Overnight – Stocks sink as strong US Labor data takes further cuts off the table

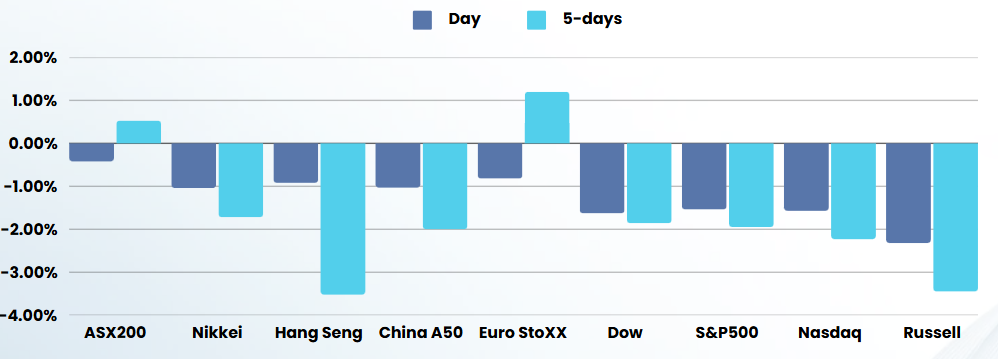

Stocks fell sharply Friday, after a stronger-than-expected jobs report for December stoked fears of a prolonged Federal Reserve pause on rate cuts, sending Treasury yields sharply higher.

The US economy unexpectedly added more jobs in December versus the prior month, according to a monthly report that could factor into how the Federal Reserve approaches possible interest rate cuts. Nonfarm payrolls increased by 256,000 jobs last month after rising by a downwardly revised 212,000 in November, the Labor Department’s Bureau of Labor Statistics said. Economists had forecast an uptick of 164,000 roles. The unemployment rate fell to 4.1%, below November’s pace of 4.2%.

Following the jobs report, the odds that the Fed keeps rates unchanged at its meeting later in January jumped to 98%, with the next cut now expected in June or July

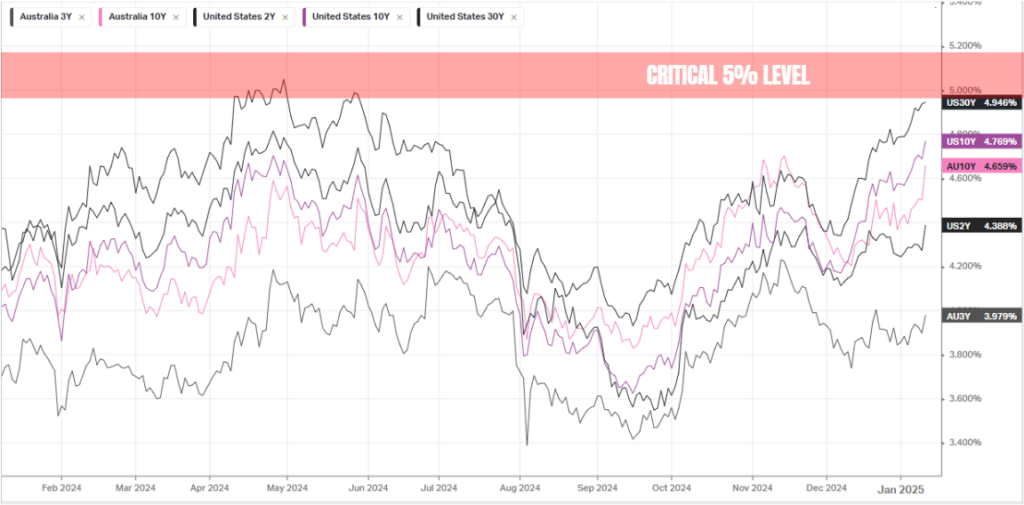

Cooling bets on Fed rate cuts, pushed the yield on the 10-year Treasury to its highest level since November 2023, weighing on growth sectors of the market including tech.

The 10-year Treasury yield climbed 8 bps to 4.765%, nearing the 5% level, which some warned could mark another blow to stocks.

If 10-year Treasury yields decisively breach 5% (the prior peak), then growth fears would soon resurface and trigger an equity de-rating,

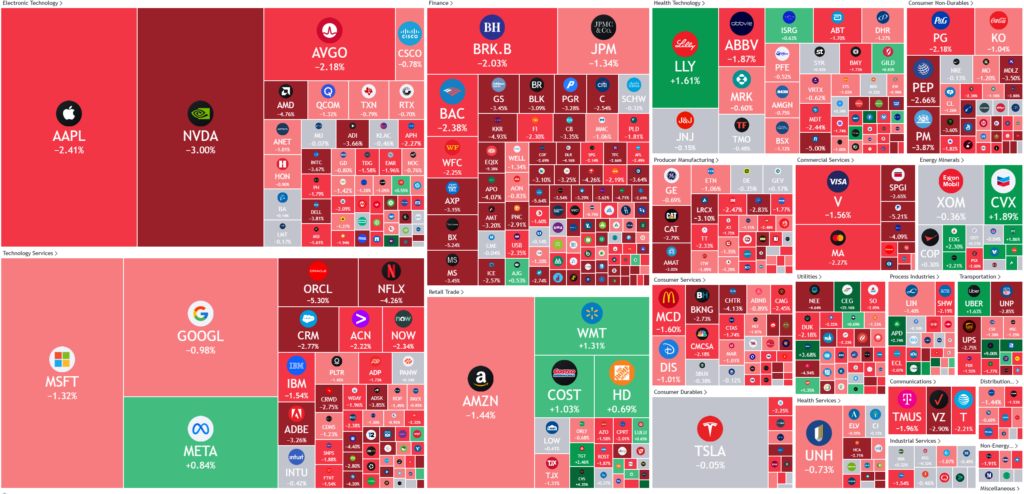

Elsewhere, tech was hurt by a slump in chip stocks as NVIDIA Corporation and Advanced Micro Devices led the sector to downside, with latter coming under pressure after Goldman Sachs downgraded AMD to neutral from buy, citing revenue growth worries.

The fourth-quarter earnings season is set to begin in earnest next week, with several major banks, including JPMorgan Chase (NYSE:JPM), Wells Fargo (NYSE:WFC), Goldman Sachs (NYSE:GS) and Citigroup (NYSE:C) set to report on Wednesday.

ASX SPI 8208 (-0.85%)

The ASX is in for a rough day as global markets are finally becoming fearful of high bond yields

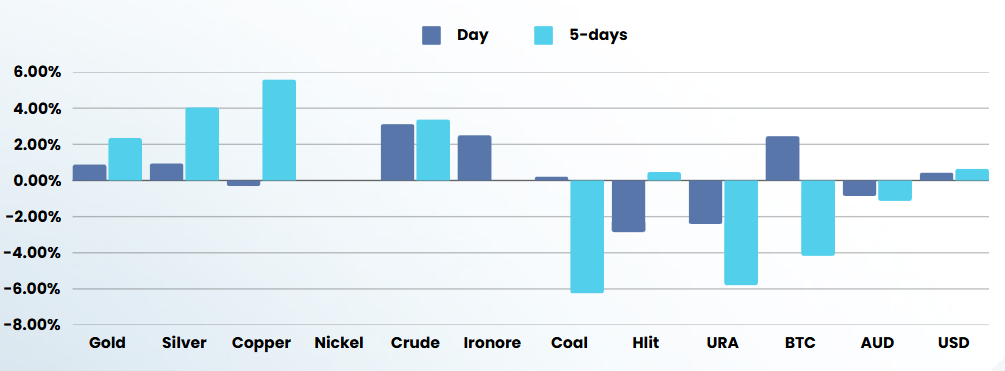

The market will (for the first time in a long time) be supported by materials and energy with crude spiking higher and general commodity strength due to China hopes