Overnight – Stocks weighed down by consumer and inflation concerns

Stock closed just shy of record Friday as data pointing to weakness in the consumer and ongoing inflation concerns weighed upside momentum

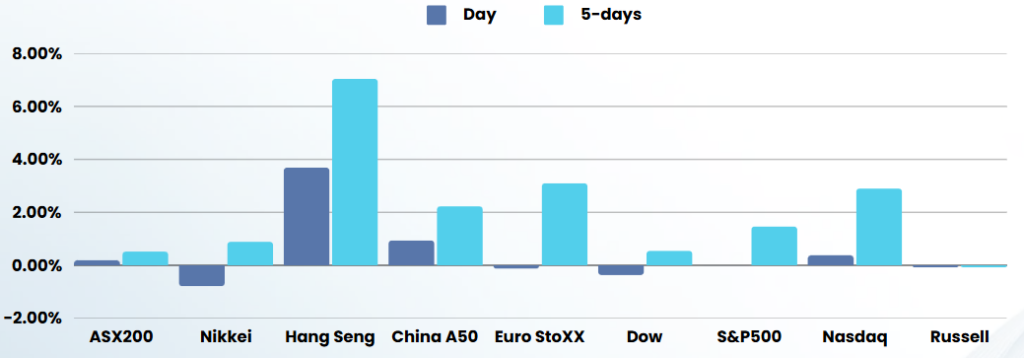

U.S. retail sales contracted by more than anticipated in January, as a cold weather snap and natural disasters hit spending activity that has been largely bolstered by a resilient labour market. Retail sales fell by 0.9% last month after an upwardly-revised increase of 0.7% in December. Economists had predicted a dip of 0.2% in retail sales, which mostly include goods and are not adjusted for inflation, after a previously reported 0.4 rise in December. Year-on-year, retail sales advanced by 4.2%. The data comes after a spell of cold weather rampaged through much of the country last month, while devastating wildfires in Los Angeles may also have weighed on spending.

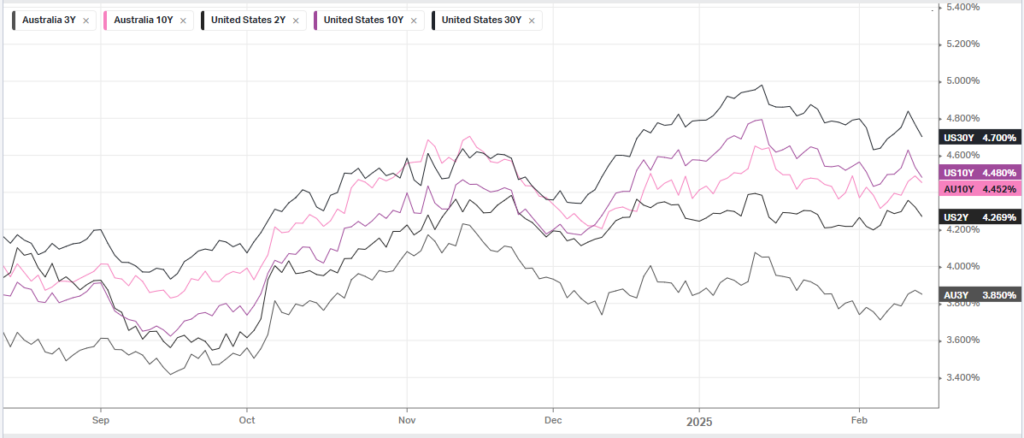

Inflation gauges, both consumer and producer prices, have come in hotter than expected this week, but the PPI data showed some softness in components of inflation that factor into PCE price index data – the Federal Reserve’s preferred inflation reading. This could herald a slightly softer PCE print for January. Easing PCE inflation could give the central bank more headroom to cut interest rates further, although Fed Chair Jerome Powell warned this week that the central bank was likely to remain cautious about further easing.

President Trump on Thursday signed an executive order outlining plans to impose trade tariffs that would match or surpass those imposed by major trading partners on U.S. imports, in the latest escalation of his drive to overhaul America’s trading relationship with its friends and adversaries alike. However, Trump did not immediately impose the new tariffs, choosing instead to conduct potentially weeks of investigations into America’s trading ties with a host of countries, including traditional allies like the European Union, South Korea, and Japan. This delay has been welcomed by investors as it provides time for negotiations, even though the tariffs could still be applied sometime this year. The president had earlier this week imposed 25% duties on steel and aluminum imports.

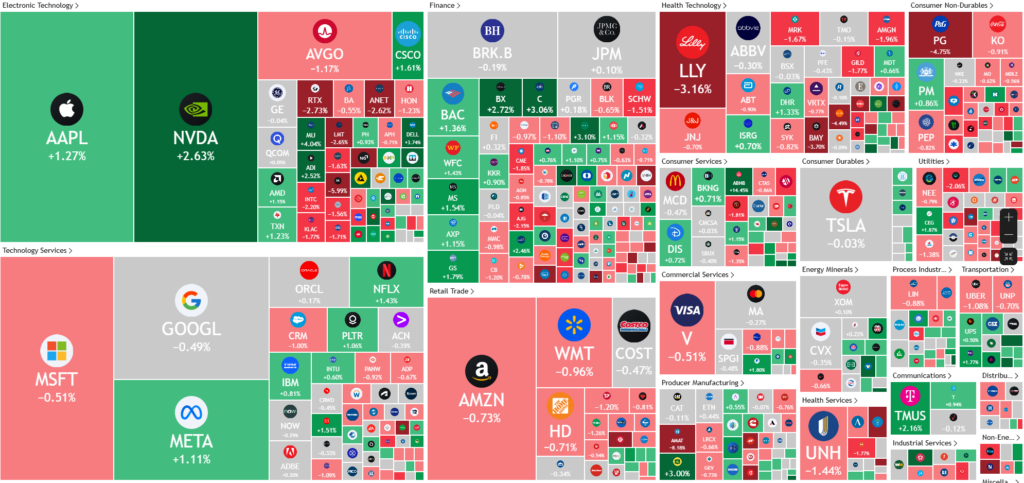

Corporate Earnings

- Moderna – rose 3% despite the biotech reporting a wider loss in fourth-quarter, as it continues to slash costs and see lower demand for its Covid vaccine.

- GameStop – stock rose 2.5% after CNBC reported that the video game retailer is mulling over potential investments into Bitcoin and other cryptocurrencies, as well as other alternative asset classes.

- Airbnb – stock soared more than 14% after the short-term housing rental company reported fourth quarter earnings and sales ahead of expectations, helped by a “notable acceleration” in the number of first-time bookers on the platform.

- Roku – stock added 14% after the technology company forecast annual revenue above expectations signaling strong advertising sales as more customers switch to streaming platforms.

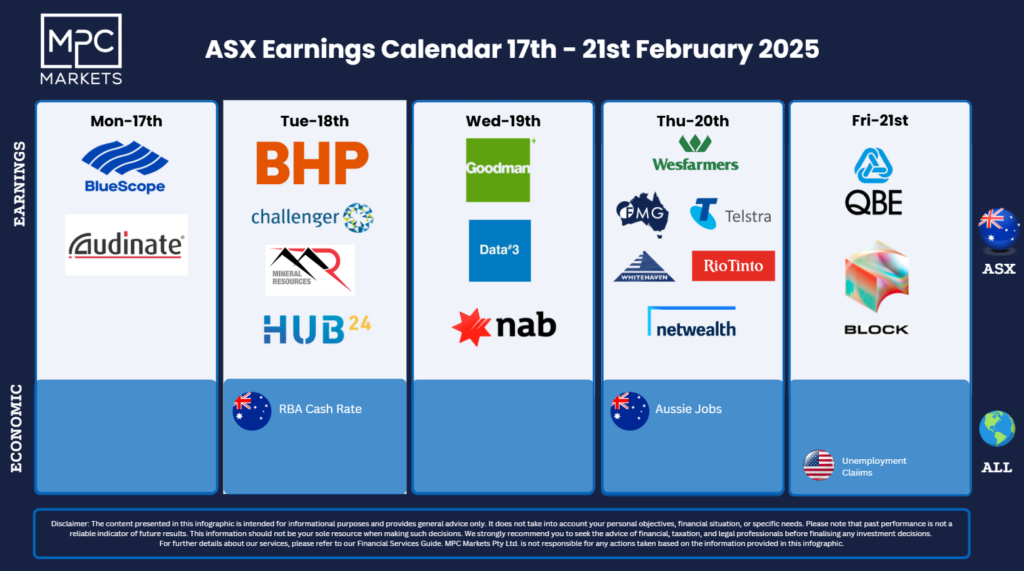

ASX SPI 8456 (-0.61%)

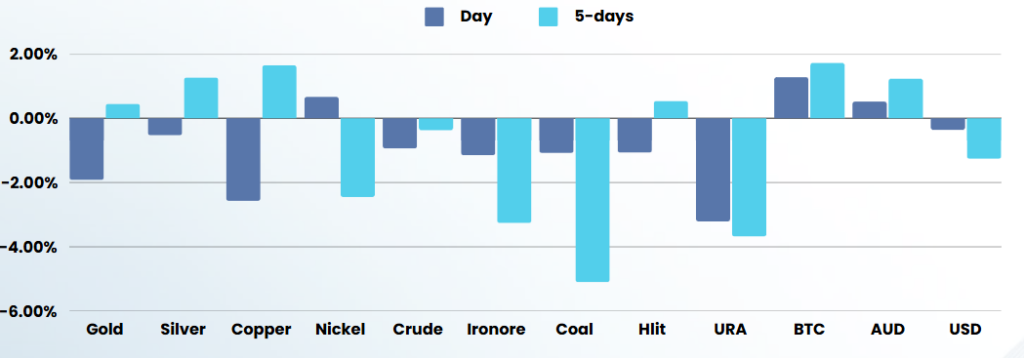

Energy and commodities may weigh down the index today, while ASX earnings continue with a heavy week of reporting ahead