Overnight – Stocks sharply higher as Trump shows the “Art of the surrender”

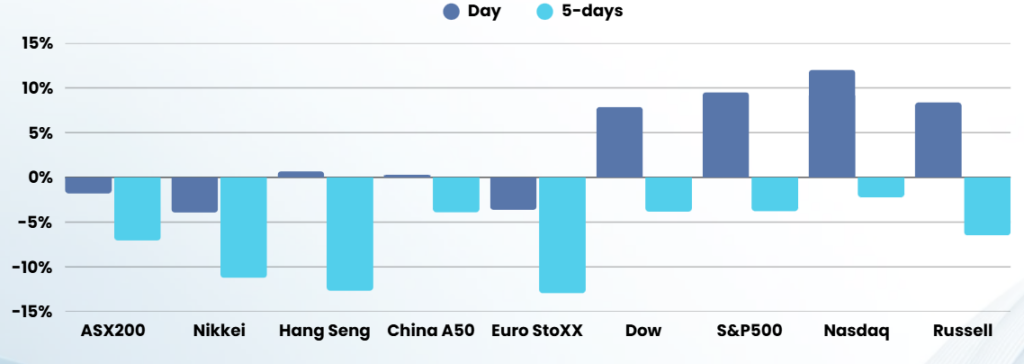

US stocks rallied sharply Wednesday after President Donald Trump embarrassingly waved the white flag and dropped reciprocal tariffs to 10% on countries excluding China for 90-days to allow trade deal negotiations on country by country basis, easing fears about a brewing global trade war.

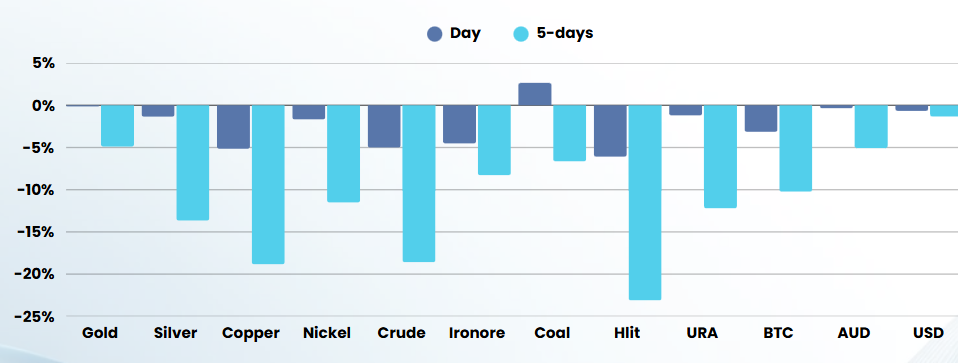

Trump said he would hike tariffs on China but pause reciprocal tariffs for 90 days for most other countries, who had not retaliated. The reciprocal tariffs that went into affect overnight would be lowered to 10% immediately. “Based on the lack of respect that China has shown to the World’s Markets, I am hereby raising the Tariff charged to China by the United States of America to 125%, effective immediately,” Trump said in a social media post after raising tariffs on China to 104% overnight. China announced earlier Wednesday that it will impose 84% tariffs on U.S. goods from Thursday, up from the 34% previously announced. Other notable tariffs included a 20% duty on the European Union, 24% on Japan, 46% on Vietnam, 25% on South Korea, and 32% on Taiwan. More than 75 countries have contacted the U.S. seeking reprieve from tariffs. U.S. Treasury Secretary Scott Bessent said on Monday. During the 90-day interim, the U.S. is expected to negotiation trade deals on a country by country basis. “The willingness of more than 75 countries to come and negotiate everything they saw last Wednesday was a ceiling and now we have a 10% temporary floor,” Bessent added.

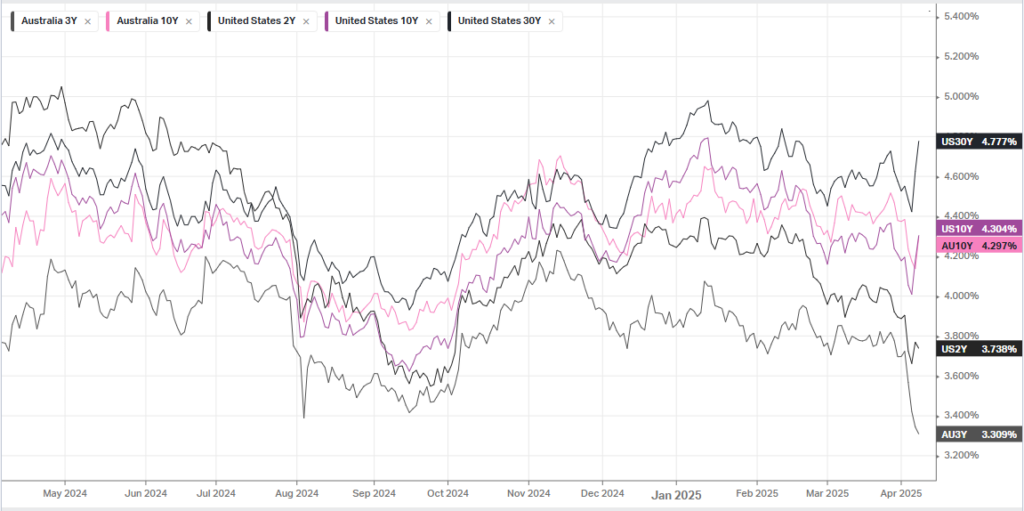

The reprieve on tariffs encouraged Goldman Sachs to pull its cool its call on its a recession, reverting to its prior forecast of a 45% chance of recession amid economic growth of about 0.5%.

Tech led the broader market as investors bought the dip in tech amid easing worries on tariffs as well as improved sentiment on the AI trade. In a sign that corporate America continues to back the AI trade, Google parent company Alphabet reiterated plans to invest $75B on AI technologies despite recent tariff turmoil. AI-related stocks including NVIDI, Meta, Amazon.com were sharply higher. Tesla meanwhile, was up more than 22% after Benchmark added the stock to its buy list, citing the recent selloff as overdone.

ASX SPI 7895 (+6.61%)

For those of you who listened to yesterdays Pre-Market Pulse, it should be a great day! For those that didn’t, don’t fall into the trap of chasing the market in FOMO.

Yesterdays Pre-Market Pulse

“As boisterous as Trump is being, the US isn’t in the position of strength it thinks and I suspect that Trump will need to do a deal quickly to save face. This will trigger a significant bounce”

Your best options are likely CSL, WTC, GMG, (which we have been buying all week) but don’t chase

The other part of yesterdays pre-market pulse which is important in context is

(in my opinion) investors should sell into any bounce as there will be another leg down over the next 2-3 months. The next leg of this downturn will be about US recession fears

The bounce has happened faster than I thought, so we may sit up around these levels for a few weeks, but make no mistake, confidence is heavily dented and the effects of that could easily cause another leg down