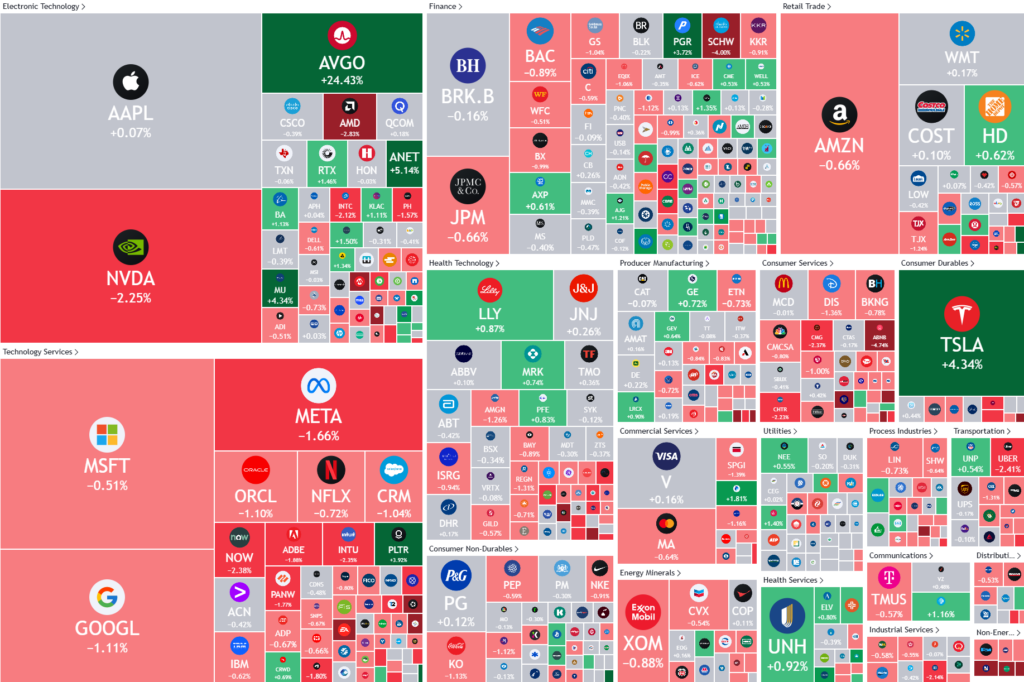

Overnight – Stocks edge lower, Nasdaq saved by new AI winner, Broadcom

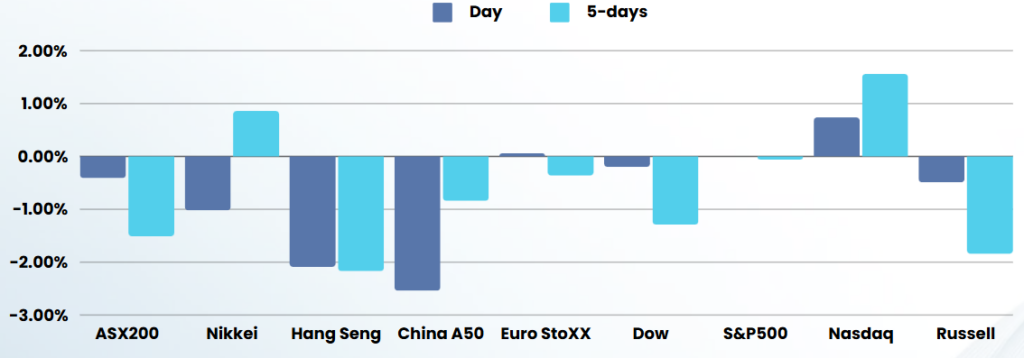

US stocks closed out the trading week near the unchanged mark in a subdued session on Friday, with the S&P 500 and Dow posting weekly declines, while the Nasdaq secured its fourth consecutive week of gains on Broadcom’s 24% rally

Broadcom forecast quarterly revenue surpassing Wall Street expectations and predicted robust growth in demand for its custom AI chips over the next few years. The optimistic outlook propelled the company’s shares 24% higher, pushing its market capitalization past $1 trillion for the first time.

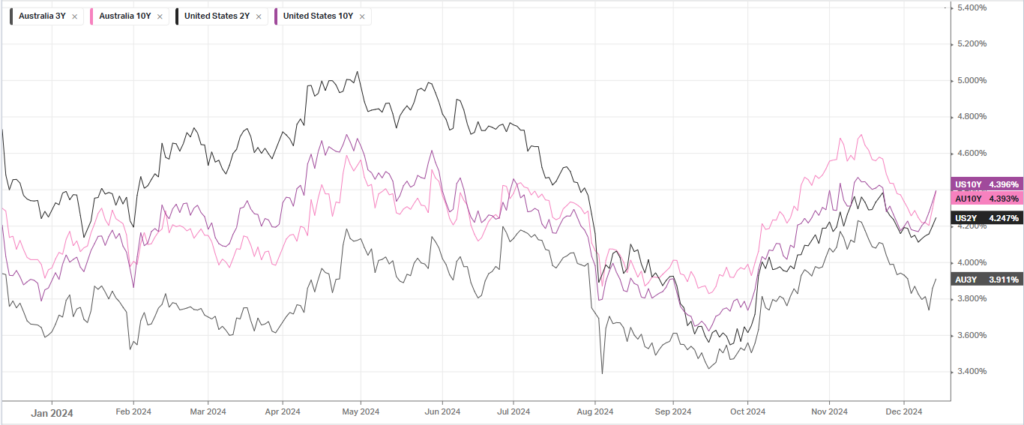

Yields on U.S. Treasuries rose across the board, with ones on the benchmark 10-year bond hitting a three-week high.

Technology stocks continued their upward momentum, driving the Nasdaq above the 20,000 mark for the first time on Wednesday. Chip stocks were mixed, with Broadcom rival Marvell Technology rising 10.8%, while AI bellwether Nvidia closed 2.2% lower. But a gauge of semiconductor stocks added 3.2%.

The rally was further bolstered by an in-line inflation report, which solidified expectations for a 25 basis-point interest rate cut from the Federal Reserve in its meeting next week.

Trader bets on the cut at the central bank’s Dec. 17-18 meeting stand at near 97%, according to CME’s FedWatch Tool. However, they indicate chances of a pause in January.

Wall Street had taken a breather in the previous session after recent gains and some hot economic data ahead of the Fed’s meeting, setting up the benchmark S&P 500 and the Dow for weekly losses. However, the Nasdaq ended the week higher.

ASX SPI 8267 (-0.46%)

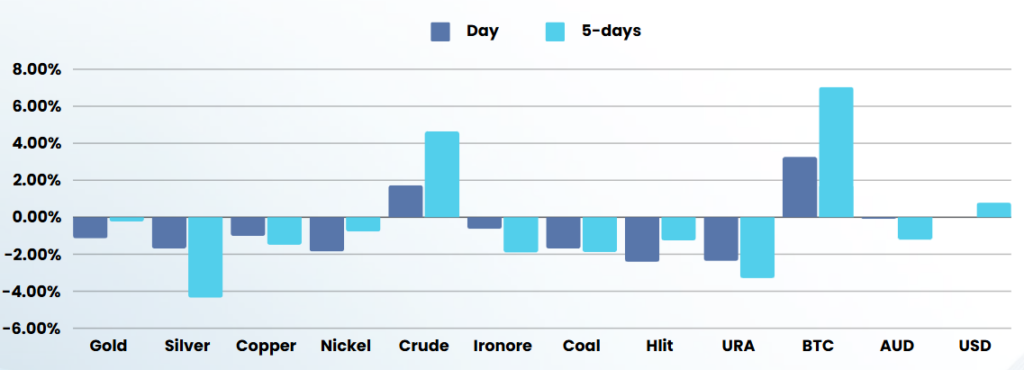

We are in for a tough start to the week, following the weak offshore lead in stocks and commodities

There are a number of important things to watch this week leading into Christmas including a slew of central bank decisions to watch this week including the Fed decision, BOJ & BOE on Thursday, global PMI data and oil prices due to Russian sanctions.