Overnight – Equities bounce as “no news is good news” for stocks

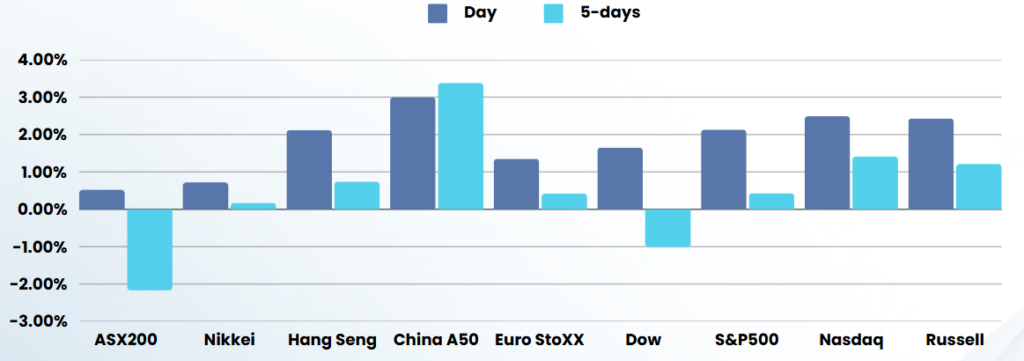

Stocks rallied on Friday, as “no news from President Trump was good news” for equities. The rally was a relief for investors in a mixed week, where the market marked its fourth consecutive weekly loss, but no where near as deep as first thought.

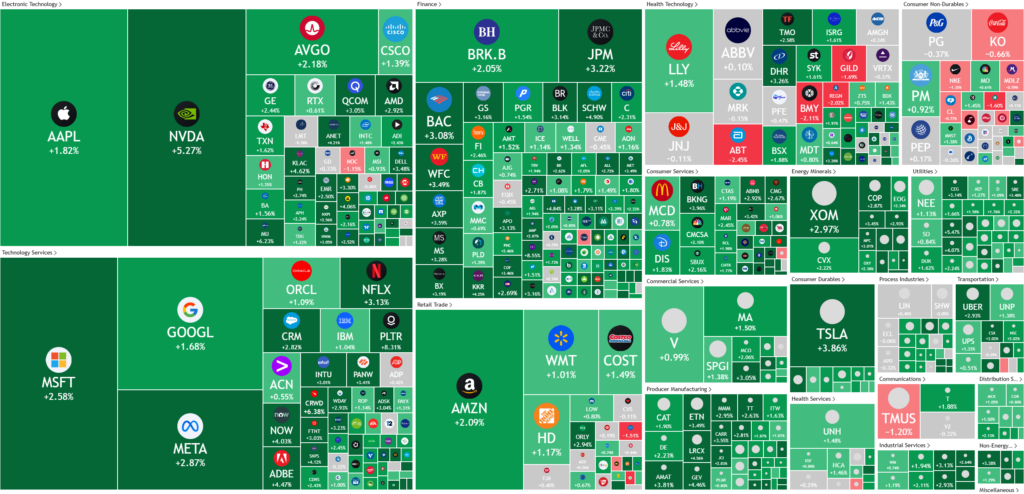

The Dow Jones Industrial Average rose by 1.7%, the S&P 500 by 2%, and the NASDAQ Composite by 2.6% on Friday, driven by gains in tech stocks like NVIDIA, which jumped over 5%.

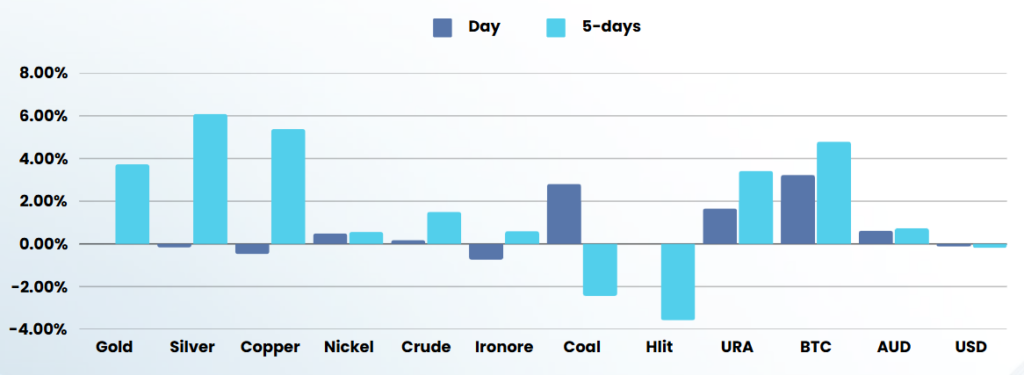

Despite these gains, consumer sentiment hit its lowest level in over two years, according to the University of Michigan’s Consumer Sentiment Index. The index fell to 57.9 from 64.7 in February, reflecting concerns about economic uncertainty and tariffs. Expectations for future economic conditions, personal finances, and stock markets all declined, while inflation expectations increased significantly. This rise in inflation expectations aligns with fears that escalating trade tensions could reignite inflation and potentially lead to a recession.

Trade tensions continued to escalate with President Trump threatening a 200% tariff on European alcoholic beverages in response to EU tariffs on American whiskey. This move is part of a broader trade conflict that has investors worried about economic stability. Additionally, the Federal Reserve has adopted a more hawkish stance due to inflation concerns, which could impact interest rates.

In corporate news, Tesla saw a slight recovery with a 3.9% stock rise after announcing plans to introduce a more affordable Model Y in China. This move aims to bolster Tesla’s position in its second-largest market amid challenges including slowing sales and trade tensions. Despite this, Tesla’s stock has fallen significantly this month due to various factors, including Elon Musk’s controversies and market pressures.

ASX SPI 7867 (+1.09%)

The ASX is in for a positive day as investors hunt for bargains after a negative few weeks. The instinct of many will be to fall into the “fear of missing out” (FOMO) trap but while its good to see some positivity, we are very reluctant to call the bottom of the market just yet. The momentum trade that helped push the S&P 500 to several record highs last year is yet to fully unwind and further unease around tariffs and Trump’s erratic decision-making