Overnight – Stocks drift with investors in holding pattern until tariff clarity

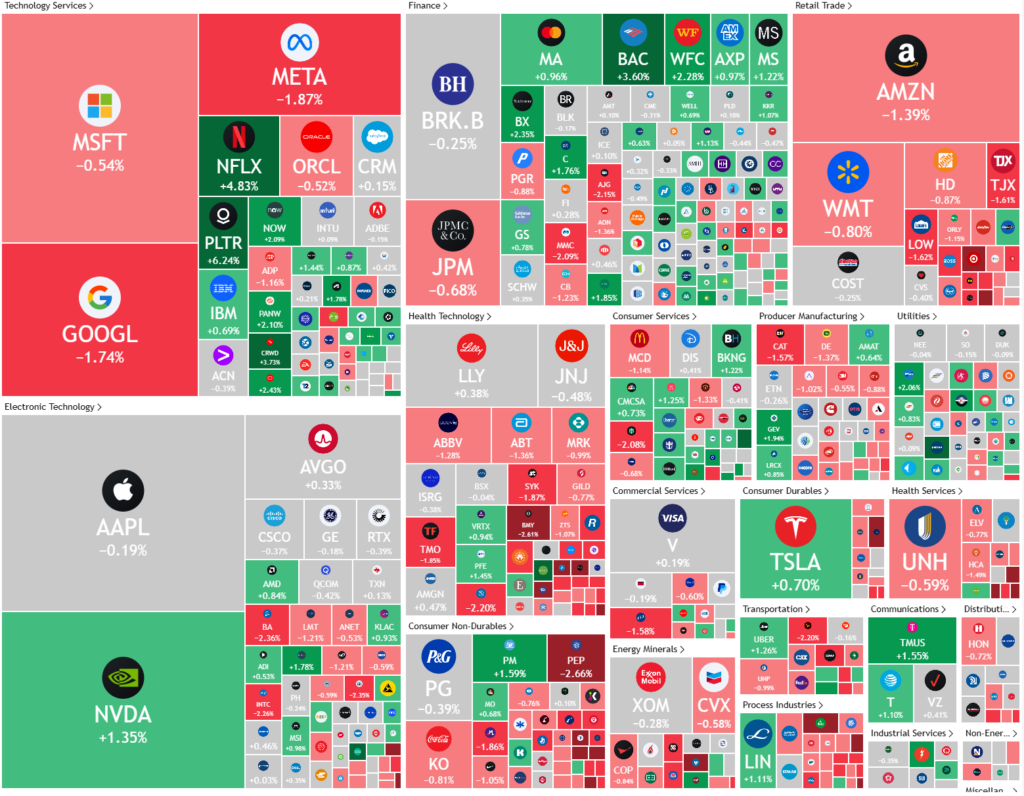

Stocks closed lower overnight, with health care and consumer stocks dragging down gains amid ongoing tariff uncertainty.

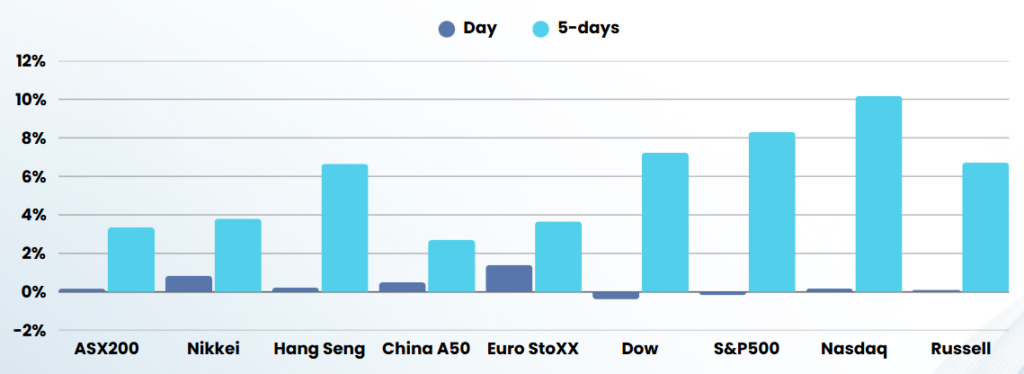

The Dow Jones Industrial Average fell 156 points (0.4%), the S&P 500 slipped 0.2%, and the NASDAQ Composite declined 0.1%. Health care stocks were under pressure after the Trump administration announced investigations into pharmaceutical and semiconductor imports, signalling potential new tariffs. Major health care companies, including Moderna, Zimmer Biomet, and Molina Healthcare, saw significant declines. French Prime Minister Francois Bayrou criticized Trump’s tariff policies, stating they have “shattered trust” globally and intensified economic volatility. Retail stocks also struggled as higher price pressures from tariffs are expected to hurt consumer spending.

Despite broader market weakness, the banking sector showed resilience as major banks reported strong first-quarter earnings. Bank of America rose over 3% due to increased net interest income and record equities trading revenue, while Citigroup gained more than 1% after posting better-than-expected results driven by volatility-driven trading gains. In other sectors, Johnson & Johnson fell 0.5% despite exceeding earnings expectations, as it revised its full-year forecast downward. Meanwhile, Netflix jumped over 4% following reports of ambitious plans to reach a $1 trillion market cap and double its revenue by 2030.

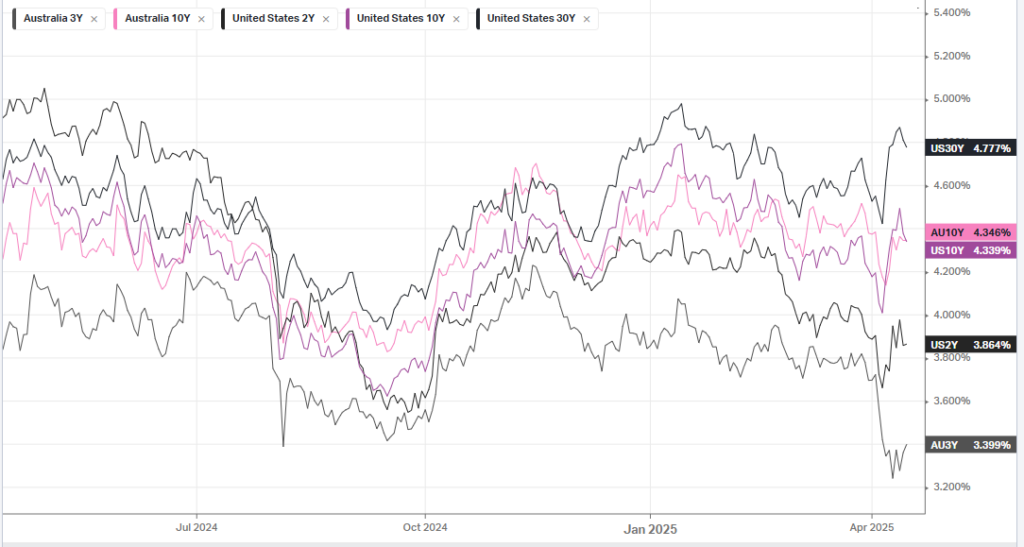

Looking ahead, market attention is focused on the Federal Reserve’s plans for interest rates amid heightened uncertainty from tariffs and recession fears. Fed Chair Jerome Powell is scheduled to speak on Wednesday, which could provide clarity on monetary policy direction. In other news, OpenAI is reportedly considering launching a social media platform to compete with existing giants like X (formerly Twitter).

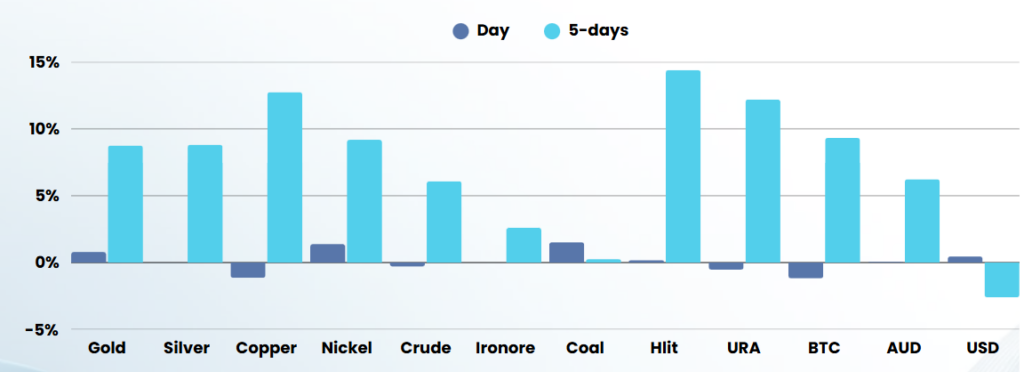

ASX SPI 7782 (0.00%)

We are likely to see a quiet day.

Companies reporting today include Iluka, Karoon Energy and mining giant Rio Tinto.