Overnight – Stocks fall as Trump will announce new tariffs this week

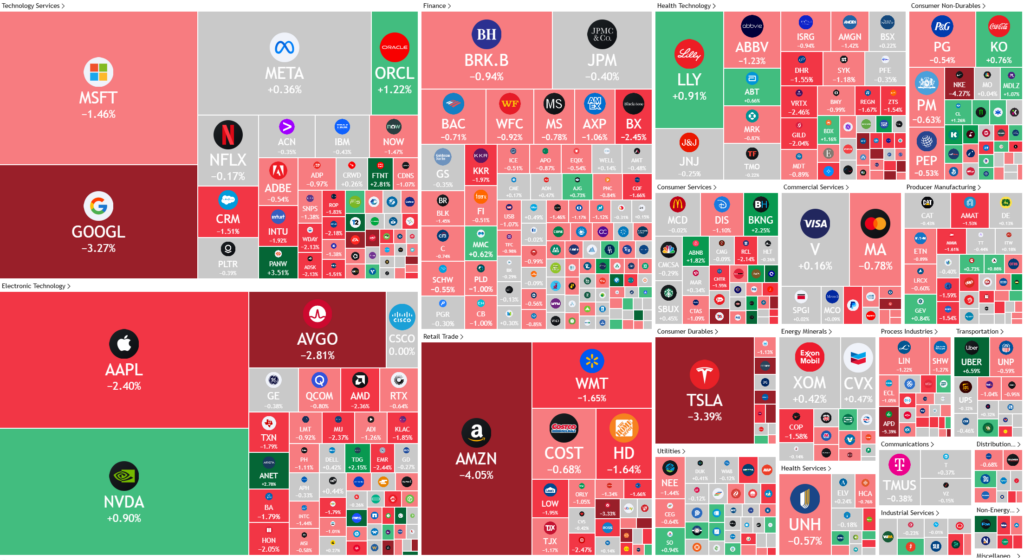

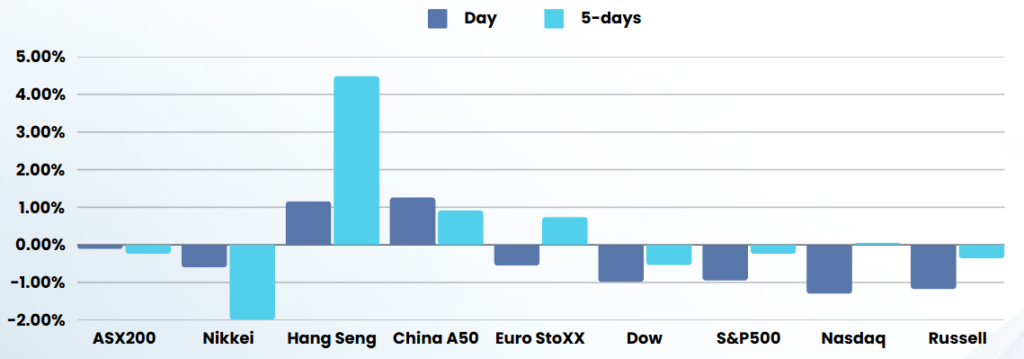

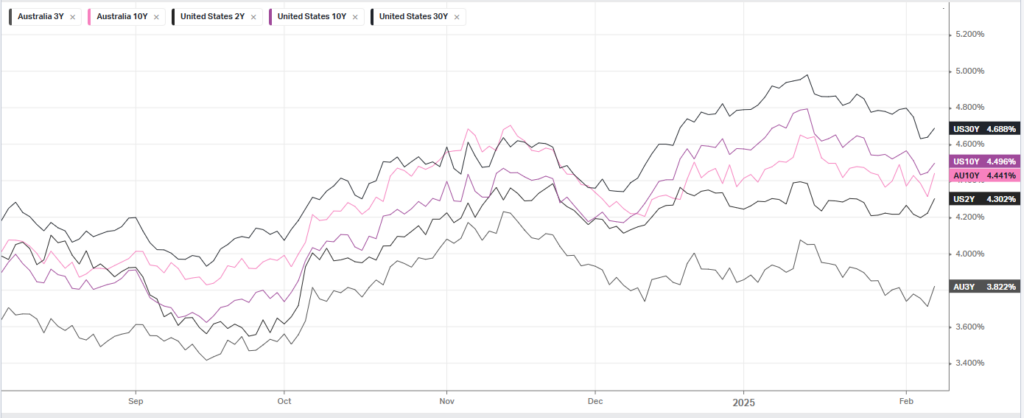

Wall Street ended sharply lower and benchmark Treasury yields jumped on Friday in the wake of a mixed U.S. payrolls report, weak consumer sentiment data and revived trade war jitters.

The much-anticipated employment report showed the U.S. added 143,000 jobs in January, 53.4% fewer than December’s upwardly revised 307,000. The report, distorted by annual benchmark revisions, along with California wildfires and unusually cold weather, also showed hotter-than-expected wage growth and a surprise dip in the unemployment rate, to 4.0% from 4.1%. It was a miss on the headline, but the revisions over the last two months were positive, and hourly earnings were also up

A separate report from the University of Michigan showed consumer sentiment has darkened unexpectedly this month as inflation expectations spiked.

The major indexes extended losses after Trump said he will announce a new round of reciprocal tariffs on many countries next week. President Donald Trump warned on Friday of plans to impose higher tariffs next week on goods imported into the U.S to match the rates that trading partners impose on American exports. While it wasn’t clear which countries would be targeted, the news stoked fresh fears about a brewing global trade war, further curbing risk sentiment. Ahead of the tariffs, the EU has already attempted to offer concessions that could lead to deal. Bernd Lange, the head of the trade committee in the European parliament, told the Financial Times on Friday that he bloc was prepared to cut its 10% import tax on cars in the EU to get closer to the 2.5% levy charged by the U.S

Corporate Earnings

- Tesla – stock fell 3.4% after the automaker’s sales of China-made electric vehicles fell 11.5% to 63,238 units in January from a year earlier, data from the China Passenger Car Association showed on Friday.

- Pinterest – stock gained 19% after the social media service reported a strong holiday-quarter performance, posting better-than-anticipated revenue of $1.15 billion – crossing the $1 billion milestone for the first time ever.

- Affirm Holdings – stock soared nearly 22% after the provider of buy now, pay later loans posted a surprise quarterly profit on the back of a strong holiday shopping season and forecast an upbeat annual revenue.

ASX SPI 8405 (-0.75%)

Australian shares are poised to open lower in line with cautious trading on Wall Street, as investors await further moves from President Trump on Tariffs

This week kicks off earnings season with JBH, AD8, CSL, CBA, TWE, NST & QBE amongst the names delivering earnings