Overnight – Inflation data fuels rate cut calls, Bitcoin soars to fresh record

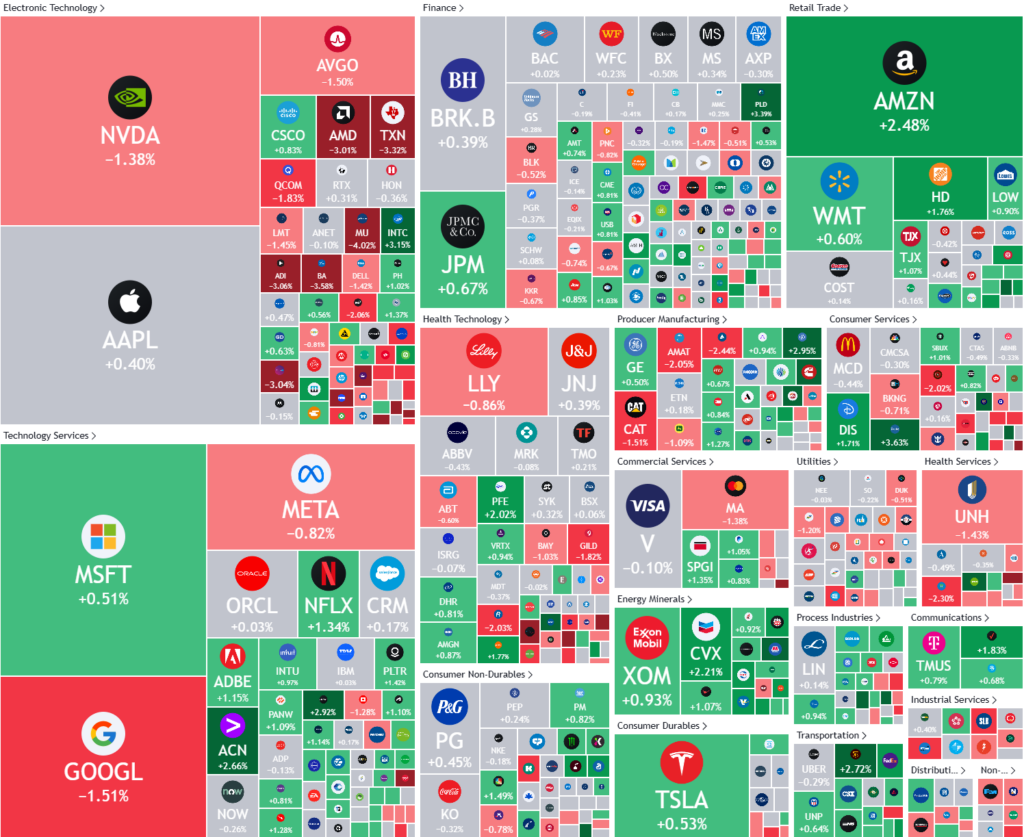

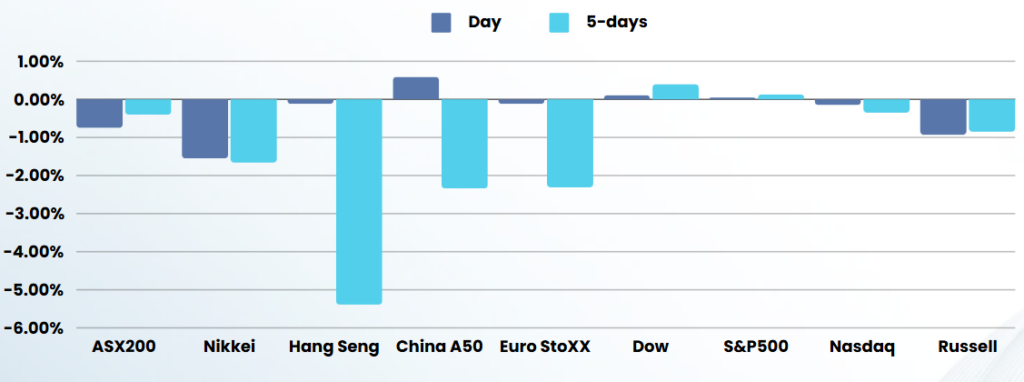

Stocks drifted higher as in-line inflation data for October, strengthened optimism that the Federal Reserve will likely deliver another rate cut in December, while Bitcoin hit fresh record highs at $93,226 overnight

Data released earlier Wednesday showed that headline consumer prices rose 2.6% last month on an annualized basis, compared to 2.4% in September. Month-on-month, the figure came in at 0.2%, matching September’s pace. The “core” reading, stripping out more volatile items like food and fuel, rose 3.3% year-on-year and 0.3% on a monthly basis, in line with September.

These figures were all in line with expectations and soothed concerns after Minneapolis Fed President Neel Kashkari had warned on Tuesday that any surprises in inflation could see the Fed keep rates steady in December.

Recent signs of sticky inflation spurred some doubts over just how much further interest rates will fall. Traders were seen pricing in a 70.7% chance for another 25 bps cut in December, and a 29.3% chance rates will remain unchanged, CME Fedwatch showed.

In a note, the Institute of International Finance said the US fiscal outlook has darkened. “The financial landscape under Trump’s presidency reflects a dual narrative of near-term growth potential tempered by fiscal constraints and long-term volatility, shaping a dynamic economic environment that could prove challenging for both policymakers and investors.“

Debt as a percentage of GDP could rise from about 100 per cent now to 135 per cent, reflecting Trump’s plans, the IIF said. That’s what the IIF calculates as an average with the low-cost end being about 120 per cent and the high mark near 155 per cent.

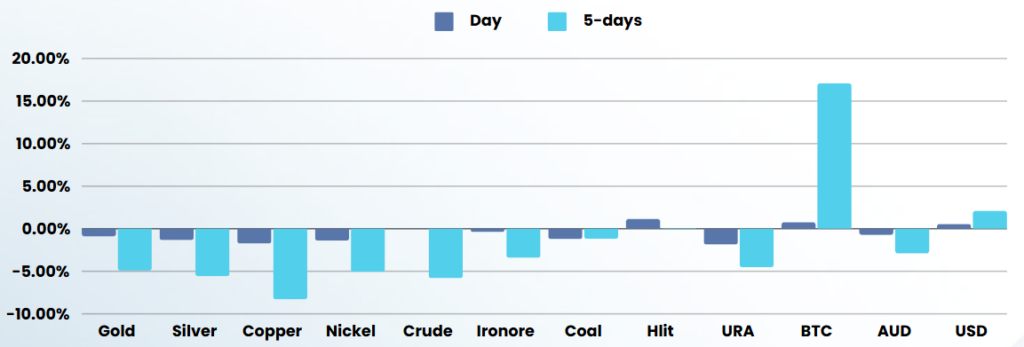

Bitcoin continued its post-election rally, rising 6% to a $93,226 fresh record high. The popular crypto topped $93,000 for the first time, early in the session amid growing bets that a second Donald Trump administration would be favorable for the bitcoin.

Stock specific

- Spotify Technology -rose 11% after it clocked strong subscriber growth for the September quarter while issuing a solid forecast for the year.

ASX SPI 8259 (+0.38%)

The local market has a full calendar today with a speech from the RBA Gov and plenty of economic and corporate data due for release.

Gov Michelle Bullock will deliver an address this morning at the annual ASIC forum, while AU Employment data is due at 1130 AEDST with expectations for the economy to add 25k jobs and the unemployment rate to remain at 4.1%. Any strength in the employment data will see RBA rate cut hopes drift even further from reality, as hawkish bond traders and analysts have suggested that Australia may miss the global easing cycle altogether.

Earnings updates – Graincorp, Orica and Xero release earnings.

AGM’s- Cettire, Computershare, Flight Centre, Goodman Group, Guzman y Gomez, Inghams, Seven Group and Superloop