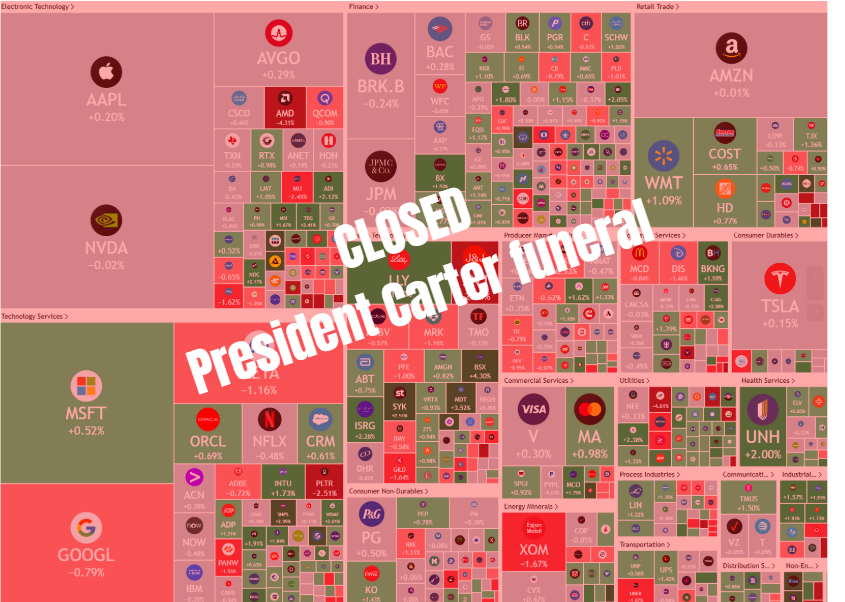

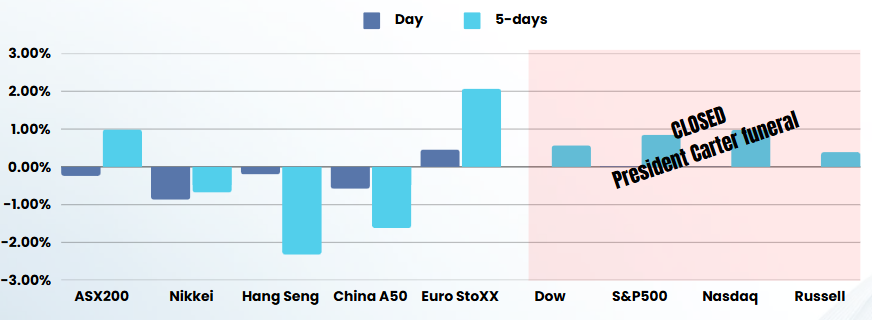

Overnight – US Market closed for Pres Carter Funeral while LA wildfires burn

The US stock market was closed overnight due to President Carters state funeral, while Wildfires in LA escalated with damages estimated at $20B

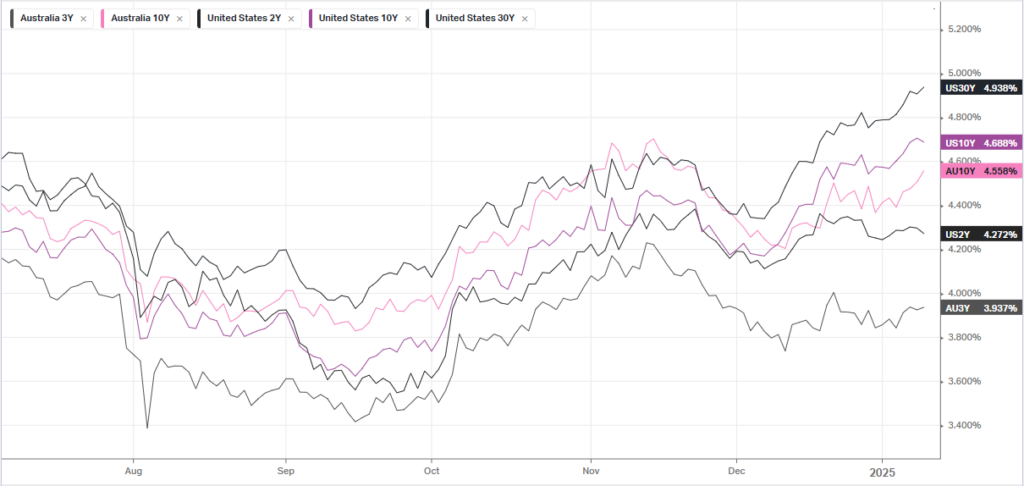

U.S. Treasury yields retreated from an eight-month high on Thursday, with the benchmark 10-year yield falling to 4.689%. This decline came after yields hit a peak of 4.73% on Wednesday, the highest since April 2024. The dollar strengthened against major currencies as markets assessed the Federal Reserve’s interest rate cut plans in light of U.S. economic resilience.

Investors are eagerly awaiting Friday’s U.S. monthly payrolls report, which will provide insights into the Fed’s policy outlook. Currently, markets are fully pricing in just one 25-basis-point U.S. rate cut in 2025.

The recent market selloff in Treasuries was fueled by a CNN report suggesting that President-elect Donald Trump was considering declaring a national economic emergency to justify universal levies on allies and adversaries. Additionally, minutes from the Fed’s December policy meeting revealed concerns about Trump’s proposed tariffs and immigration policies potentially prolonging the fight against inflation.

European shares finished higher, with the pan-European STOXX 600 closing up 0.42%. The U.S. dollar index traded near 109.54, its highest level since November 2022. Meanwhile, the British pound faced its biggest three-day drop in nearly two years due to a global bond selloff that hit gilts particularly hard.

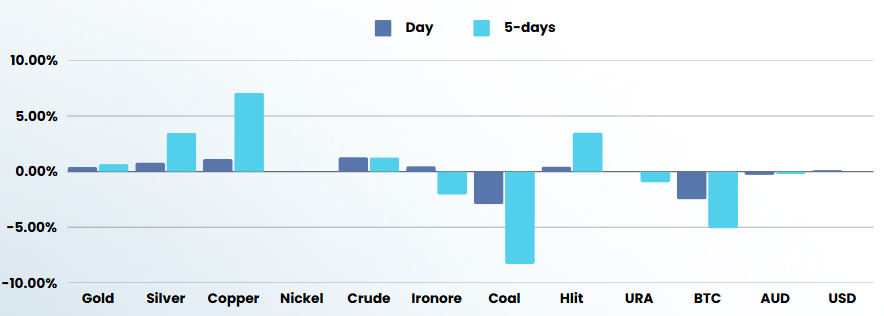

In other markets, oil prices gained more than 1% as cold weather increased winter fuel demand. Gold prices also advanced, with spot gold rising 0.31% to $2,670.09 an ounce.

Overall, markets remain focused on upcoming economic data and potential policy shifts as they navigate uncertain economic conditions and geopolitical tensions.

ASX SPI 8336 (+0.31%)

The ASX is set to rise slightly today with the miners likely to support the market as iron ore rose.

All eyes will be on US payrolls tonight and the progress of getting the LA wildfires under control. Insurers with US exposure will likely be sold, while repairers like Johns Lyng Group could be supported

Star Entertainment’s lenders warn the Sydney and Gold Coast embattled casino owner could be in voluntary administration within months. A lifeline deal to preserve its future as a listed company fails to materialise. Star’s shares lost a third of their value yesterday as investors dumped the stock.