Overnight – DOW suffers 9th consecutive down day, longest streak in 45 years

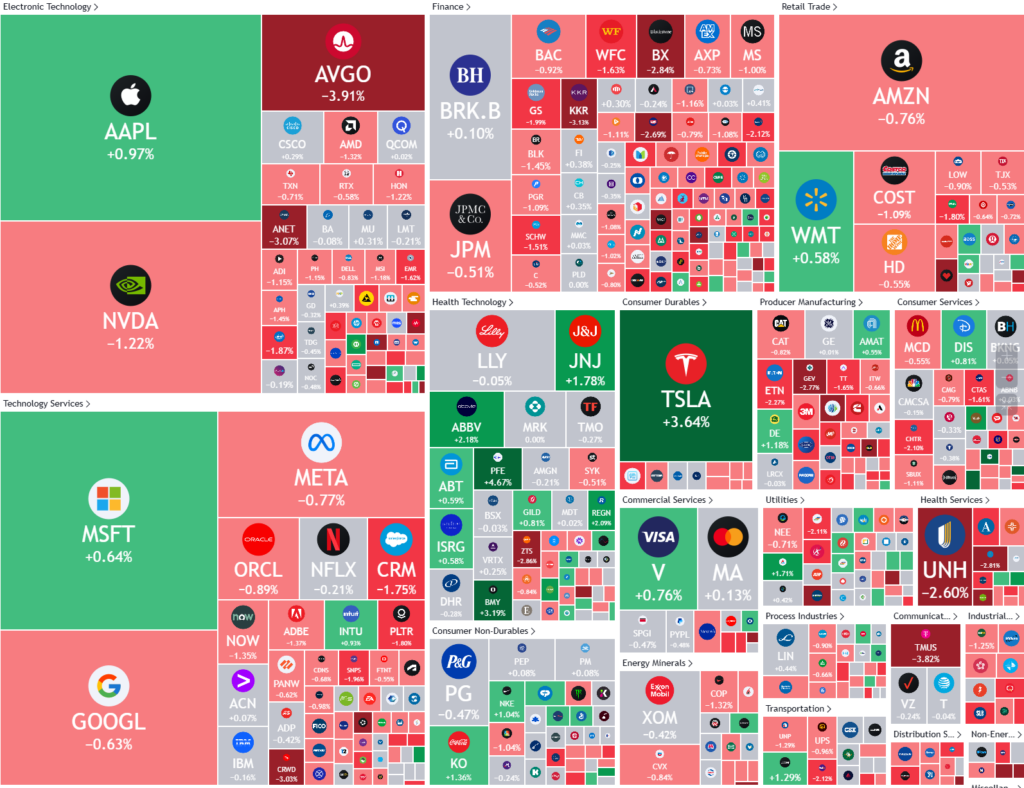

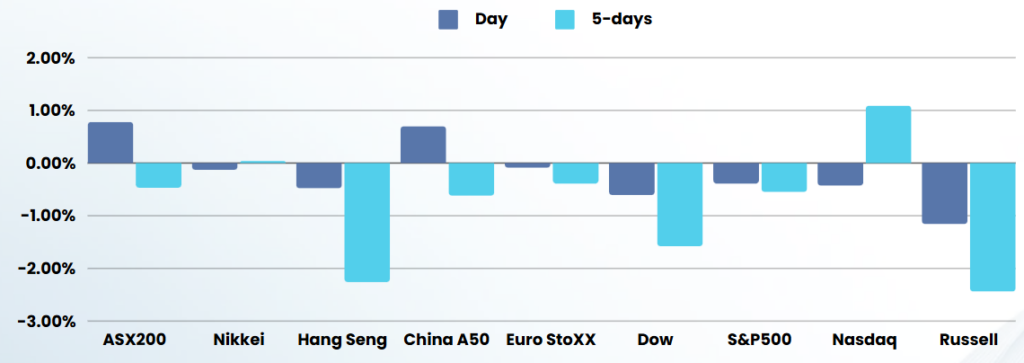

Equities headed lower overnight, with the DOW suffering its longest losing streak since 1978 as the Federal Reserve kicked off its last meeting of the year.

Retail sales rose by 0.7% in November, above the 0.6% forecast, underscores that the US economy is still growing at a healthy pace even with higher interest rates.

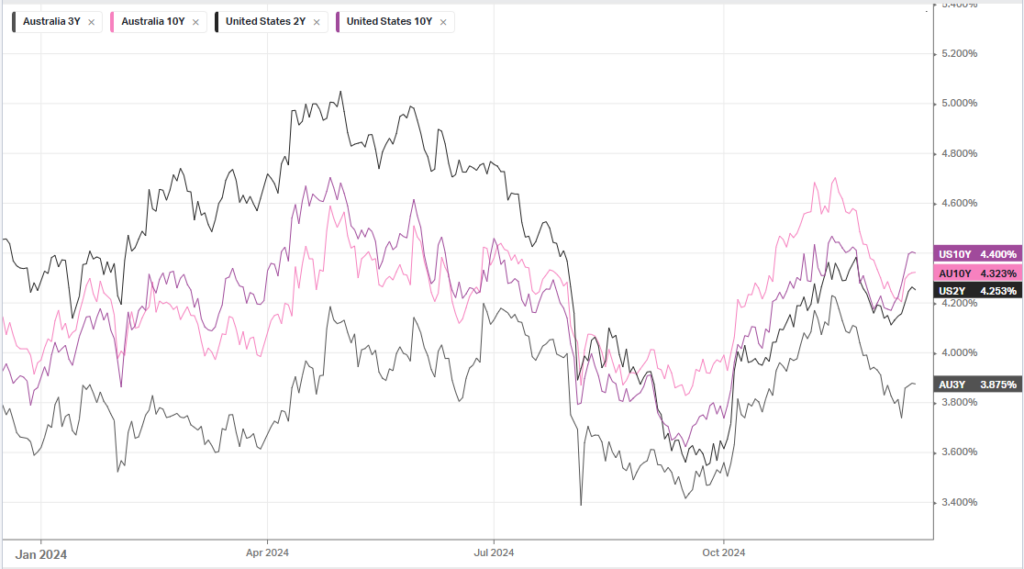

While a rate cut appears to be largely priced in by markets, especially considering recent gains in Wall Street, focus will be chiefly on the central bank’s outlook on rates.

The central bank is widely expected to cut interest rates by 25 basis points at the conclusion of a two-day meeting on Wednesday, at MPC we aren’t so certain. Goldman Sachs analysts said in a recent note that they no longer expect a rate cut in January, and that the bank will cut rates by a slightly slower pace in the coming year.

Investors are bracing for the Fed to signal a slower pace of easing in 2025 amid growing signs of sticky inflation and strength in the labour market- two major points of contention for the Fed.

Tech took a breather Tuesday as NVIDIA dropped 1% to fall deeper into correction territory following the chipmaker’s 10% slump from its more recent high.

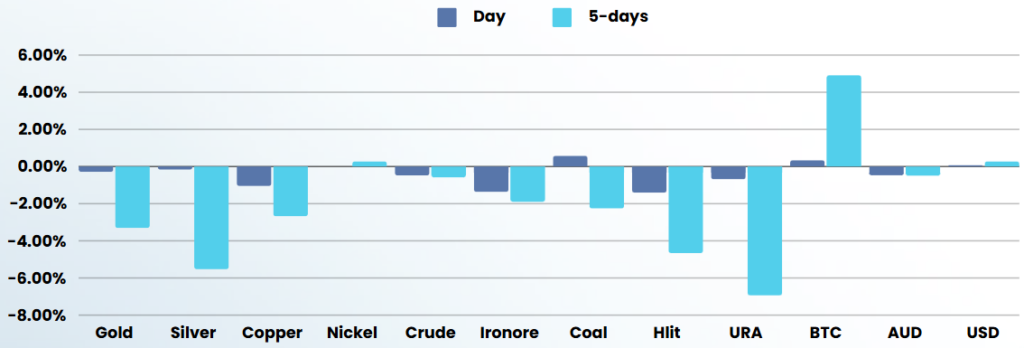

In another sign inflation may prove more stubborn than the market is pricing, UK wages spiked for a second consecutive quarter, similar to Australian wages, raising a red flag for 2025 on further cuts

Company Specific

- Tesla meanwhile, sidestepped the broader weakness after Mizuho upgraded the EV maker to outperform and hiked its price target on the stock to $515 from $230, citing a boost from loosening regulations.

- Pfizer stock rose 4.6% after the drugmaker said it was expecting its 2025 profits to be nearly in line with expectations, with the company reining in costs and cutting debt by shedding non-core businesses as its rebuilds itself post a sharp slump in sales of COVID-19 products.

- Crypto-focused stocks including Coinbase Global and MicroStrategy ended lower as bitcoin retreat from its record high after topping $108,000.

ASX SPI 8310 (-0.16%)

The ASX is likely to drift lower after yesterdays unexpected gains. The “Santa rally” is looking increasingly at risk as the 2024 “melt up” looks tired.

The Fed’s rate decision tonight, is the last key piece for the year and will dictate the tone for the remainder of 2024

Company news

- National Australia Bankhosts its annual general meeting

- KKR’s $2.2 billion deal for Perpetual’s wealth and corporate trust business has been hit by another setback after an independent expert cast doubt on the deal.