Overnight – Stocks grind higher on tariff calm

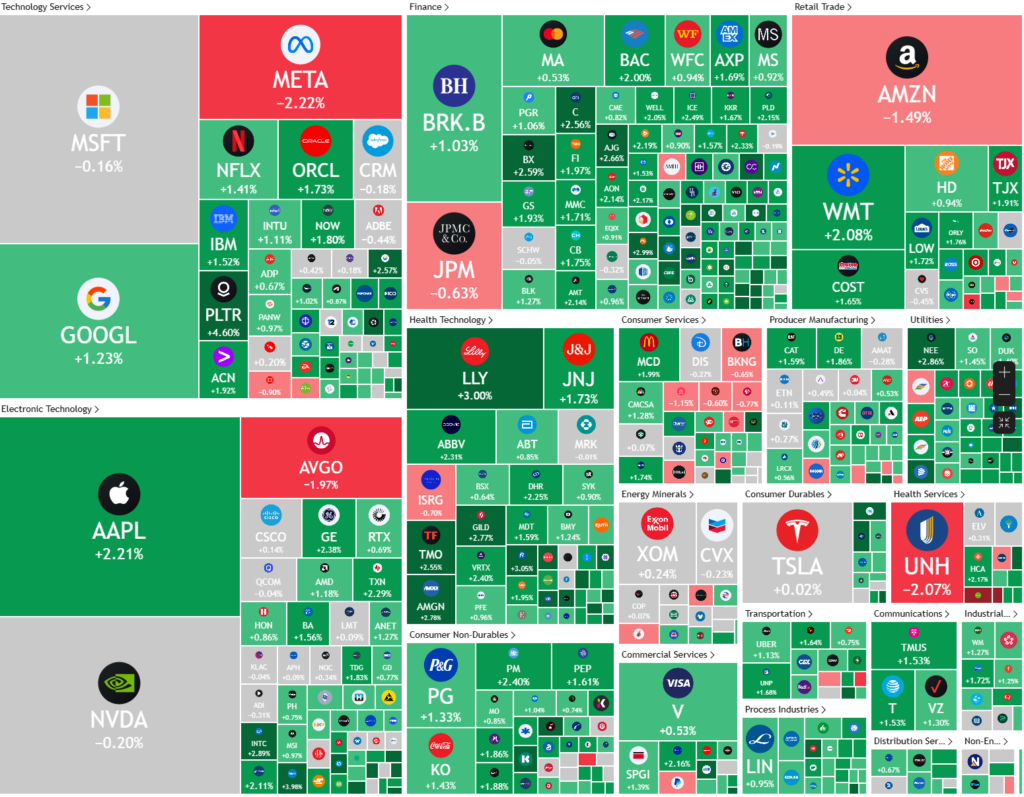

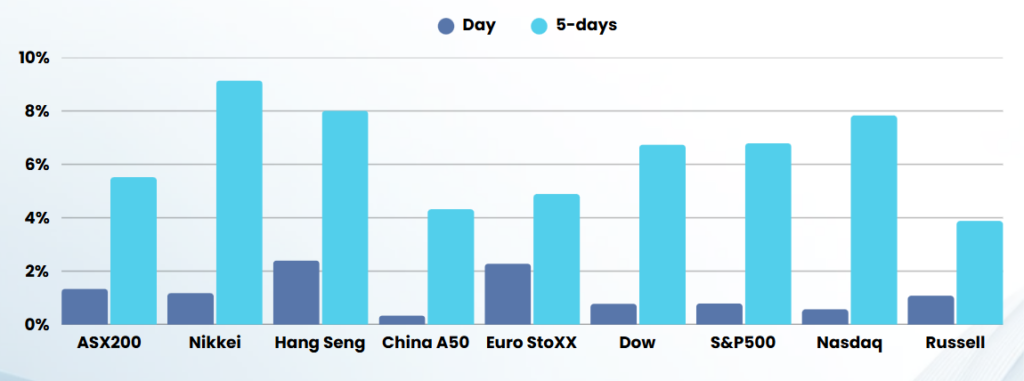

U.S. stocks closed higher on Monday, driven by a combination of factors including temporary tariff exemptions for electronics and positive earnings reports from major banks. The market uptrend was supported by the decision to exempt smartphones, computers, and semiconductors from new tariffs, which provided relief to tech giants. This move helped stabilize investor sentiment, as these companies have significant exposure to international trade and supply chains. The overall market performance was robust, with key indices showing notable gains.

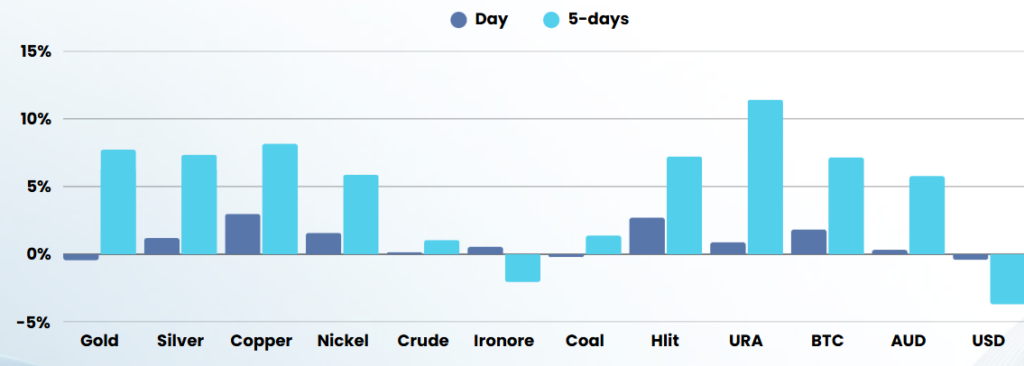

However, despite these exemptions, uncertainty persists due to the temporary nature of these reprieves. The future of tariffs remains unclear, with indications that electronics could face duties in the future. Specifically, semiconductor tariffs are expected to be implemented soon, which could impact companies reliant on these components. Additionally, there are signals of potential relief for automakers, which could lead to a temporary exemption from existing tariffs. This news led to significant gains for companies in the automotive sector.

In another significant development, plans to impose tariffs on imported pharmaceuticals were announced. This move could disrupt global supply chains and lead to price hikes or shortages. The pharmaceutical industry is bracing for potential chaos, as these tariffs could force companies to absorb higher costs or pass them on to consumers. The broader strategy aims to encourage domestic manufacturing, but it raises concerns about the impact on generic drugs and overall healthcare costs.

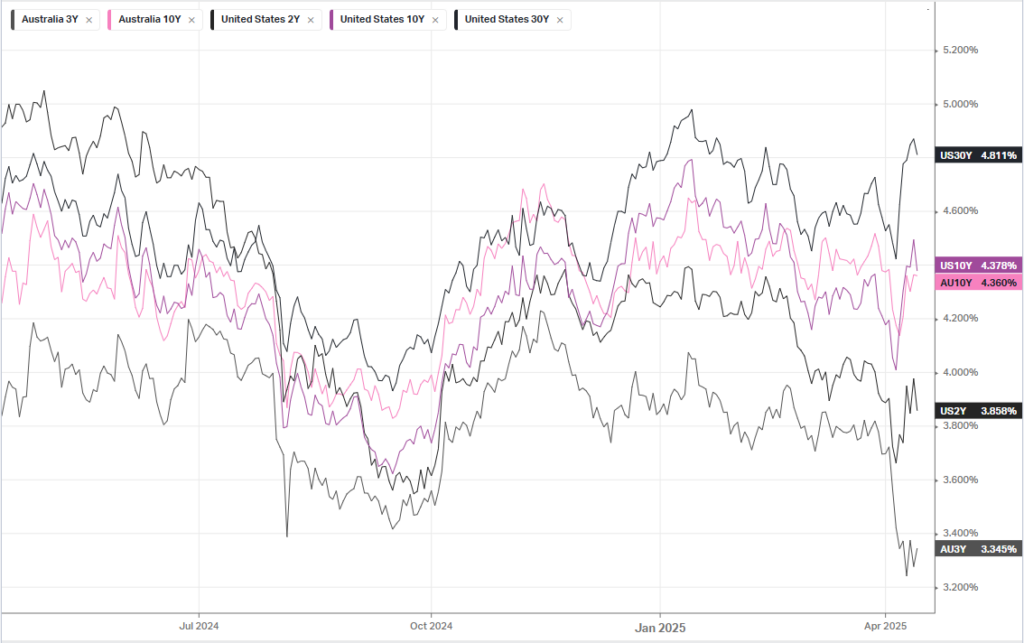

The central bank is also closely monitoring the economic impact of tariffs. There is a growing consensus among policymakers that if tariffs lead to a significant slowdown or recession, monetary policy adjustments may be necessary. This could include earlier interest rate cuts, even if it means higher inflation. Meanwhile, major financial institutions reported strong earnings, with significant gains in equities revenue contributing to their profitability. Other major companies are set to release their earnings this week, which will provide further insights into the current economic landscape.

ASX SPI 7792 (+0.23%)

With markets calming, we don’t see any major opportunities outside the buying we have done over the last week.

- Companies set to report quarterly earnings today include Amplitude Energy and Hub24.

- Collins Foods is to exit its Taco Bell business in Australia amid a slew of operational changes announced by the restaurant chain owner.

- Evolution Mining said it was on track to hit financial year guidance despite a fall in quarter-on-quarter gold production.

- Presdient of Orora’s beverages division Simon Bromwell will join Bapcor later this month amid a wider restructure of the auto parts maker’s business.