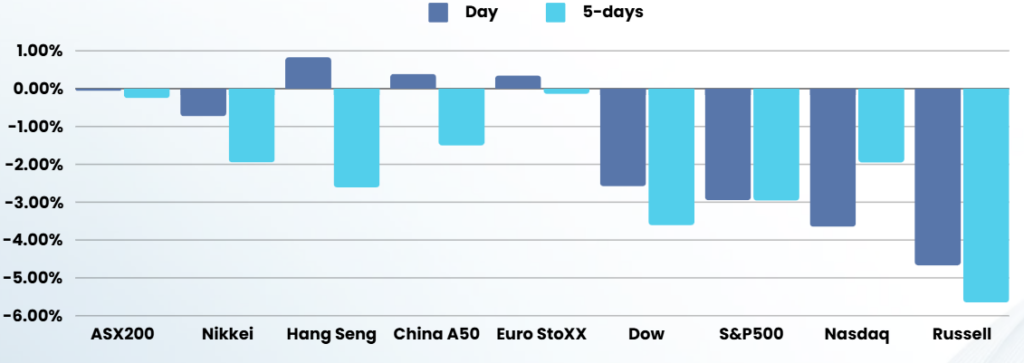

Overnight – Santa rally derailed as Fed halves the rate-cut outlook for 2025

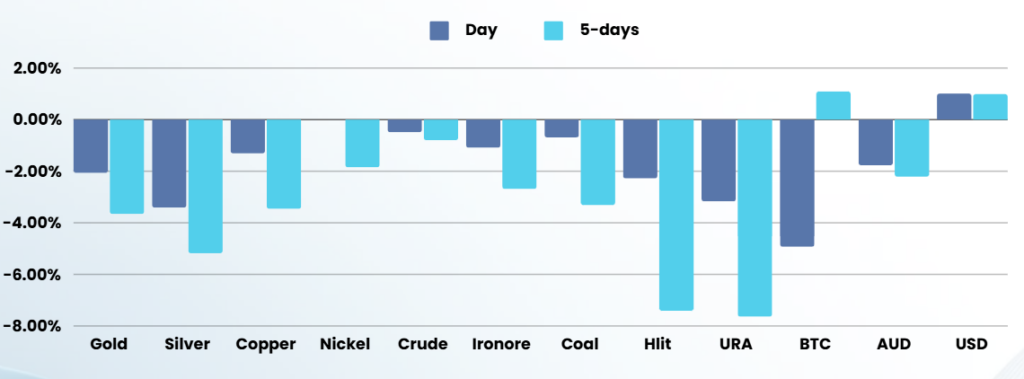

The Federal Reserve cut interest rates by 25 basis points overnight, but halved the number of rate cuts expected for next year as the battle to bring inflation down toward the central bank’s target is now expected to take longer than previously expected.

In what was the third rate cut of the year since the first cut in September, Fed members now appear to be easing away from a deep rate cut cycle, betting on fewer rate cuts ahead.

Fed members now see the benchmark rate falling to 3.9% for next year, suggesting just two rate cuts, compared with a prior forecast in September for four cuts. Rates are seen falling to 3.4% in 2026, up from a prior forecast of 2.9%.

Powell pointed to stronger economic growth in second half of 2024, a lower downside risks for the labour market as well as uncertainty on inflation as factors that contributing to the slower path of rate cuts.

The Fed chief also pointed to expectations that a higher neutral rate suggests that destination end game for interest rates cuts are closer than previously expected. The Fed lifted its expectations for longer-run interest rate to 3% from 2.9% previously.

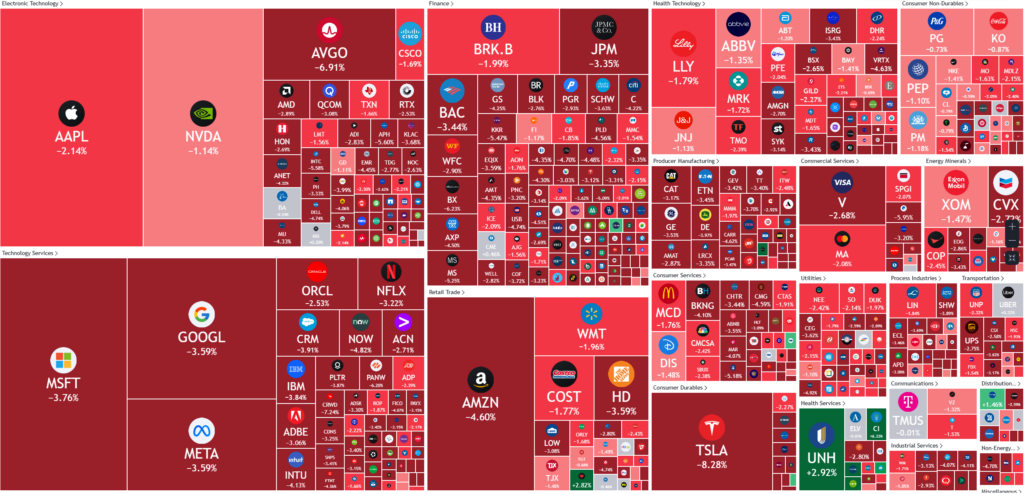

NVIDIA cut its intraday gains to close 1% lower following the broader market slump. The chipmaker fell deeper into correction territory on Thursday following its 10% plunge from a recent peak.

Tesla meanwhile, halted its impressive run with a 8% slump.

ASX SPI 8192 (-1.61%)

The ASX is in for a punishing day with the Feds reality check for over inflated equities markets caught investors off guard.

The most vulnerable sectors and stocks will be those that have been 2024’s favourites as investors deal with negative momentum for the first time in months

Company news

ANZ, Elders and Incitec Pivot all host AGMs