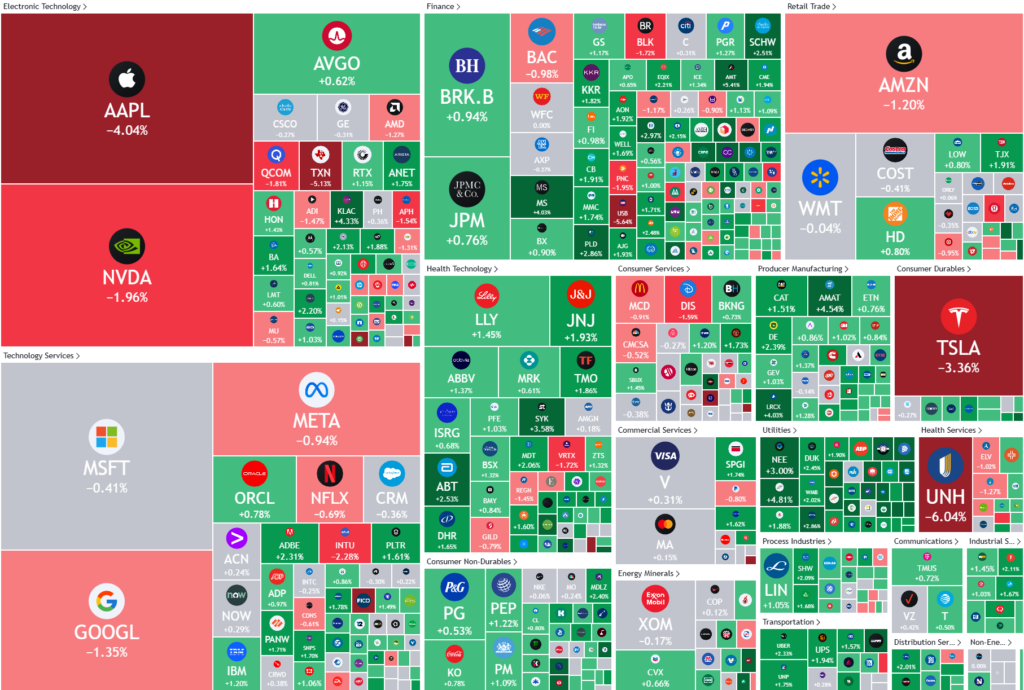

Overnight – MAG7 drags indexes lower despite broader market positivity

US stocks were broadly positive overnight, however the MAG7 concentration worked against the indices to see the market give up that early strength and close lower

The main Wall Street indexes had recorded strong gains on Wednesday, helped by benign inflation data and strong bank earnings. Investors also welcomed a U.S.-brokered ceasefire deal between Israel and Hamas, which heralds cooling geopolitical tensions in the Middle East.Compared to a year earlier, the PPI ticked up by 3.3%, accelerating from 3.0% in the prior month but cooler than estimates of 3.5%.

Apple’s smartphone sales in China experienced a significant decline in 2024, with the tech giant losing its top position to local rivals like Vivi and Huawei. The company sold 42.9 million smartphones in China, marking a 17% year-over-year decrease from 51.8 million units in 2023. This news led to a 4% drop in Apple’s stock price and contributed to a broader slide in the tech sector, despite easing concerns about Federal Reserve rate cuts

.The U.S. economy showed signs of slowing down, with retail sales growing at a lower-than-expected rate of 0.4% in December, down from 0.8% in November. Additionally, unemployment claims rose to 217,000, higher than anticipated. These economic indicators, along with recent inflation data, have sparked speculation about potential interest rate cuts by the Federal Reserve in the first half of the year, as suggested by Fed Governor Christopher Waller

In the banking sector, Morgan Stanley reported increased profits in the fourth quarter, driven by a surge in dealmaking activity, leading to a 4% rise in its stock price. Bank of America also posted higher profits due to strong performance in investment banking, although its stock fell slightly by 1%. These results followed positive earnings reports from other major banks, indicating a generally robust performance in the financial sector.

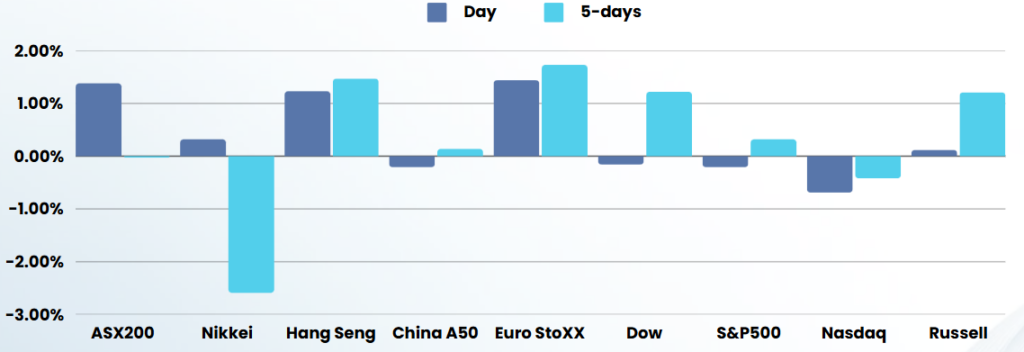

ASX SPI 8309 (+0.12%)

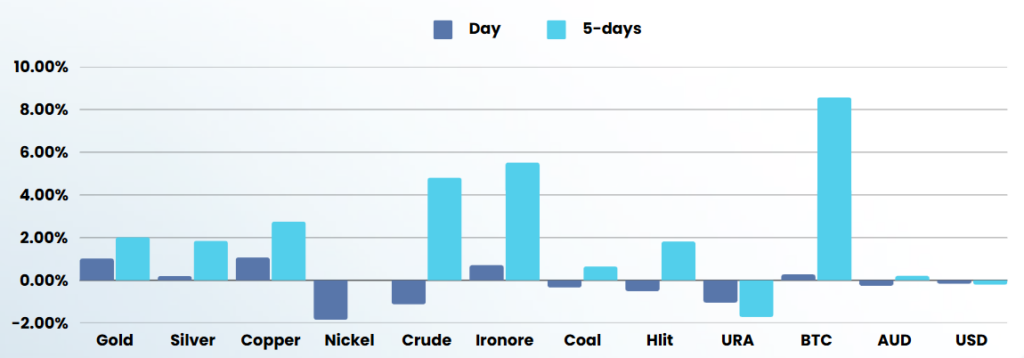

The ASX should have a relatively positive day with the materials and gold sector holding up the market while the tech sector might see some selling

Bloomberg is reporting that Rio Tinto and Glencore are holding talks about merging their businesses, a combination that would leapfrog BHP as the world’s largest mining group.