Overnight – Investors breathe a sigh of relief as US labour market holds up despite Trump uncertainty

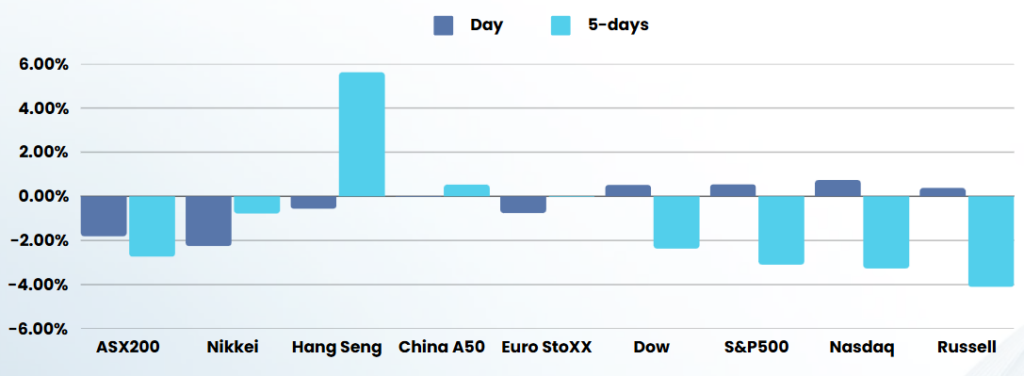

Stocks bounced on Friday after cutting intraday losses, but the major index still ended the week in the red as investors weighed a soft employment report and a wild week of trade uncertainty.

There was a collective sigh of relief as US employment numbers came in around expectation, not adding to the uncertainty President Trump has been creating.

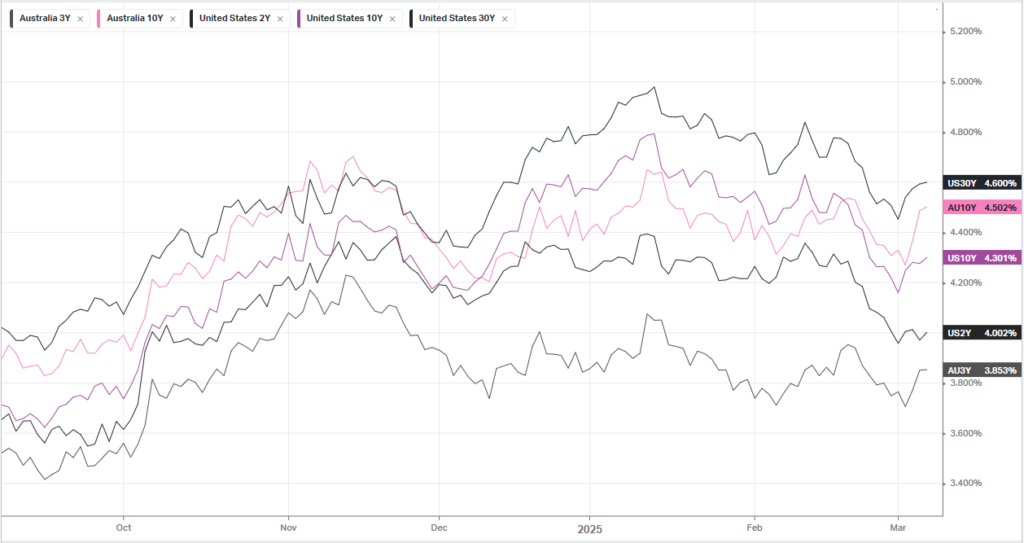

In February, the U.S. economy created fewer jobs than expected, and the unemployment rate saw a slight increase, potentially indicating some strain on the labour market. This development could influence the Federal Reserve’s decision-making regarding future interest rate adjustments. Nonfarm payrolls increased to 151,000, surpassing the revised January figure of 125,000, according to data from the Bureau of Labor Statistics. Economists had forecast 159,000 new jobs. The unemployment rate rose to 4.1%, up from 4.0% in January.

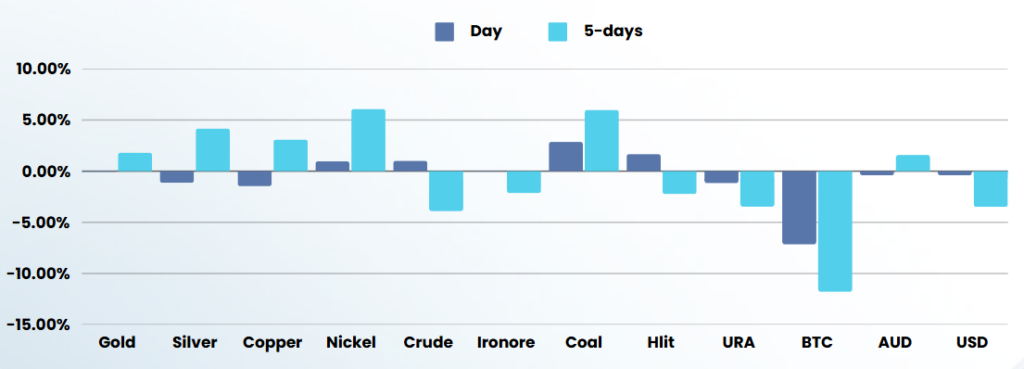

It was the usual fears around Trump capped gains as Trump stated that reciprocal tariffs on Canada could begin as early as Friday, ahead of the April 2 deadline, increasing trade uncertainty. On Thursday, he announced a temporary exemption for Canadian and Mexican goods under the USMCA, delaying a 25% tariff until April 2. In response, Canada postponed retaliatory tariffs on $125 billion of U.S. products to the same date. Meanwhile, the White House is considering easing energy sanctions on Russia to encourage a ceasefire agreement in Ukraine.

Federal Reserve chairman Jerome Powell also spoke on Friday, suggesting the central bank may continue to take a patient approach on interest rates as the economy remains in good place despite elevated uncertainty.

“We do not need to be in a hurry and we are well positioned to wait for clarity [on whether to adjust monetary policy],” Fed chairman Jerome Powell said Friday in prepared comments to the University of Chicago Booth School of Business’ US Monetary Policy Forum before level discussion.

Company Earnings

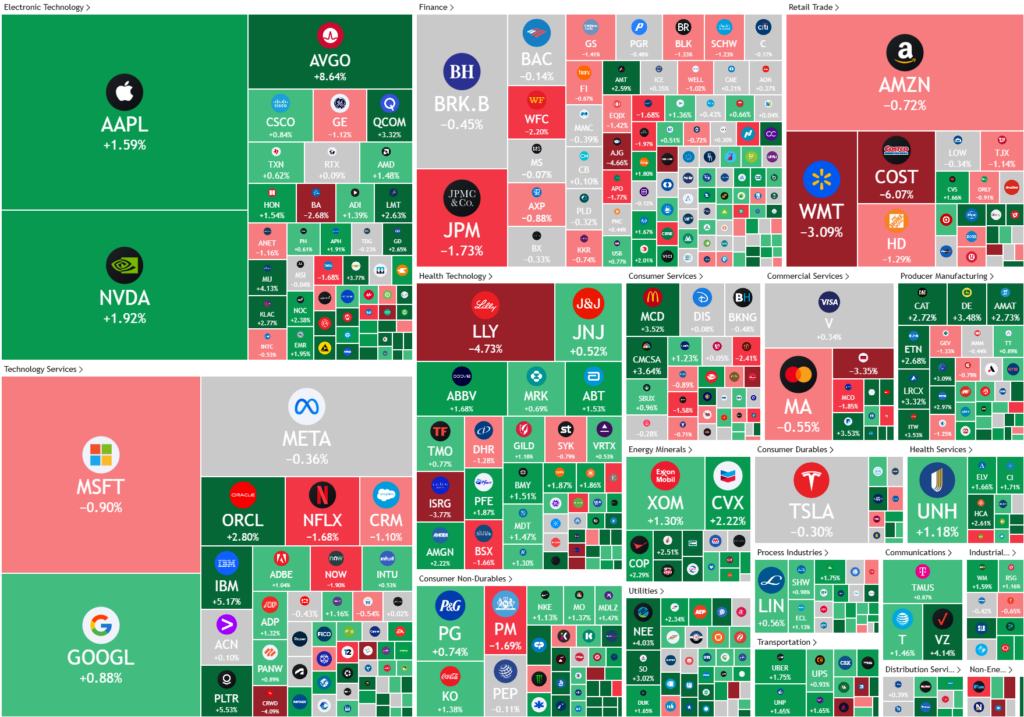

- Broadcom –stock rose more than 8% after the chipmaker assuaged investor worries about artificial intelligence infrastructure demand with a strong second-quarter forecast.

- Hewlett Packard – stock slumped 12% after the AI-server maker said its annual profit forecast would be hit by U.S. tariffs in an intensely competitive market.

- Gap –stock surged nearly 19% after the apparel company beat fourth-quarter sales and profit estimates, as the retailer’s turnaround strategy helped attract customers to its apparel brands including Old Navy and Banana Republic during the holiday quarter.

- Costco Wholesale – stock dipped 6% after the wholesale retailer reported lower-than-anticipated fiscal second-quarter profit, although revenues topped expectations, as consumers wary of the potential inflationary impact of U.S. tariffs turned to bulk-buying.

ASX SPI 8011 (+0.68%)

The ASX is due a bounce today after heavy risk-off selling on Friday. Chinese CPI and PPI numbers were softer than expected over the weekend, giving room for the PBOC to add stimulus.

Cyclone Alfred is still wreaking havoc on the SE Queensland and Northern NSW coast

US inflation data will be the focus for the economic numbers this week, on Wednesday night.

US HAS GONE TO DAYLIGHT SAVINGS, US MARKETS WILL CLOSE AT 7am AEDST FOR THE NEXT FEW WEEKS