Last Night's Market Recap

S&P 500 - Heatmap

Overnight – Equities edge higher as Investors re-assess rate cut timing

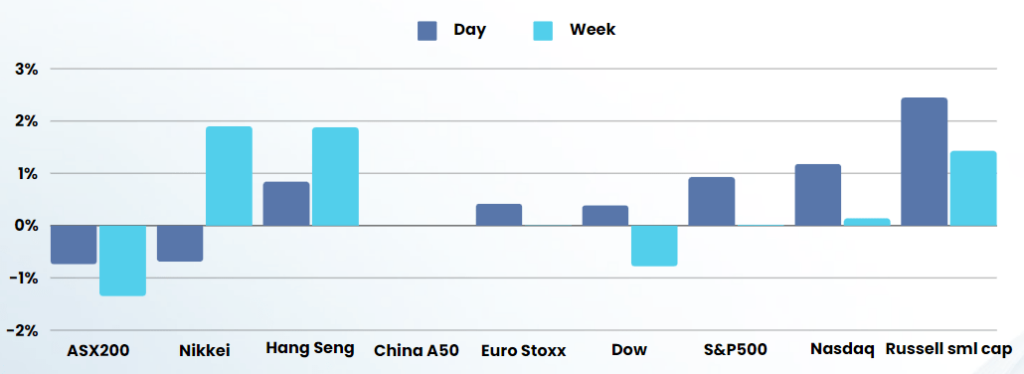

The Dow edged higher while Treasury yields slipped on Wednesday as investors tried to assess the timing of possible interest rate cuts from the Federal Reserve, while the dollar eased off of a three-month peak against the yen.

Nvidia whose shares were last up 1.4% and were helping to support the S&P 500 and Nasdaq, topped Alphabet’s market value to become the third-most valuable U.S. company. Yields briefly extended declines after Chicago Fed President Austan Goolsbee said the Fed’s path back to its 2% inflation target rate would still be on track even if price increases run a bit hotter than expected over the next few months, and the central bank should be wary of waiting too long before it cuts interest rates. Market expectations for a cut by the Fed in June of at least 25 basis points stand at 78.5%, according to CME’s FedWatch Tool, while expectations for a cut in May have fallen to 38.5%, down from 63.7% a week ago. The latest shift in rate expectations came after an upside surprise in U.S. inflation on Tuesday that showed the consumer price index (CPI) rose 3.1% on an annual basis, above forecasts for a 2.9% increase.

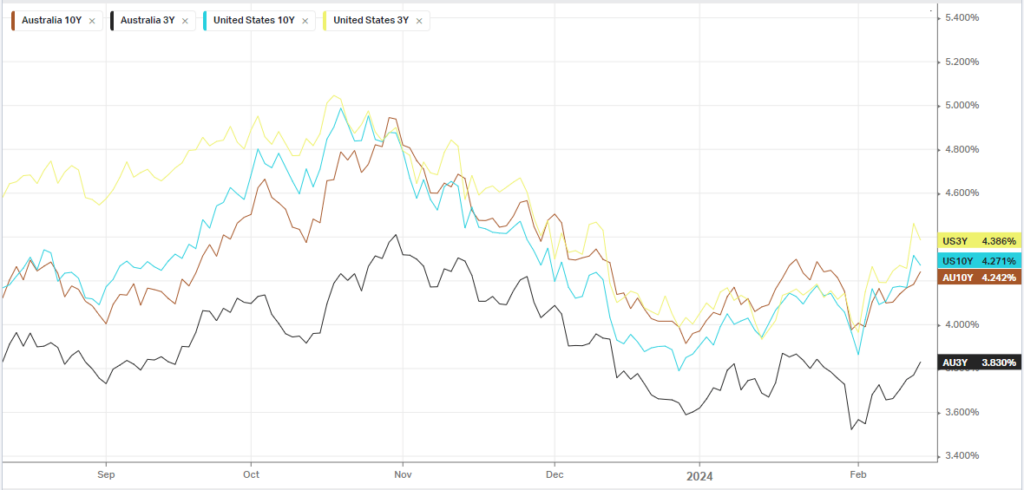

The yield on benchmark U.S. 10-year notes fell 5.1 basis points to 4.265%, from 4.316% late on Tuesday. Yields had surged on Tuesday following the CPI data.

The dollar index fell 0.13% to 104.72, with the euro up 0.15% at 1.0725. Against the Japanese yen, the dollar weakened 0.16% to 150.55. The dollar was at a three-month peak against the yen on Tuesday.

The 150 level on the pair has been seen in the past as a potential catalyst for intervention by Japanese monetary authorities. It was just past this level that they intervened to shore up the yen in late 2022.

In cryptocurrencies, bitcoin gained 4.20% to $51,659.22.

Oil futures declined as higher U.S. crude inventories

Bonds

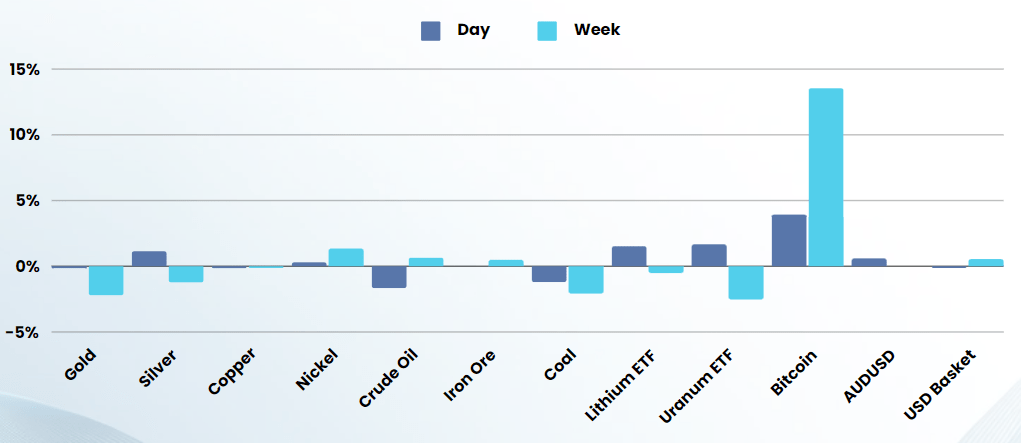

Commodities & FX

The Day Ahead

ASX SPI 7546 (+0.69%)

Australian shares are poised to rise, as Wall Street hit session highs at the closing bell and the S&P/500 topped 5000 points. Wall Street’s benchmark index closed up 0.9 per cent to 5000.06 points, with the tech-heavy Nasdaq Index adding 1.3 per cent. Six of the seven Magnificent Seven tech stocks were higher, though Apple slumped for a third day.

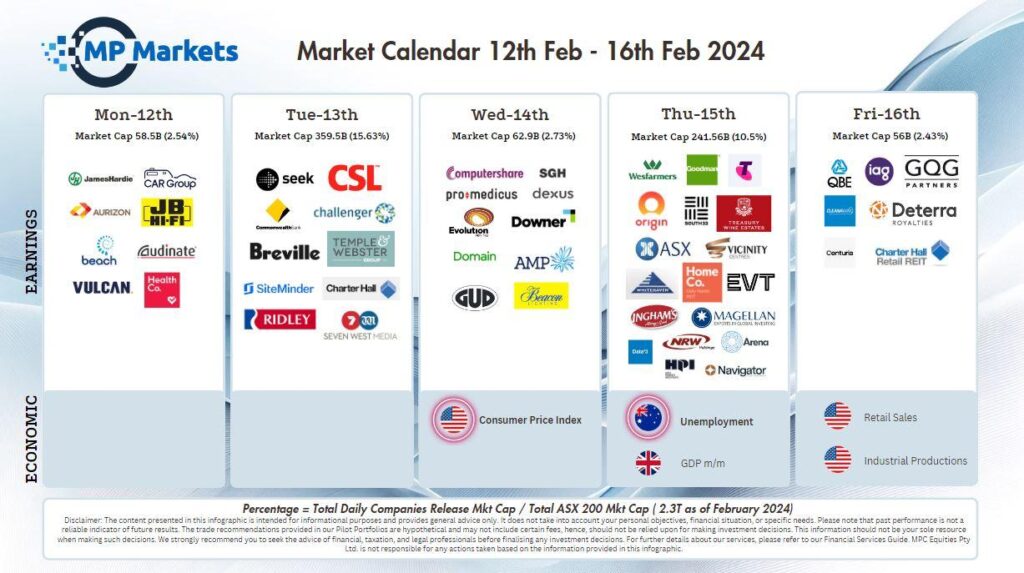

Local investors face a deluge of earnings and January’s labour force report.

Earnings

- Telstra lifted its dividend 5.4 per cent to 9¢ on a profit up 11.5 per cent to $1.04 billion.

Companies set to report: Arena REIT (ARF) | Beacon Lighting (BLX) | Goodman Group (GMG) | Magellan (MFG) | Origin Energy (ORG) | Pact Group (PGH) | South32 (S32) | Telstra (TLS) | Treasury Wines (TWE) | Vicinity Centres (VCX) | Wesfarmers (WES) | Whitehaven (WHC)