Overnight – Stocks recover as inflation cools

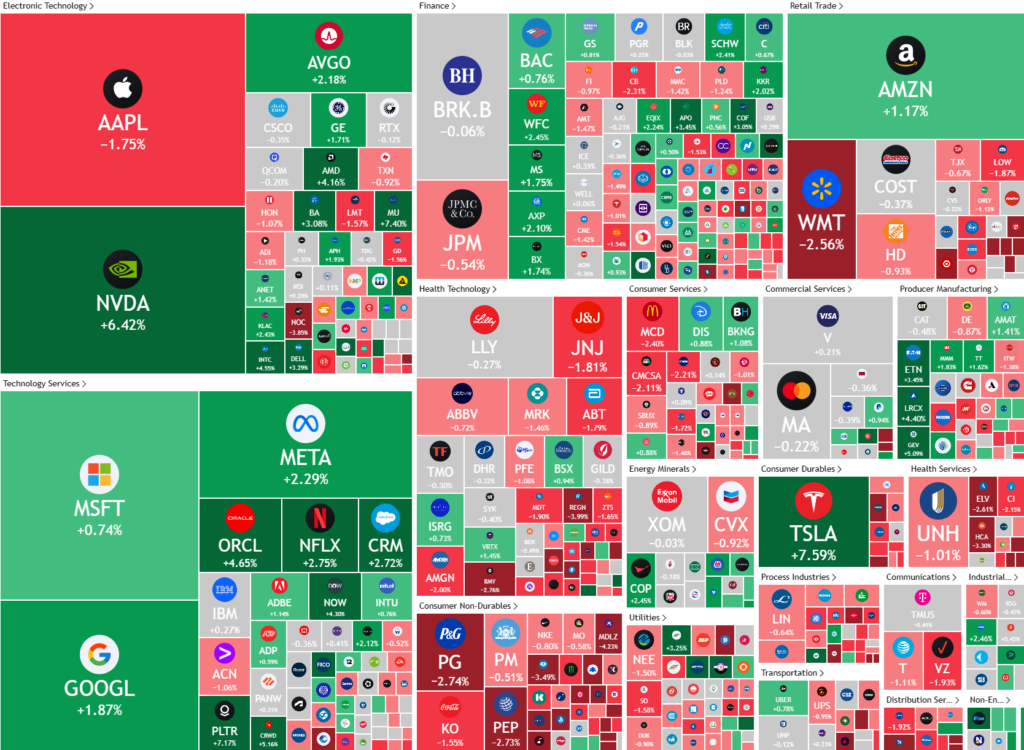

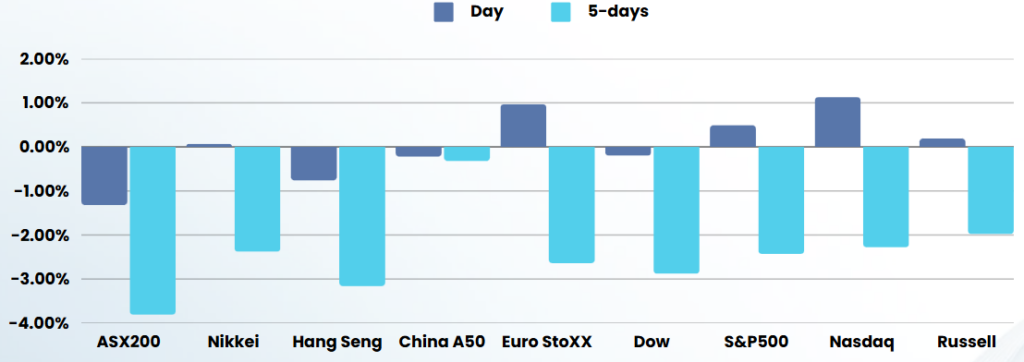

Stocks recovered overnight, as a rebound in tech following softer-than-anticipated inflation data helped offset ongoing tariff uncertainty.

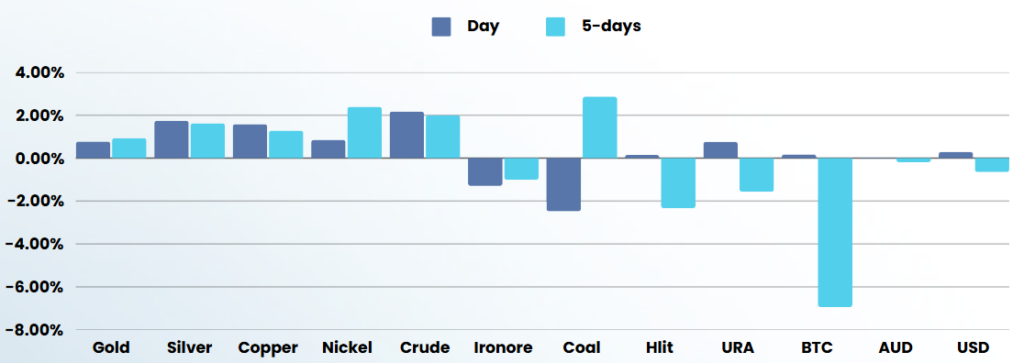

Tech led the broader market move higher, with NVIDIA leading to the upside with a 8% rally as investors bought the recent dip in the sector. Sentiment on risk assets were buoyed by cooling inflation data that helped ease stagflation concerns.

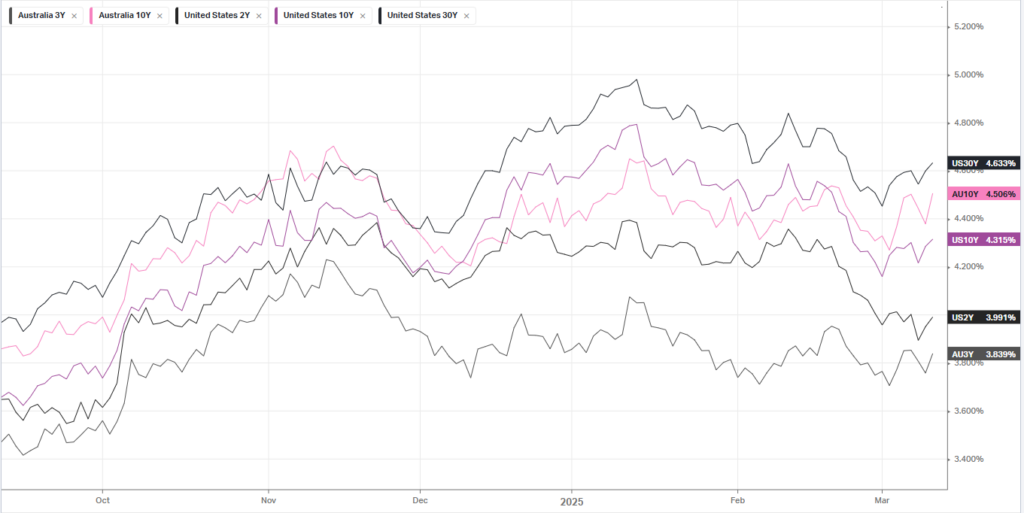

U.S. consumer prices rose at a slower-than-anticipated pace in February, according to government data on Wednesday that will likely be closely monitored by Federal Reserve officials wary of the potential impact of President Donald Trump’s policies on inflation. The headline consumer price index (CPI), a key measure of inflation in the world’s largest economy, came in at 2.8% in the twelve months to February, cooling from 3.0% in January. Month-on-month, the gauge eased to 0.2% from 0.5%, figures from the Labor Department showed. Economists had predicted readings of 2.9% and 0.3%, respectively.

Stripping out volatile items like food and fuel, so-called “core” CPI was 3.1% year-over-year and 0.2% on a monthly basis. Both of these decelerated from the prior month and were below estimates. For the Fed, this shouldn’t move the needle too much.

The U.S. has expanded tariffs on steel and aluminum, marking the latest move in its efforts to reshape trade relationships. In response, the EU announced countermeasures, including allowing previous retaliatory tariffs to lapse and imposing new tariffs on U.S. exports. This comes as the U.S. has levied tariffs on over €18 billion in EU goods. President Trump has threatened to retaliate further by imposing tariffs on imported cars from the EU. Meanwhile, Canada initially planned to impose reciprocal tariffs but later dropped the plan after a resolution was reached.

Intel’s shares rose significantly after reports emerged of a potential joint venture with TSMC to operate Intel’s U.S. foundries. Under the proposal, TSMC would manage the factories without owning more than 50% of the venture, pending approval from the Trump administration. This development comes as Intel struggles with weak sales and a loss-making foundry division.

Additionally, Amazon’s stock saw a slight increase after the Federal Trade Commission requested a delay in its lawsuit against the company. The lawsuit alleges that Amazon misled consumers about its Prime program, but the FTC cited staffing issues as the reason for the delay.

ASX SPI 7799 (+0.23%)

The ASX to rise after US consumer prices rose slower than expected last month, helping relieve the panic for investors. Expect recovery in many names, after some panic selling yesterday.

Looking at the forest thru the trees, the market is still vulnerable to the downside and any bounce is an opportunity to return to cash in underperforming names