Overnight – Equities continue to bounce despite mounting uncertainty

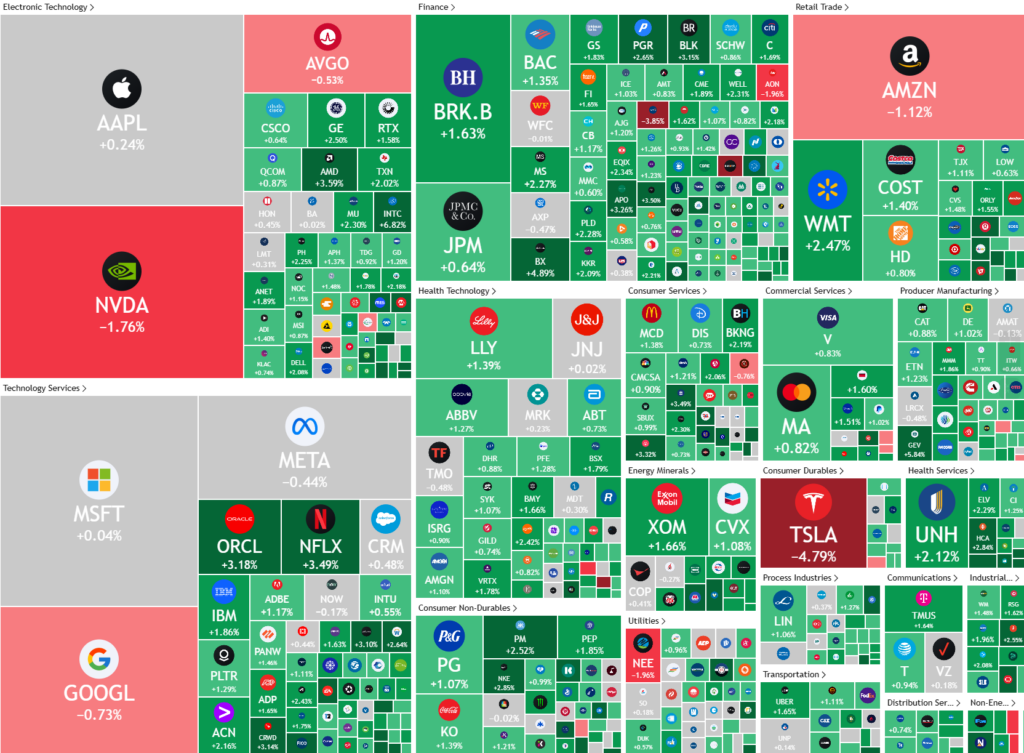

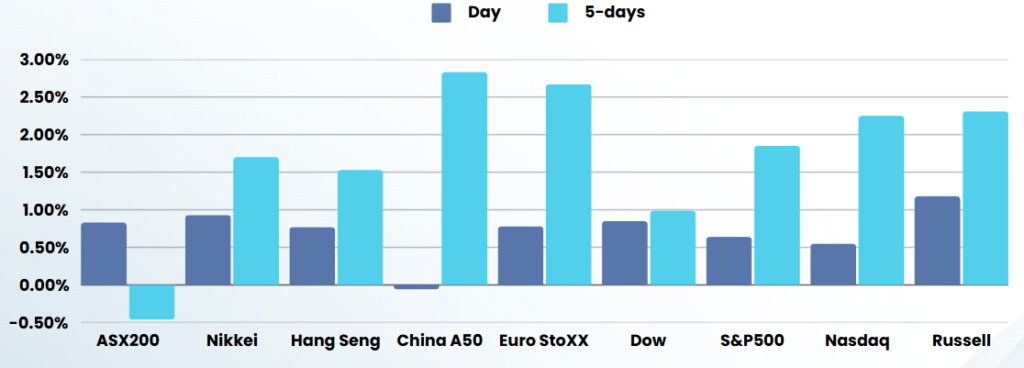

Stocks continued to bounce overnight, as investors awaited the start of the Federal Reserve’s meeting and the Nvidia’s annual conference for further insight into AI demand.

Despite the “green on the screen” there are still issues bubbling in the background. US Retail sales rebounded in February, although less than expected, though at a moderate pace as tariffs on imports and mass firings of federal government workers weigh on sentiment. Retail sales rose 0.2% last month, weaker than the 0.6% growth predicted, after a revised 1.2% decline in January.

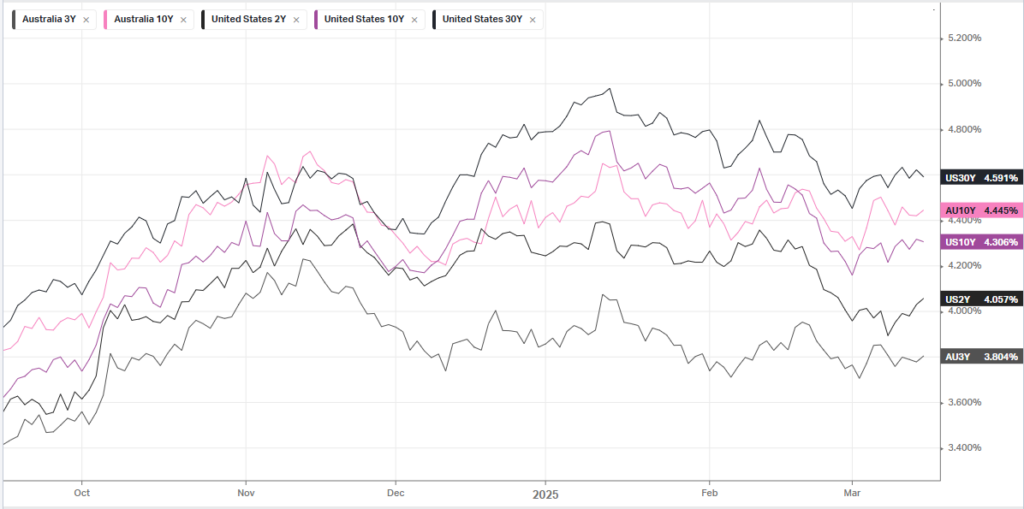

Investors are also on guard for more economic cues from a Federal Reserve meeting this week, with the central bank widely expected to keep rates unchanged. Trump’s flip-flopping on trade tariffs against major trading partners, coupled with his continued threats of more tariffs, were a key point of uncertainty for markets in recent months.

Concerns are increasing from analysts that the Fed is not ’in charge’ anymore, having relinquished control of macroeconomic policy to the Trump administration, and are stifled in delivering the 3 rate cuts the market was expecting. Recent data showed inflation remained resilient, while retail sentiment and the labor market cooled. The latter could give the Fed some impetus to soften its hawkish stance on rates.

In company news:

- Nvidia – started the week down nearly 2%, although in the context of Fridays 5.25% rally, the price action remained fair, a day ahead of the chipmaker’s annual GTC conference. At the conference, Nvidia is expected to provide datapoints that support expectations that its next-gen AI chip Blackwell’s issues have been sorted and continued to tout strong AI-led demand amid rising competition.

- Tesla – fell more than 4% after Mizuho cut its price on the stock to $415 from $430 a share, citing a softer EV sales outlook.

- Robinhood –The US retail broker said it was rolling out prediction markets for users on its app allowing them to bet on events including sports tournaments to Fed rate decision, sending its stock more than 7% higher.

ASX SPI 7909 (+0.67%)

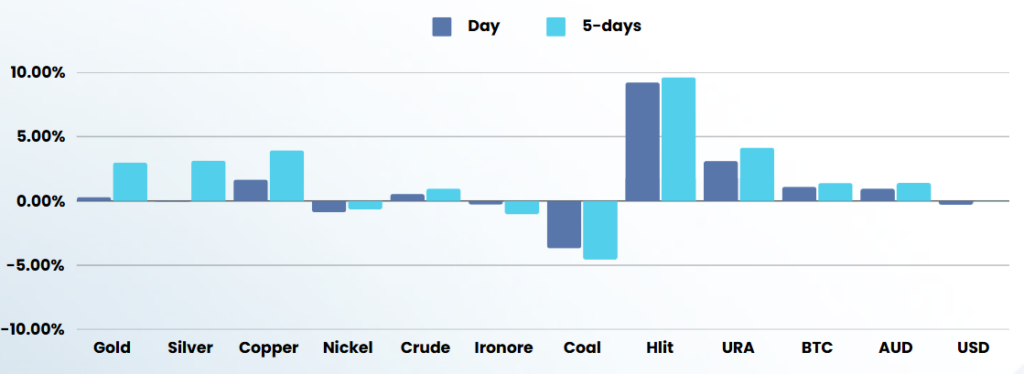

Australian shares are expected to increase for the third day in a row, following gains in all three major US benchmarks. This rise is attributed to an increase in US retail sales, which is a significant indicator of consumer confidence. Meanwhile, iron ore prices have dropped by 2% to $101.95 per tonne due to mixed economic reports from China and the ineffectiveness of recent measures aimed at boosting consumption.

- DexusWholesale Airport Fund is attempting to raise funding from high-net-worth investors to lob a bid for a slice of the two airports.

- Medtech Imricor Medical Systemsbegan wall-crossing investors over the weekend, seeking support for an equity raising of as much as $80 million, Street Talk reported. Morgans is the sole lead manager on the deal, slated to launch on Monday.