Overnight – Stocks grind lower into US inflation data

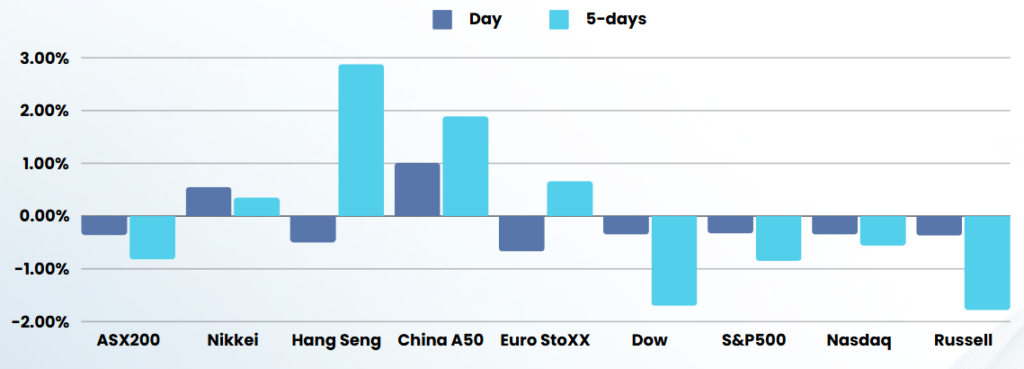

US Stocks were mixed Tuesday and the dollar rose, as investors awaited fresh inflation data and a meeting by the European Central Bank on Thursday.

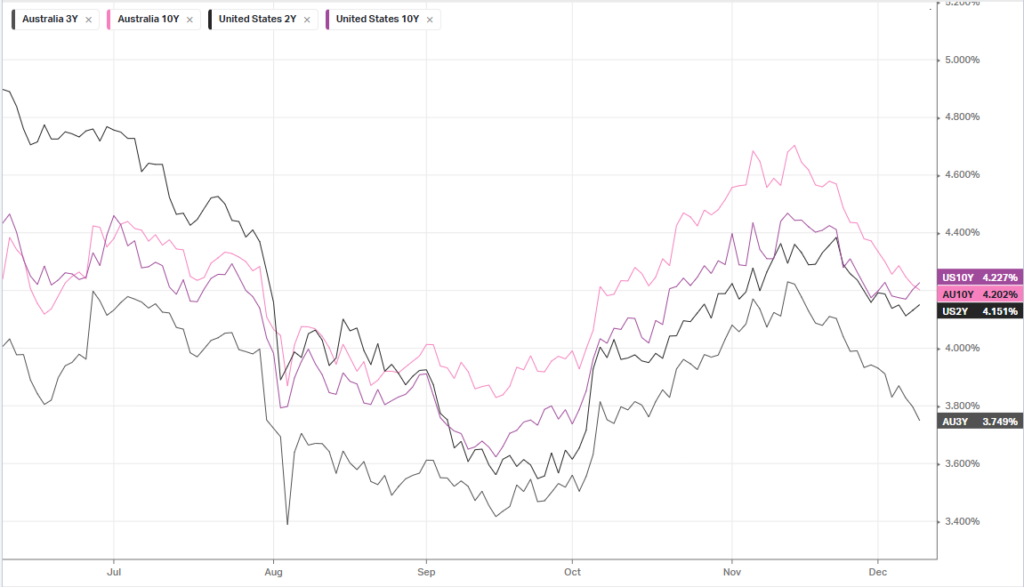

Investors will be closely watching tonight’s consumer price index report for insight into the trajectory of U.S. inflation and ensuing Federal Reserve policy. A Reuters poll of economists found 90% anticipate a 25 basis point rate cut from the Fed at its Dec. 18 meeting (we are in the 10% camp of no cut). With an ECB rate cut all but certain, investors will be watching for clues about its policy path. Another boost to U.S. sentiment was a report showing small business confidence climbing to its highest level in nearly 3-1/2 years in November.

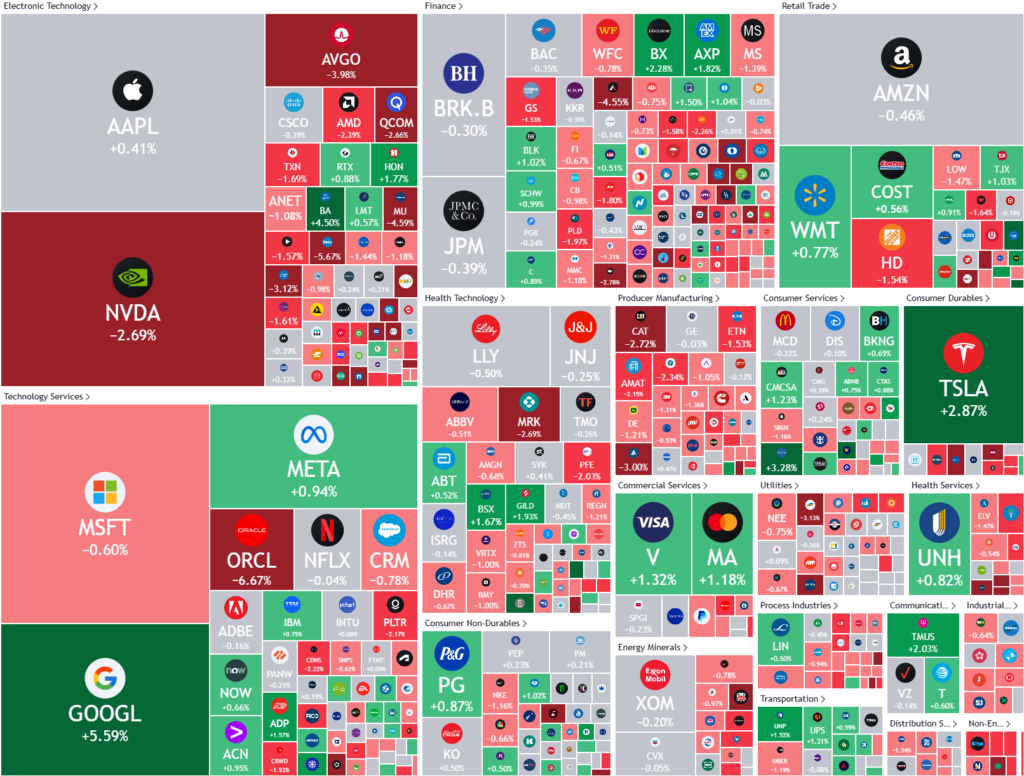

the biggest gainer with a strong boost from Google-parent Alphabet, whose shares rose 5.3% after it unveiled a new-generation chip.

The weakest sectors were rate-sensitive real estate, down 1.4%, and technology, down 1%. Tech was dragged down by a 7.7% drop in Oracle after the cloud computing company missed Wall Street estimates for second-quarter results.

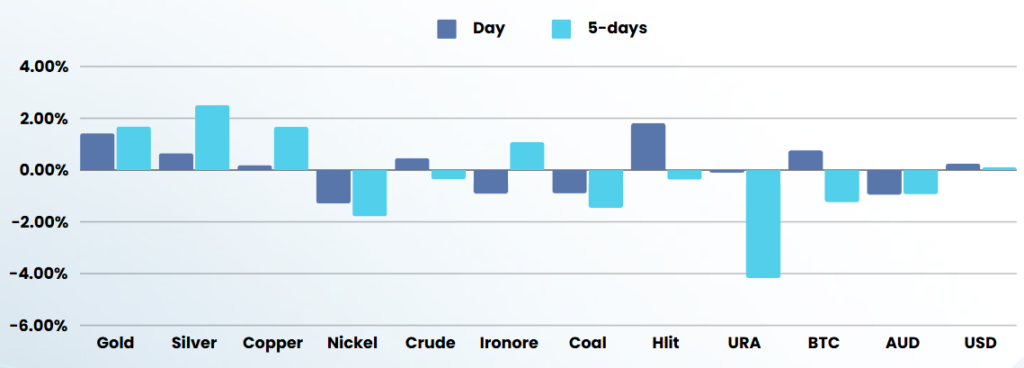

Gold prices hit a two-week high, boosted by rising geopolitical tensions and expectations of a third U.S. rate cut by the Federal Reserve next week.

Elsewhere in commodities, oil prices rose on the China stimulus and possible tight supply in Europe. Investors assessed the potential regional fallout from the overthrow of Syrian President Bashar al-Assad.

ASX SPI 8383 (-0.32%)

The Aussie market is likely to be fairly quiet ahead of the last significant economic number for the year, US Inflation.

Interest rate sensitive stocks may find a bid tone as the RBA was slightly more downbeat on the economy, (which is upbeat for lower rates) however nothing will change in AU until at least the February meeting next year

The RBA surprised the market by adopting a far more dovish tone than anticipated, noting softer-than-expected economic data. It also dropped a long repeated reference that it was “not ruling anything in or out”, a move RBA governor Michele Bullock said was “deliberate”.