Overnight – Quiet Columbus Day Market drifts to new record on tech strength

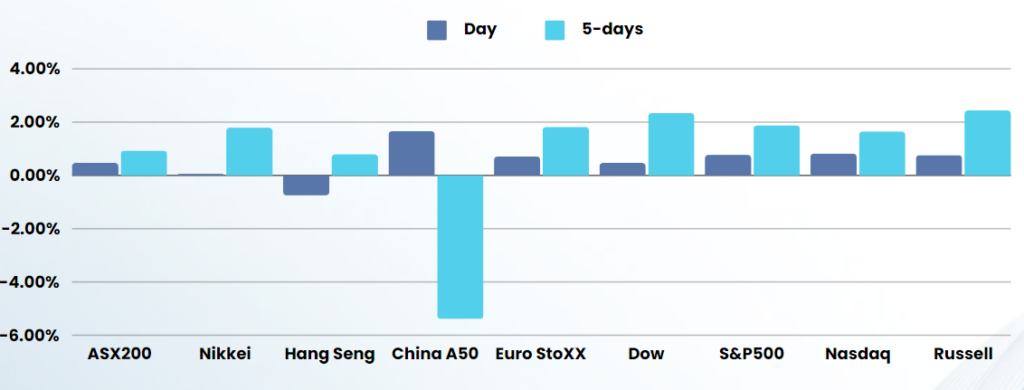

fresh record highs on a Columbus Day affected session, as investors bought into technology stocks ahead of a busy week packed with corporate earnings and crucial economic data.

On a somewhat subdued day for trading, given bond markets were shut due to the federal holiday, U.S. equities maintained the upward momentum from Friday, when major banks kicked off the third-quarter corporate earnings season on a positive note.

With 41 S&P 500 companies expected to report results this week, this flood of new data points from corporate America will help investors assess the health of the U.S. economy, and whether companies can continue to justify stretched stock market valuations.

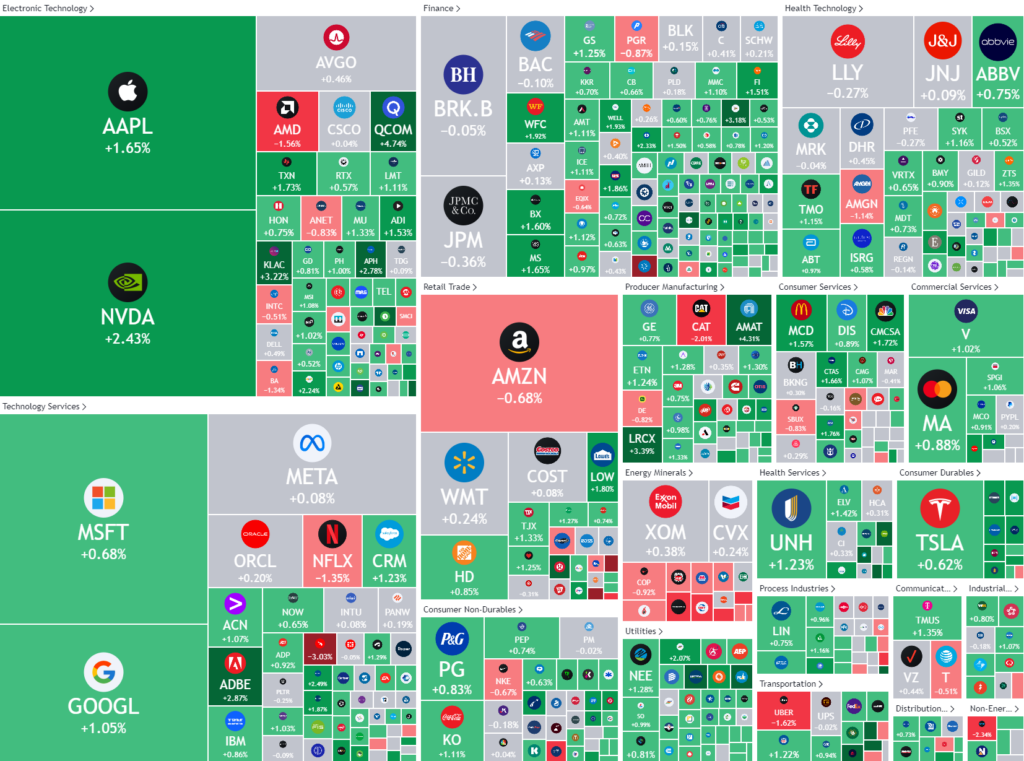

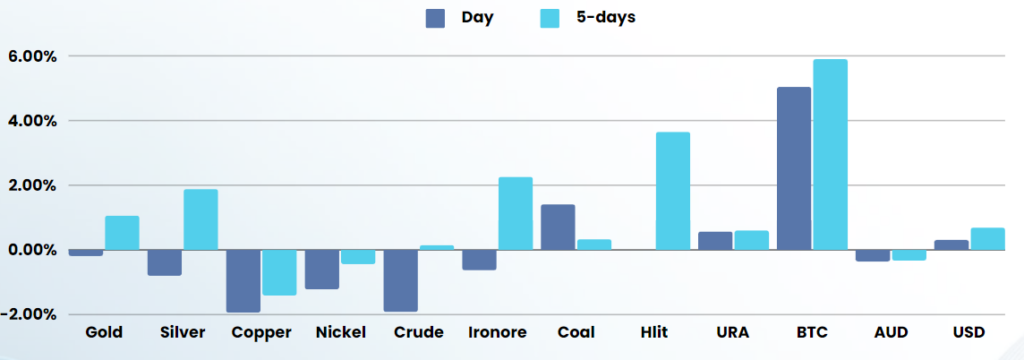

Before then though, it was technology stocks, which helped drive markets higher on Monday with semiconductors particularly in vogue. An index of semiconductor companies jumped to a more than two-month high, aided by advances by market heavyweight Nvidia, as well as gains by Arm Holdings and Qualcomm. The information technology index was a leading gainer among the S&P 500 sectors. Among other growth stocks, Apple and Microsoft advanced, as did Alphabet and Tesla

Bank earnings may have boosted hopes that solid results could help stocks continue their strong 2024 run. However, with stock valuations stretched – the S&P 500 is trading at 21.8 times forward earnings, versus a long-term average of 15.7 – companies might struggle to satisfy investors.

Investors will also watch for crucial economic data this week, notably the September retail sales figures, for clues on the financial health of U.S. consumers. The two Fed speakers on Monday both adopted cautious tones on future rate policy. Minneapolis Fed President Neel Kashkari said he sees modest interest-rate cuts ahead as inflation hovers near the central bank’s 2% target. Speaking this afternoon, Fed Governor Christopher Waller called for “more caution” on interest-rate cuts ahead.

Bets on a 25-basis-point reduction at the Fed’s November meeting stood at 86.1%, according to the CME Group’s FedWatch tool, as traders dialled back expectations of an outsized cut.

U.S.-listed shares of Chinese firms dropped, including Alibaba and PDD Holdings, as investors were left guessing at the size of the overall fiscal stimulus China announced on Saturday.

ASX SPI 8341 (+0.44%)

We should push through a new record today as the public holiday market in the US provides a strong offshore lead.

Higher long-term bond yields should be hurting the growth section of the market, but they are being ignored, which is usually at the peril of equities investors.

We would look to be trimming some holdings and returning back to some cash as the market looks over-extended

Today in corporate news, Telstra, Baby Bunting, IDP Education and Region all host AGMs. HUB24 provides a market update. Harvey Norman and Soul Pattinson trade ex-dividend.