Overnight – Hotter Inflation data stifles bullish rate expectations

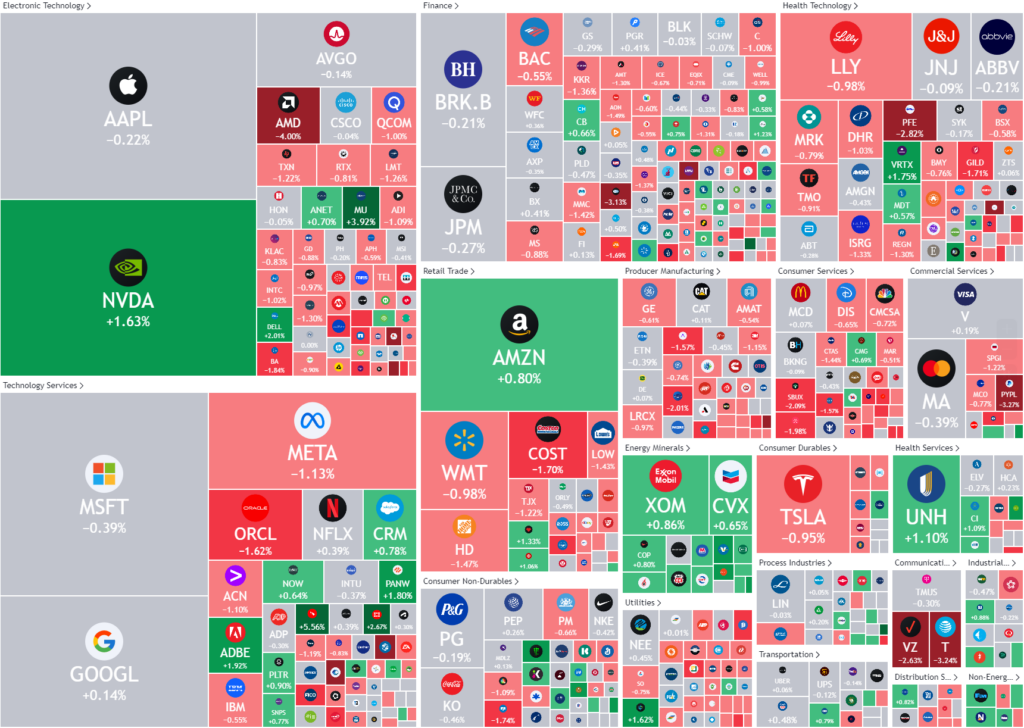

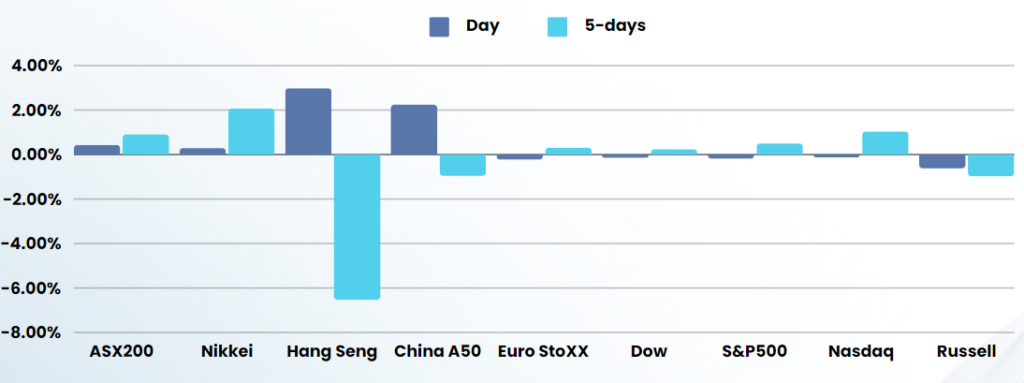

Stocks fell Thursday as stronger-than-expected inflation data muddied the outlook for Federal Reserve rate cuts, Hurricane Milton hit landfall in Florida and Israel launched an attack on Beirut

Headline inflation in the US slowed on an annualized basis in September, but was still faster than expectations, providing the Federal Reserve with less impetus to cut interest rates at a fast pace. The consumer price index (CPI). was 0.2% in September, unchanged from August but above the 0.1% expected. That took the annual pace through August to 2.4%, down from 2.5% in August, but above expectations of 2.3%.

Core CPI, which strips out food and energy and is closely watched by the Fed, rose at 0.3%, taking the annual pace through September to 3.3%, topping economists estimates of 2.3%. With a further emphasis back towards inflation, investors appear to be “recalibrating” their outlook for rate cuts, reducing expectations for a second-round outsized 50bp cut in November and sending the 10-year back over 4% for the first time since July

Focus this week is also on the third-quarter earnings season, with a string of major banks set to report on Friday.

JPMorgan Chase, Wells Fargo and Bank of New York Mellon are set to report third-quarter earnings on Friday, while Goldman Sachs, Bank of America and Citigroup will report earnings next week.

Earnings from Johnson & Johnson, Unitedhealth Group and Walgreens Boots are also due early next week.

Hurricane Milton hit ground fall as a category 3 hurricane yesterday, the second severe storm in as many weeks. This pushed jobless claims higher and will likely compound the hotter than expected inflation data with rebuild costs being estimated at close to the $200B mark

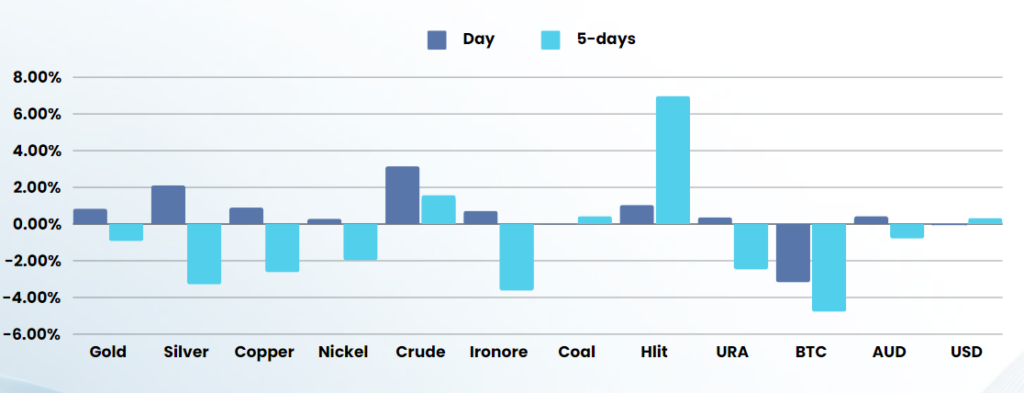

Commodities and energy were also higher on the back of the US Hurricanes and continued Israeli attacks in Beirut which reportedly killed 22 people, including, 2 Hezbollah commanders and injuring 2 UN peacekeepers

Stock specific

- Tesla was little changed as investors awaited the EV maker to unveil its robotaxi at an event Thursday.

- Advanced Micro Devices, meanwhile, fell more than 4% as the chipmaker kicked off its artificial intelligence event to showcase its latest plans including new chips to compete with rival Nvidia. AMD said Thursday it plans to ramp production of its new artificial intelligence M1325X chip starting in the fourth quarter and the chipmaker also unveiled a new server chip as well as announced a new AI chip slated to be released in the second half of next year.

ASX SPI 8256 (-0.01%)

The local market will hold up better than the overnight lead would suggest with the materials and energy sector set for a boost due to the ongoing geopolitical turmoil in the middle east, hurricane damage in the US and optimism around the potential China stimulus measure being announced over the weekend.