Overnight – US Stock rally stalls ahead of Inflation data

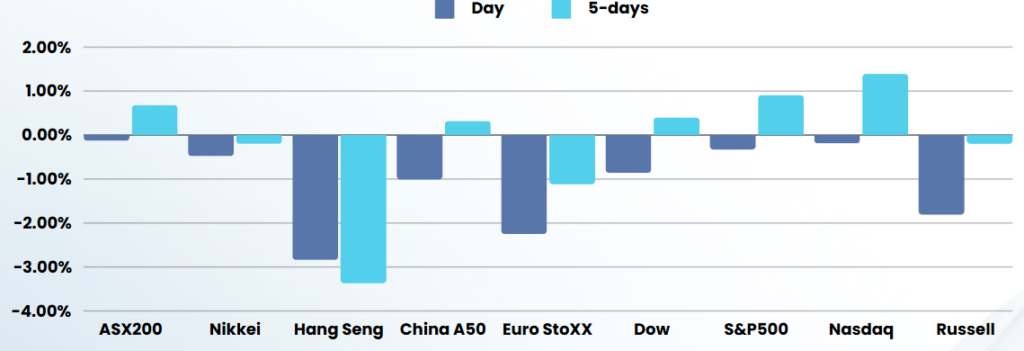

Stocks took a breather from their recent melt-up Tuesday, pressured by a surge in Treasury yields just a day ahead of fresh inflation data.

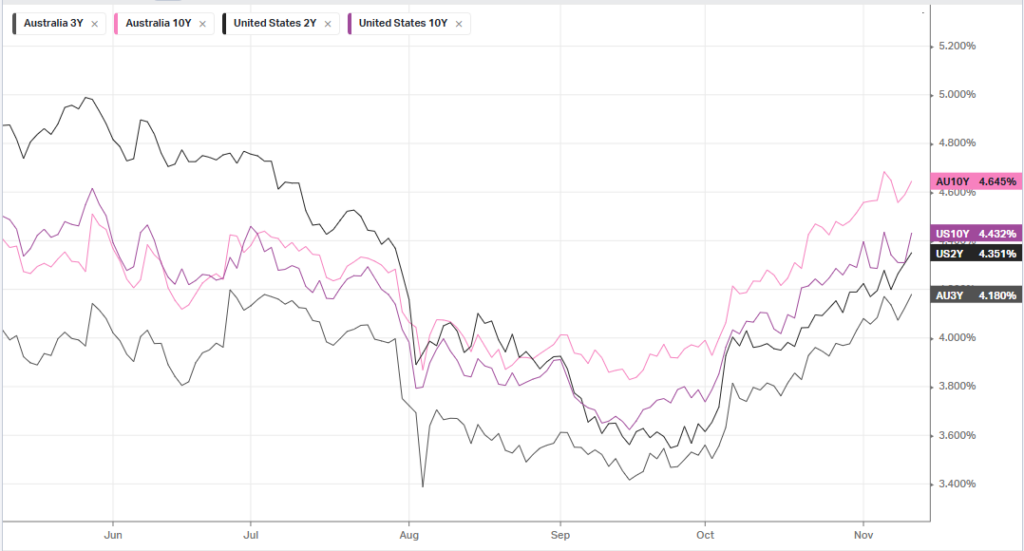

Treasury yields jumped Tuesday, with yields on the 10-year Treasury10 rising 9 basis points as investors grow wary ahead of key CPI inflation data due on Wednesday. Inflation is expected to have remained steady in October from the prior month amid continued resilience in the US economy, but any signs of elevated inflation could potentially delay the Federal Reserve’s plans to cut interest rates further.

Recent signs of sticky inflation spurred some doubts over just how much further interest rates will fall. Traders were seen pricing in a 70.7% chance for another 25 bps cut in December, and a 29.3% chance rates will remain unchanged, CME Fedwatch showed.

Beyond the CPI data, focus this week is also on addresses from a slew of Fed officials for more insight into the central bank’s plans for rates.

Richmond Fed Barkin said Tuesday that the labour market is resilient, but the Fed is in position to respond to risks as needed.

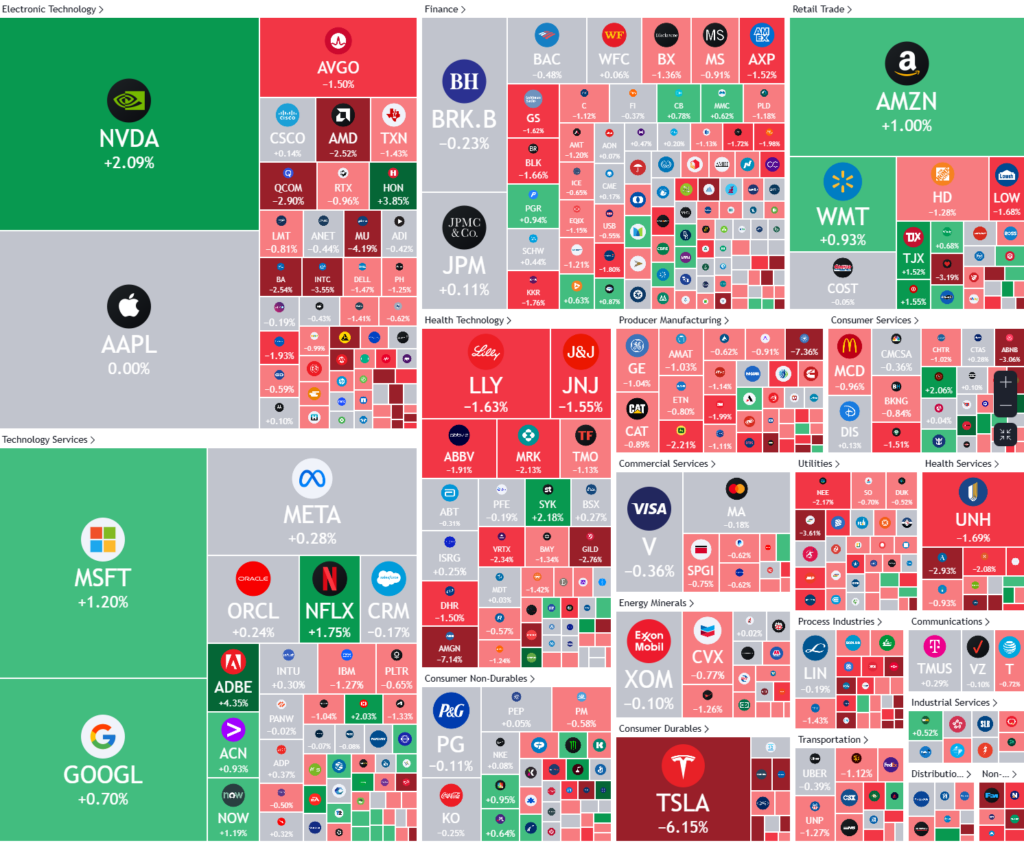

Stock specific

- Home Depot – stock fell 0.5% after the DIY retailer raised its annual same-store sales forecast, betting on resilient demand from professional contractors to offset weak spending on bigger projects such as kitchen renovations.

- Shopify – stock soared 24% after the Canadian e-commerce retailer forecast fourth-quarter revenue growth above estimates, while Live Nation Entertainment

- Hertz – stock fell 9% after a wider-than-expected third-quarter loss and missed revenue estimates on Tuesday, hurt by depreciation charges from its fleet vehicles.

- Tyson Foods – stock gained 7% after the food giant reported better-than-expected fourth-quarter earnings and revenue while also providing an optimistic outlook for fiscal 2025.

ASX SPI 8201 (-1.00%)

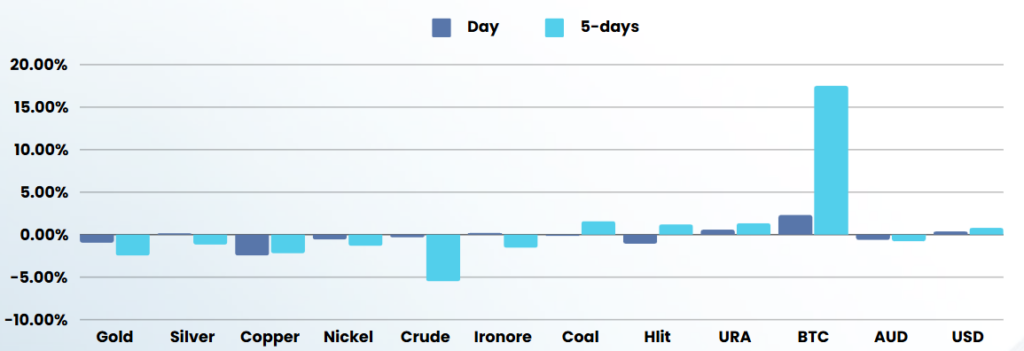

The ASX is in for an ugly day as the “Trump Bump” fades, particularly for everywhere except the US. More trouble from MinRes and lower commodity prices will weigh on the materials sector, while a raft of updates from index majors are unlikely to help, with CBA delivering a disappointing update (in relation to the elevated share price) as CEO Matt Comyn has told investors growth in the nation’s economy remains slow after the bank posted a net profit of around $2.5 billion in the first quarter of the 2025 financial year. The profit was in line with the previous corresponding quarter and up around 5 per cent on the average profit over the previous two quarters. Comyn cited said many Australians were “challenged by cost of living pressures”.

Earnings updates – Aristocrat Leisure, Commonwealth Bank of Australia, James Hardie, Life360 and Light & Wonder all release earnings.

AGM’s- Beach Energy, Endeavour Group, Johns Lyng, Nuix Sims and Tyro Payments all host AGMs