Overnight – Stocks enter correction territory as investors flee to gold, silver & copper

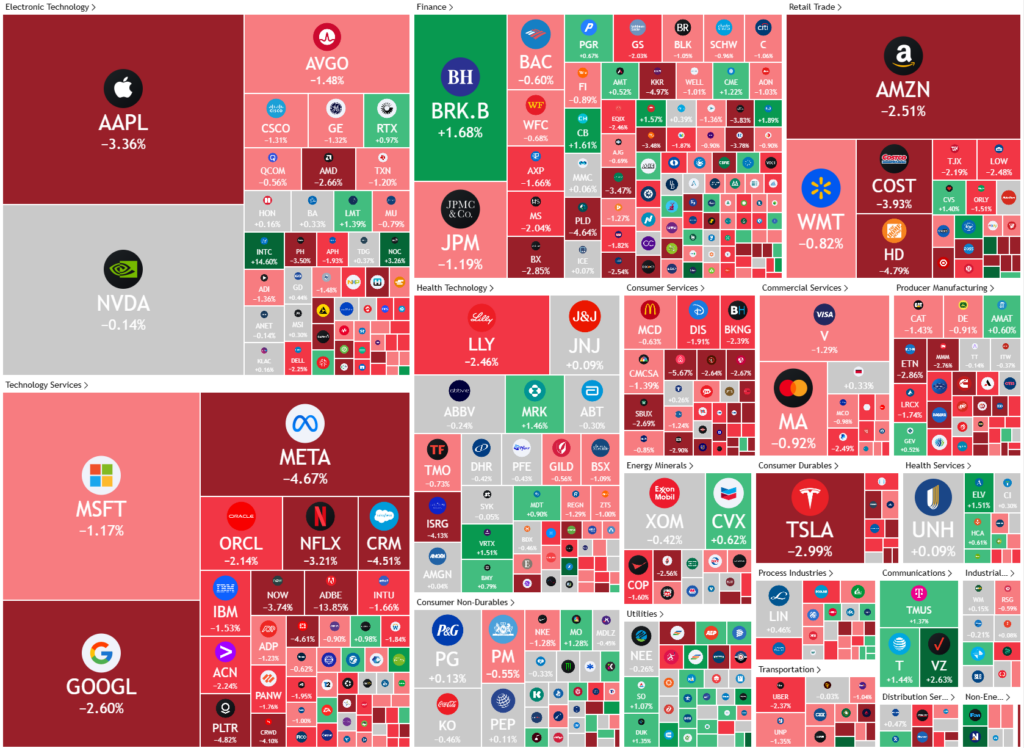

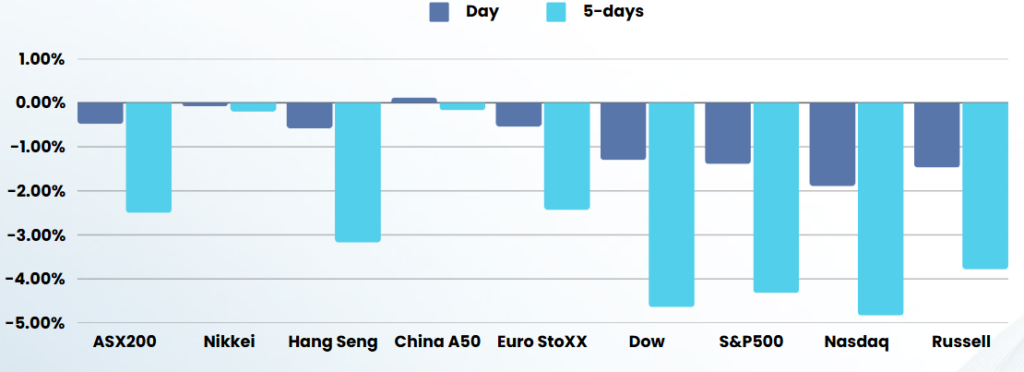

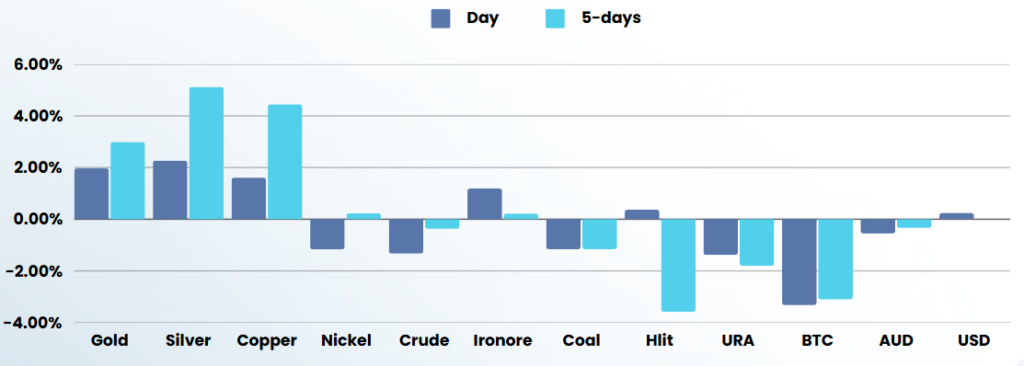

Stocks fell into correction territory overnight as rising concerns about a trade war continued to sour sentiment and send investors towards safehaven assets like gold, silver & copper, offsetting fresh signs of cooling inflation.

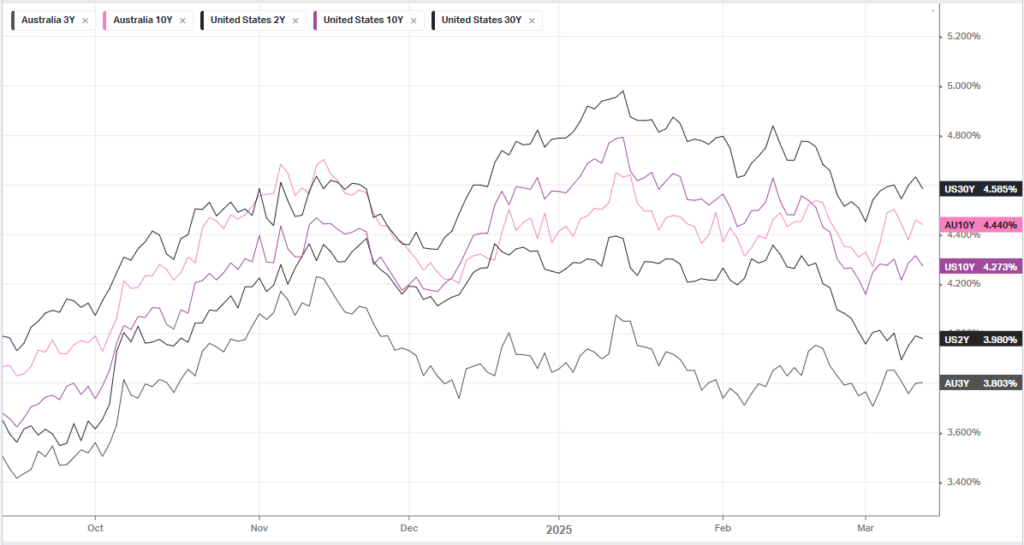

U.S. producer prices showed a slower-than-expected annual increase in February and remained unchanged from the previous month. This follows data indicating that consumer prices also rose at a slower pace, which could influence the Federal Reserve’s view on inflation amidst uncertainty over trade policies under Donald Trump. The cooling of producer prices is seen as a positive development but does not guarantee a sustained trend of disinflation, as some monthly gains suggest potential future price pressures.

President Donald Trump has reaffirmed plans to impose global reciprocal tariffs starting April 2, escalating trade tensions. This move includes a threat of 200% tariffs on alcohol imports from the European Union in response to EU countermeasures against U.S. steel and aluminum tariffs. Upcoming discussions between U.S. officials and Ontario Premier Doug Ford may address the renewal of the United States-Mexico-Canada trade agreement, following recent trade disputes and the implementation of expanded steel and aluminum tariffs.

In stock market news, Intel experienced a significant rise after announcing Lip-Bu Tan as its new CEO, succeeding interim co-CEOs. Meanwhile, Adobe’s stock fell sharply due to soft second-quarter guidance despite better-than-expected first-quarter results. Other companies like SentinelOne also saw declines after disappointing earnings reports. Tesla resumed its selloff, erasing some recent gains, as market volatility continues to impact major tech stocks.

ASX SPI 7741 (-0.01%)

A continuation of this weeks trend of selling in last years “market darlings and buying in the gold and commodities will continue as investors finally start to return to using valuation, not momentum as their primary guide.

While we expect a “buy the dip” mentality for the next few weeks, its inevitable that we will see a panic fall at some stage in the next couple of months. High levels of cash are recommended for portfolios