Overnight – Post-election rally shows no sign of slowing

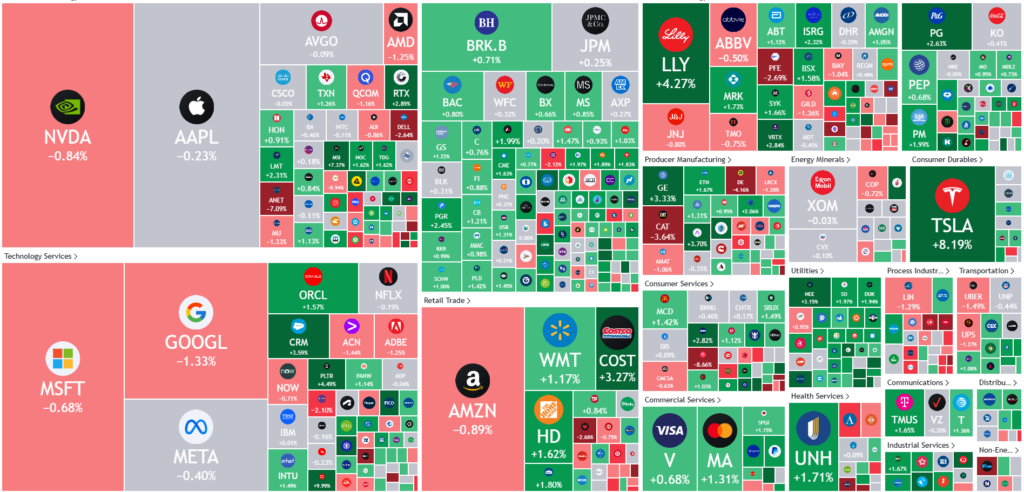

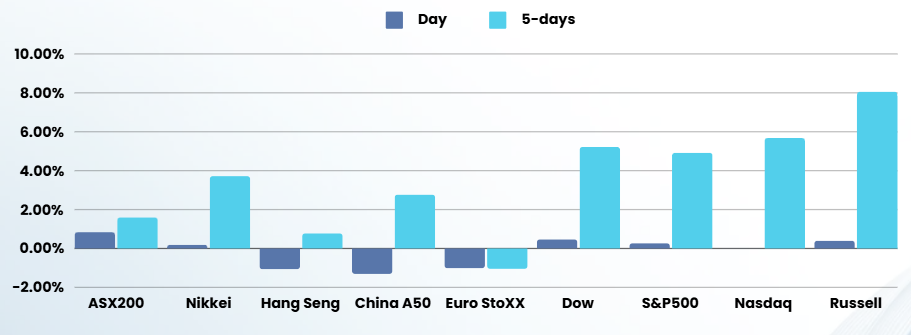

Wall Street’s post-election rally shows no signs of slowing down as the S&P 500, Nasdaq 100, and Dow Jones Industrial Average all closed at record highs on Friday.

The S&P 500 gained 0.4% to reach a new peak, while the Nasdaq 100 and Dow Jones also achieved unprecedented milestones. This surge in the stock market reflects growing investor optimism about the potential economic growth under a second Trump administration.

The Federal Reserve’s decision to cut interest rates has further fueled the market’s upward trajectory. The central bank lowered the benchmark overnight interest rate by 25 basis points to the 4.50%-4.75% range, marking the second consecutive reduction. Fed Chair Jerome Powell indicated that the economy might perform better than previously anticipated next year, with inflation seemingly on track to reach the 2% target.

Consumer sentiment in the U.S. has reached its highest level since April, with the University of Michigan’s Consumer Sentiment reading climbing to 73 in November. This increase reflects growing consumer optimism about the economy and expectations of improved personal finances.

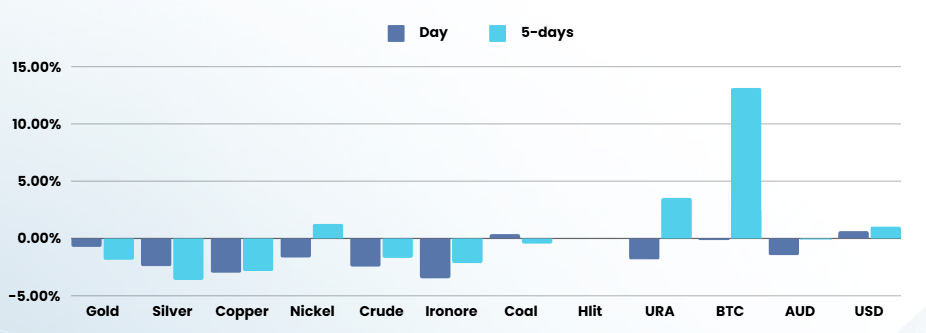

The technology sector continues to show mixed signals. Taiwan Semiconductor Manufacturing (TSMC), the world’s largest contract chipmaker, reported healthy sales in October, but with signs of slowing growth. While demand for advanced chips in the artificial intelligence sector remains strong, TSMC warned of weakening chip demand in other areas such as personal computers, smartphones, and consumer electronics.

Looking ahead, some Wall Street analysts are predicting further gains in the stock market. BofA strategists suggest that the period between the U.S. election and Inauguration Day presents a “risk-on window of opportunity” for U.S. stocks.

ASX SPI 8281 (-0.43%)

The ASX is likely to drift lower today, as the “glow” of new leadership isn’t shining on the local market like American markets.

The materials sector by get some support from China’s announcement late Friday of trillions in yuan to support heavily indebted local governments, as it tries to support its already faltering economy bracing for new risks from incoming US president Donald Trump. The government pledged the 6 trillion yuan ($1.26 trillion) fiscal package to help China’s leveraged local governments restructure their finances in a bid to shore up the world’s second-largest economy. Authorities also said local governments will be able to tap another 4 trillion yuan in a new special local bond quota over five years for the same purpose.