Overnight – Tech rallies on rate cut hopes, despite stubborn inflation

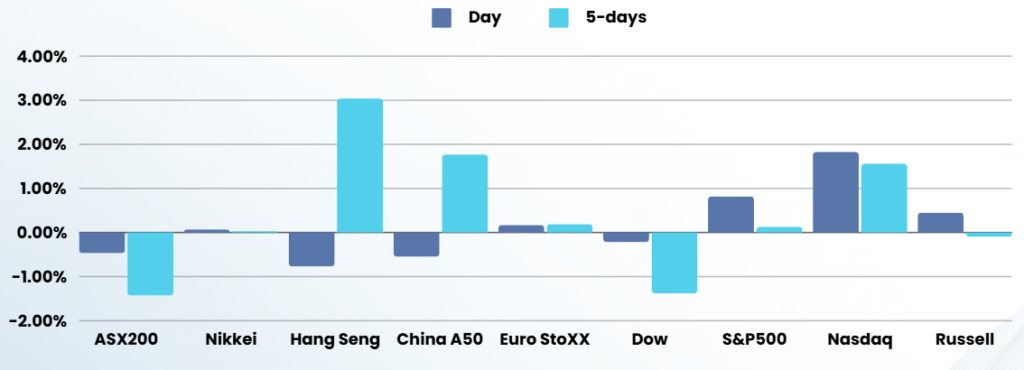

The Nasdaq closed above 20,000 for the first time ever Wednesday, as tech resumed its rally following in-line inflation data that largely cemented a Federal Reserve interest rate cut next week.

Consumer price index (CPI) rose by 2.7% last month, accelerating slightly from 2.6% in October, while stripping out more volatile items like food and fuel, the “core” number climbed by 3.3% in the twelve months to July, also in line with expectations. This was the highest monthly print in 7 months, which markets ignored

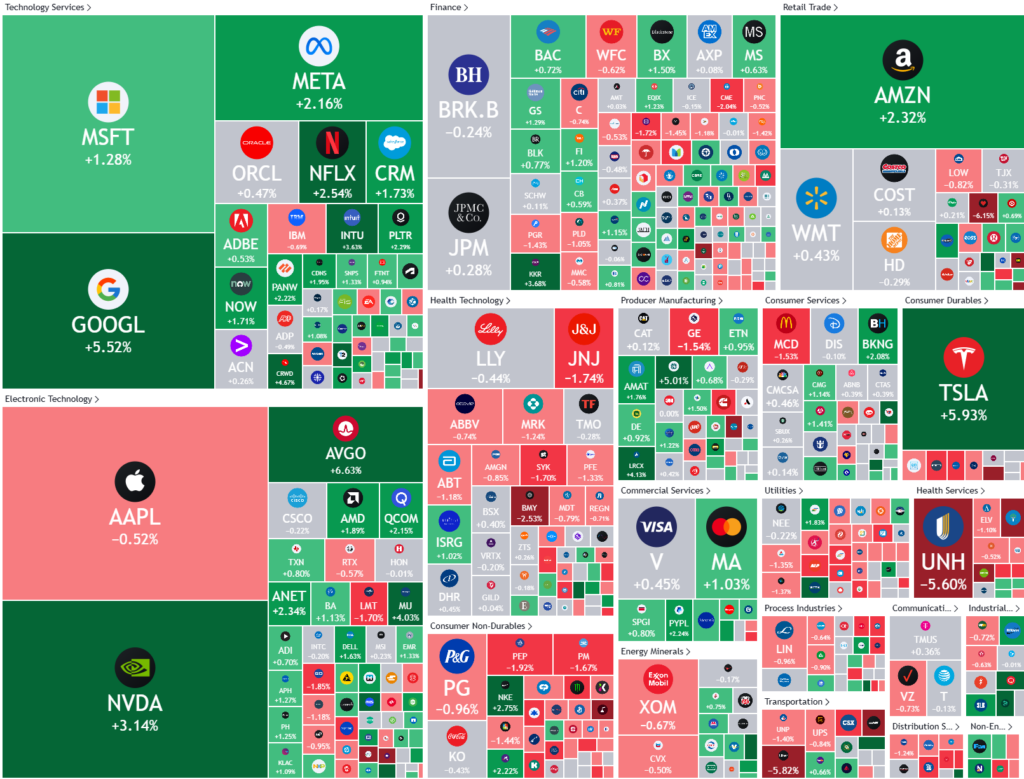

Tech snapped out of its recent malaise, pushing the broader market higher as Google and NVIDIA led to the upside. Alphabet jumped more than 5% adding to its gains from a day earlier, when the tech giant announced a new breakthrough in quantum computing, which could herald a sharp increase in computing speeds.

Rigetti Computing which produces quantum integrated circuits for quantum computers, continued ride Google’s rally, adding 13% to its 45% gain from Tuesday. Broadcom Inc, meanwhile, rallied more than 6% as the chipmaker is reportedly helping Apple create an AI chip, The Information reported.

Tesla meanwhile, climbed 5% to close at a record high. the EV maker’s shares have jumped 64% since its Donald Trump’s election victory on bets that CEO Elon Musk’s close relationship with the president elect will benefit Tesla.

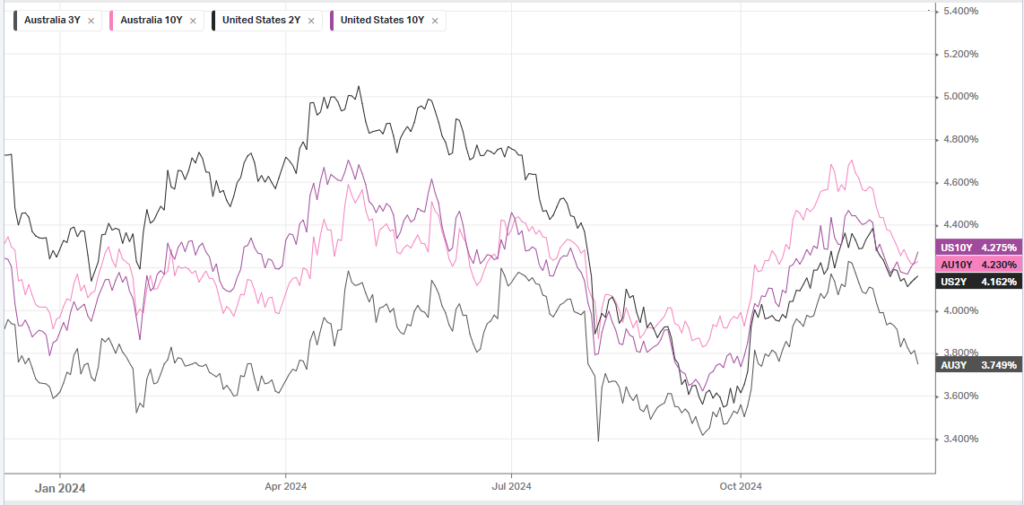

About 98% of traders expect the Fed to cut next week, up from 92% a day earlier, according to Investing.com’s Fed Rate Monitor Tool.

ASX SPI 8412 (+0.45%)

The ASX is in for a rally today as the last “risk” number (US CPI) has passed with little affect. Global equities now have a clear path to rally until late January unless the Fed leaves rates on hold

Company Specific

- Glass bottles and cans maker Ororahas sold its North American business for $1.7 billion.

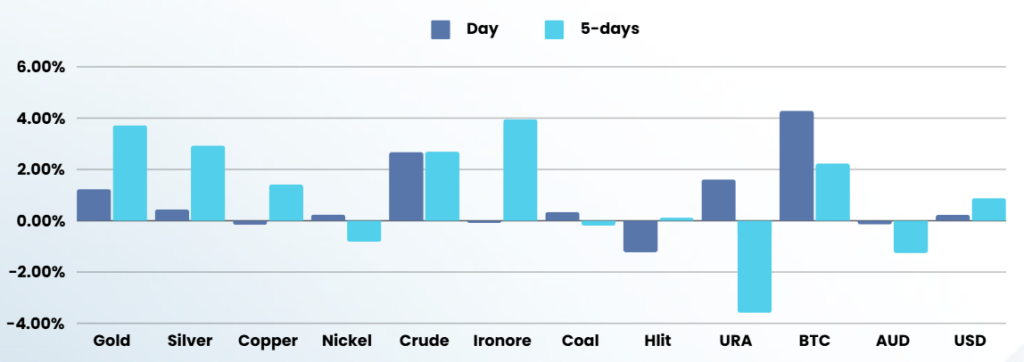

- Citi has initiated coverage on metal producer Capstone Copperwith a “buy” rating, citing “positive earnings momentum”.

- Telecom company Spark New Zealand sold its remaining stake in mobile towers business CDPQ for $NZ314 million ($285 million).