In markets, the only certainty is eventually, there will be uncertainty, and Trump has certainly delivered in spades. Recent market fluctuations have left many investors scrambling for ways to protect their portfolios. If you’re feeling the heat, you’re not alone, but there are some practical ways to safeguard your portfolio

Understanding Risk (and your risk tolerance)

Risk is often what’s left over after you think you’ve covered everything. It’s those “unknown unknowns” that can catch you off guard, much like the infamous “black swan” events. As Charlie Munger once said, “Risk is what’s left over when you thought you pretty much covered everything.” No one has all the answers, and even the most seasoned investors can be caught off guard.

Key to managing your portfolio in volatile markets is working out how much risk are you willing to take. The biggest mistake you can make is crossing your fingers an hope for the best, be honest with yourself and set your limits

Hedging: A Beginner’s Guide

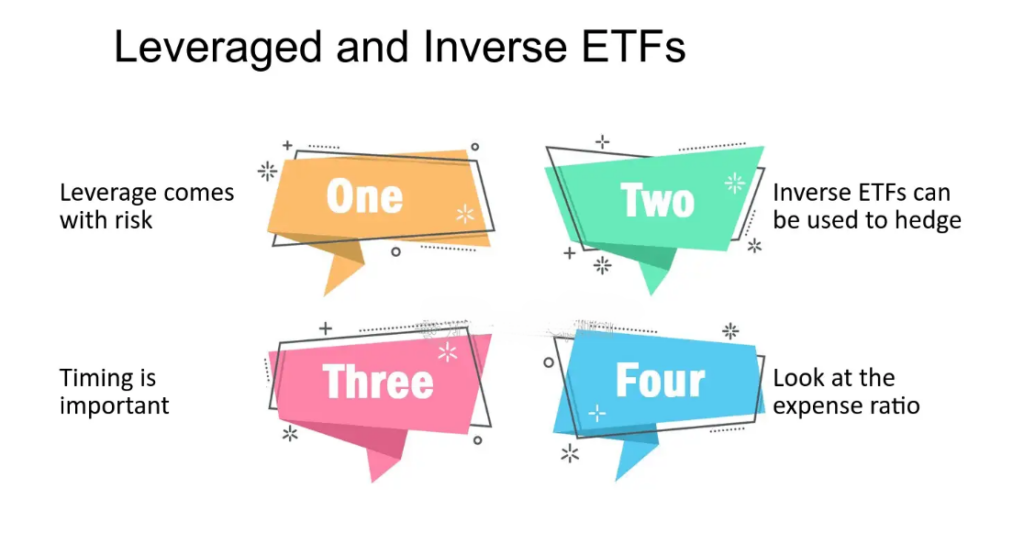

Hedging is essentially placing a trade that rises if the market falls. It’s a way to partially offset potential losses without selling your existing stocks. For those new to hedging, ETFs are a great starting point. There are non-leveraged options, like bear ETFs, which increase by about 1% for every 1% market drop. For those seeking more leverage, there are options like B-Bos or B-Bus, which can offer up to two and a half times the return of a non-leveraged bear ETF for the same market drop.

The beauty of these tools is that you don’t need to deploy a lot of capital to protect your portfolio. A small allocation, say 10%, can safeguard against a 20-30% market downturn. This strategy isn’t meant for long-term holding; it’s a temporary shield during times of volatility.

Economic Weakness – Short ETF’s

Non-leveraged

- BEAR – for every 1% the ASX200 falls, BBOZ will rise 0.9-1.1%

Leveraged (ties up less capital)

- BBOZ – for every 1% the ASX200 falls, BBOZ will rise 2.4-2.7%

- BBUS – for every 1% the S&P500 falls, BBUS will rise 2.4-2.7%

- SNAS – for every 1% the NASDAQ falls, SNAS will rise 2.4-2.7%

Geopolitical worries – Real assets

- War – Gold, oil

- Tariffs – Gold, Commodities*

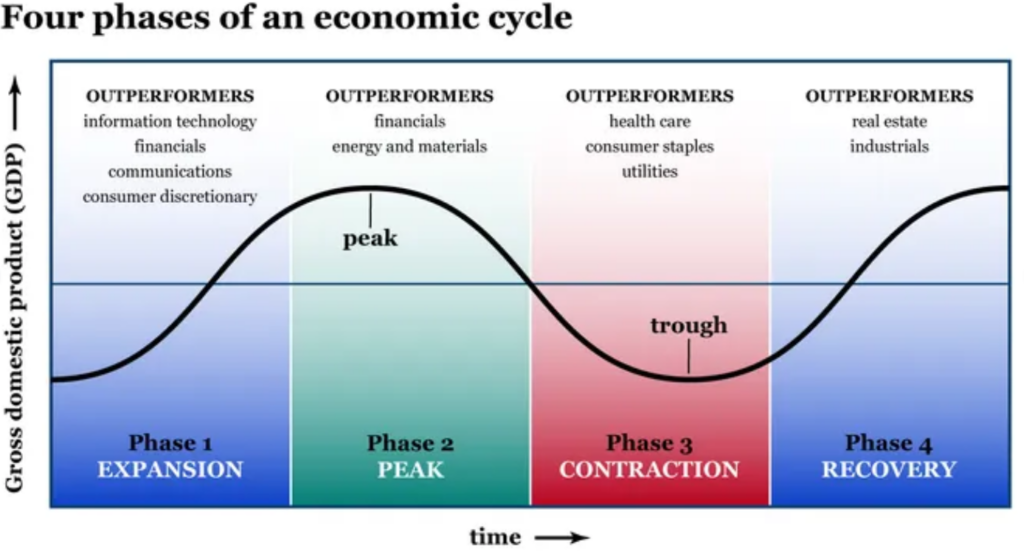

Defensive Sectors: Where to Find Safety

When markets are turbulent, it’s wise to gravitate towards sectors that are less likely to be affected by economic downturns. These are often referred to as “defensive” sectors because they provide essential goods and services that people will continue to need regardless of the economic climate.

- Healthcare: Companies like CSL and ResMed are staples in this sector. People will always need healthcare, making these stocks more resilient during downturns.

- Utilities: Providers like APA offer essential services that are less volatile.

- Consumer Staples: Companies like Woolworths provide everyday necessities.

These sectors are often undervalued and can offer a safe haven during market turmoil. They also tend to provide a decent yield, which can be attractive when other sectors are struggling.

The Importance of Planning

Having a plan in place is crucial for making smart decisions during chaotic market conditions. Emotional decisions made in the heat of the moment often lead to suboptimal outcomes. By setting clear goals and triggers, you can avoid panic selling and ensure that your portfolio is aligned with your long-term strategy.

Structured Investments: A Smarter Approach

For those looking for more sophisticated solutions, structured investments can offer a better outcome than traditional index ETFs. Products like Index Pro combine fixed interest with leveraged upside, allowing you to outperform the market during upswings while protecting your downside during downturns. These products typically come with a capped downside risk, ensuring that your losses are limited.

Navigating turbulent markets requires a combination of strategy, patience, and the right tools. By understanding risk, using hedging strategies, focusing on defensive sectors, and having a solid plan in place, you can safeguard your portfolio and position yourself for success when the market recovers. Remember, long-term wealth creation is the goal, but protecting your assets during times of uncertainty is just as important.

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.