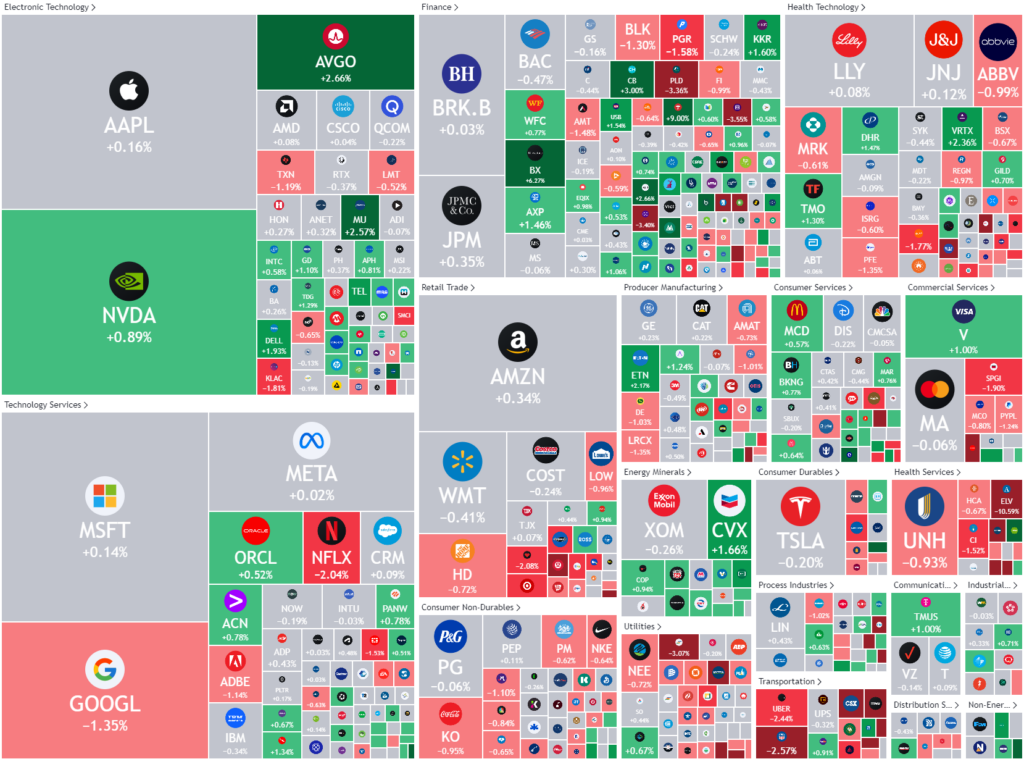

Overnight – Chip stocks drag market higher as TSMC says AI Chip demand “Real”

Stocks surges for the 4th session in the last 5, as stronger-than-expected monthly retail sales indicated a robust U.S. consumer and chips stocks were buoyed by TSMC’s upbeat forecast.

The chipmaker’s U.S.-listed shares soared, while AI-trade favourite and TSMC customer Nvidia gained. The optimism spread to other chip stocks, sending the broader Philadelphia SE Semiconductor index higher.

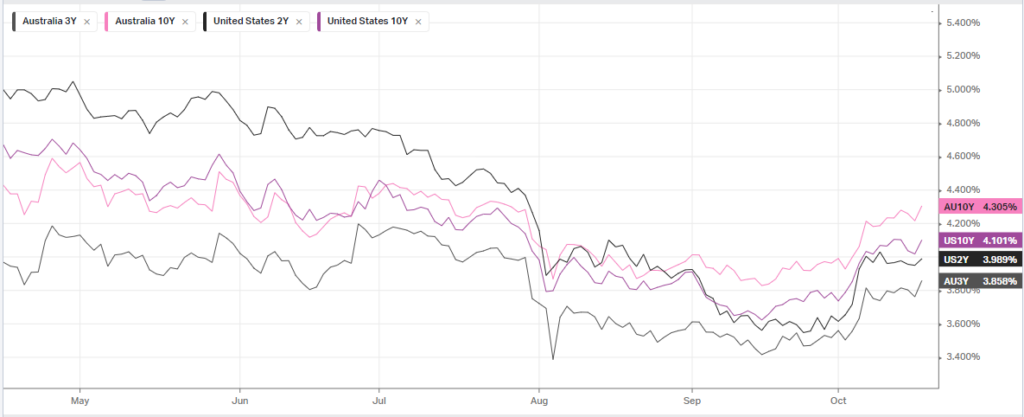

Fresh U.S. data confirmed healthy growth in the world’s largest economy, while keeping bets on a 25-basis-point rate cut at the Federal Reserve’s next meeting largely intact at 89.4%, according to CME’s FedWatch. U.S. retail sales increased 0.4% in September, slightly more than expected, while weekly jobless claims fell unexpectedly.

A broadly upbeat start to the third-quarter earnings season, strong economic data and the Fed kicking off its policy-easing cycle have pushed the Dow and the S&P 500 to record highs in recent sessions, with the latter close to the psychologically important 6,000 mark.

One other quirk is that U.S. equity benchmarks have advanced in recent days even as U.S. Treasury yields have crept up. On Thursday, the yield on the benchmark 10-year note rose 7.5 basis points to 4.091%.

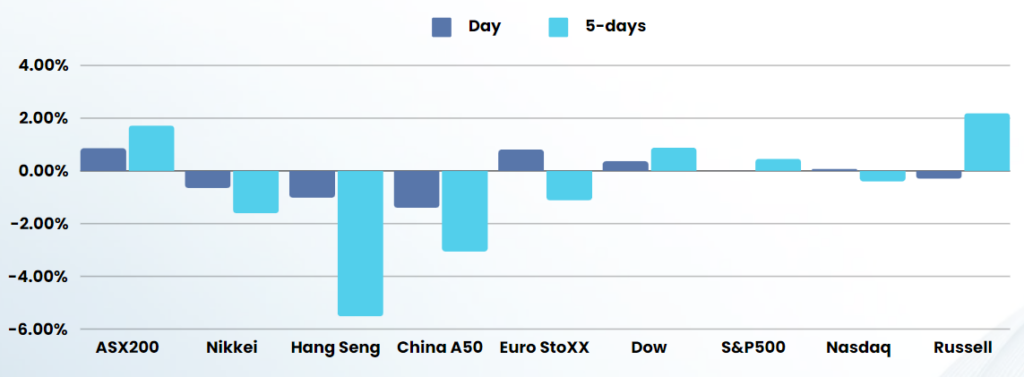

The European Central Bank has slashed interest rates by a quarter point at a second straight meeting on Thursday as policymakers look to address twin slowdowns in inflation and economic growth. It is the first back-to-back borrowing cost drawdown in 13 years, and serves as a sign that the ECB has begun to pivot away from a period of interest rate hikes designed to quell elevated price growth. Instead, the ECB has signaled that it is refocusing policy on trying to reinvigorate a sputtering Eurozone economy that has struggled to keep pace with the US for much of the last two years.

Stock specific

- Netflix – The steaming service reported upbeat guidance Thursday following third-quarter results that topped Wall Street expectations as the streaming giant added more subscribers than expected in quarter. Netflix was up more than 5% in afterhours following the results. Netflix reported earnings of $5.40 a share on revenue of $9.83B, topping estimates for earnings of $5.12 a share on revenue of $9.77M. The streaming giant added in 5.07M users in Q3, well above the 4.54M estimated

- TSMC – The worlds largest chip maker, TSMC reported that third-quarter revenue increased 39.0% year-over-year, while net income and diluted EPS both increased 54.2%. The company cited strong smartphone and AI-related demand. TSMC’s CEO C.C. Wei said, “[w]e continue to observe extremely robust AI related demand from our customers throughout the second half of 2024, leading to increasing overall capacity utilization rate for our leading 3 nanometer and 5 nanometer process technologies.” They now forecast the revenue contribution from server AI processors to more than triple this year, and account for mid-teens percentage of our total revenue in 2024. As a result, TSMC now forecasts that its full-year revenue will increase by close to 30% in US dollar terms.. When asked if the AI demand is real and sustainable, Wei said it is “real.”

ASX SPI 8358 (-0.38%)

Australian shares are expected to decline following strong job market data that diminished prospects of an interest rate cut by the Reserve Bank of Australia (RBA). This contrasts with the positive sentiment on Wall Street, where both the S&P 500 and Dow Jones Industrial Average briefly reached record highs, buoyed by robust retail data.

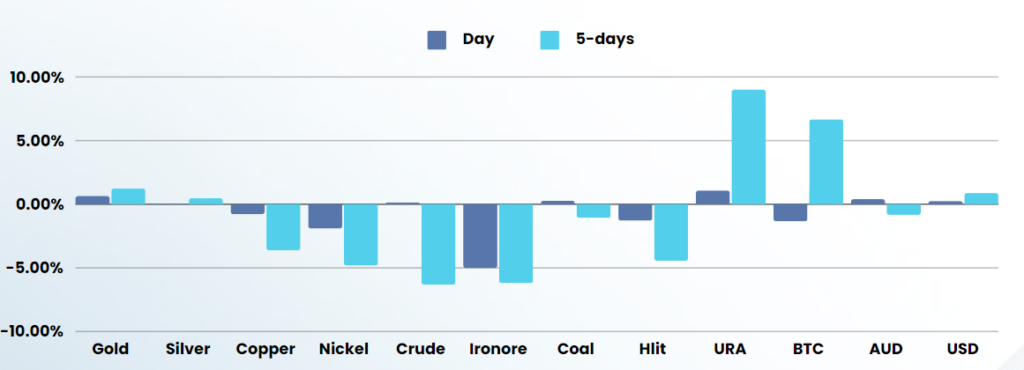

The materials sector is anticipated to be a significant factor in pulling down the Australian market index, primarily due to a 5% drop in iron ore prices. While some of this decline was already factored into the previous day’s trading session, it is likely to continue exerting downward pressure. Meanwhile, the oil market experienced volatility as U.S. data revealed a larger-than-expected decrease in crude inventories, with stockpiles falling by 2.19 million barrels.

While we continue to see record highs, we are still of the view that investors should be looking to take some profits and returning back to some cash