Donald Trump and three major tech leaders have announced a significant joint venture called Stargate to fund AI infrastructure in the United States. The key points of this announcement are:

Participants and Investment

- Partners: Donald Trump, OpenAI, SoftBank, Oracle, and other companies

- Initial commitment: $100 billion ($159 billion AUD)

- Planned investment: Up to $500 billion over the next four years

Project Details

- Name: Stargate

- Purpose: To build physical and virtual infrastructure for AI advancements

- Initial focus: Construction of a data center in Texas, with plans to expand to other states

- Job creation: Trump claims it will create 100,000 jobs “almost immediately”

Political Context

- The announcement coincides with Trump’s second term inauguration

- Trump pledges to ease regulations and use executive actions to facilitate construction projects

- Tech executives, including Elon Musk, Mark Zuckerberg, and Jeff Bezos, attended Trump’s swearing-in ceremony

Industry Implications

- The venture aims to boost capacity for training and running new AI models

- It underscores the growing importance of AI in the American economy

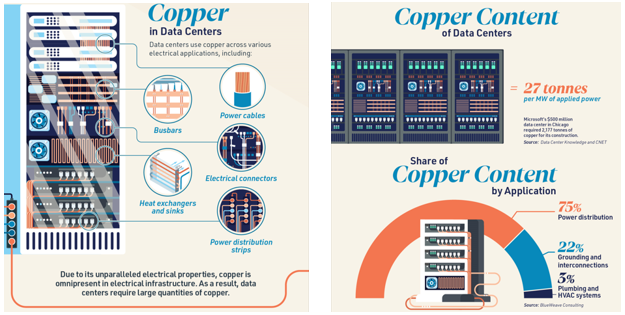

- Powering and wiring AI datacenters will drive demand for Copper and Uranium

We are looking at adding to our BHP and Paladin energy holdings

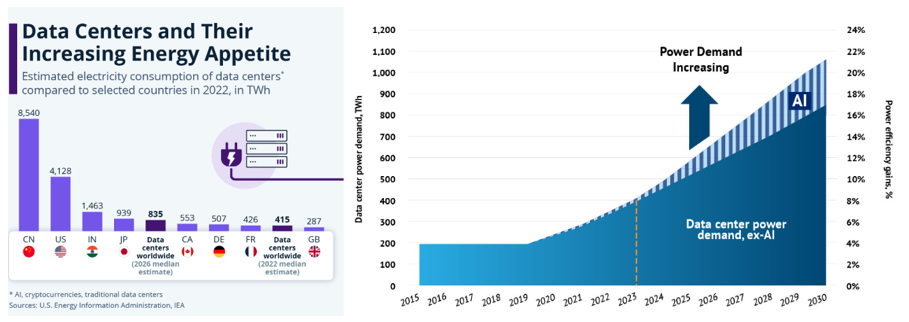

The rapid growth of artificial intelligence and cloud computing is driving an unprecedented expansion in data center infrastructure, creating a compelling investment thesis for copper and (Uranium) nuclear power.

Data centers are projected to consume 9% of global electricity by 2050, up from 2% today. This surge in energy demand is pushing tech giants to seek reliable, carbon-free power sources. Nuclear energy has emerged as an attractive option due to its consistent output and low emissions profile

Major companies like Microsoft, Amazon, and Google are already investing billions in nuclear projects to power their data centers

Simultaneously, the copper intensity of data centers is increasing dramatically. BHP forecasts that copper demand from data centers will grow six-fold by 2050, from 0.5 million tonnes annually to 3 million tonnes. This represents a significant new source of demand in an already tight copper market.

The investment opportunity lies in:

- Uranium miners and nuclear technology companies, particularly those focused on small modular reactors (SMRs) which are well-suited for data center applications

- Copper miners and processors, as the metal is critical for both data center construction and the broader electrification trend.

- Companies developing energy infrastructure to support data center growth.

- Data center REITs that can capitalize on the sector’s expansion.

We are looking at adding to our BHP and Paladin energy holdings