ETF Elite March 2025

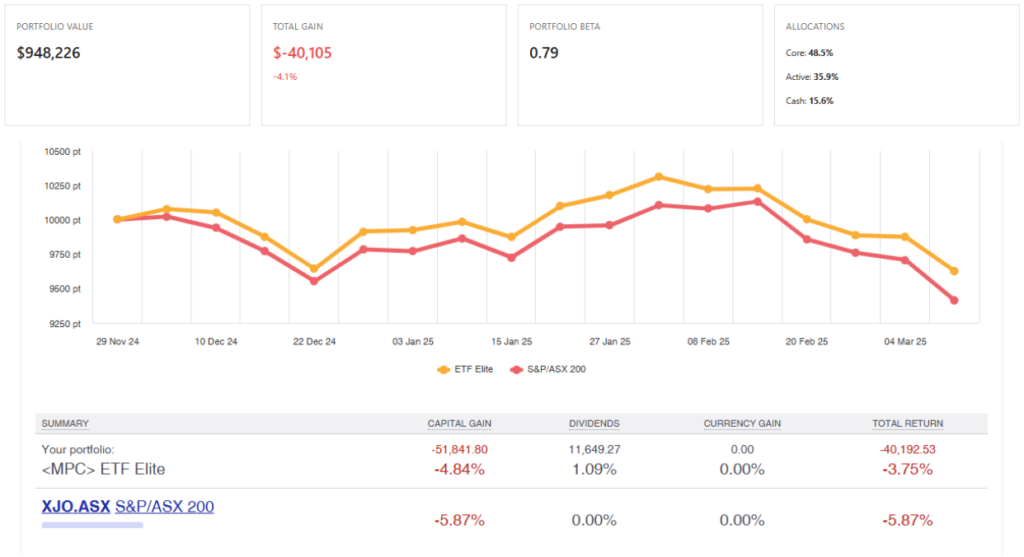

The discussion revolves around the ETF Elite Portfolio managed by MPC Markets, focusing on its performance and strategic adjustments for March 2025. The portfolio has shown a positive trajectory, outperforming the index by nearly 2% since its inception in December. This success is attributed to a cautious approach, particularly the decision to increase cash allocation as the market declined, which allowed for reallocation and locking in gains.

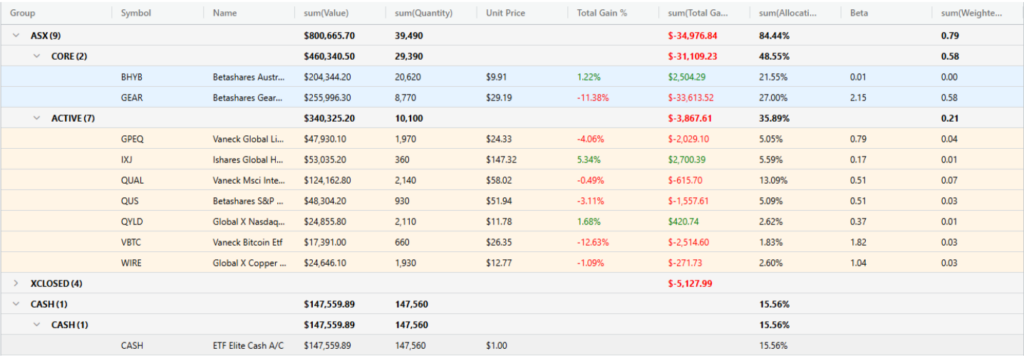

Portfolio Composition and Performance

Core Positions: The portfolio includes core positions in BHYB and GEAR, a leveraged long in the Australian market. These positions are part of the smart allocation strategy to maintain an active management approach.

Active Components: The portfolio has a 5% allocation to private equity (GPEQ), which has performed well despite recent market volatility. Healthcare investments have also been successful, contributing significantly to the portfolio’s performance.

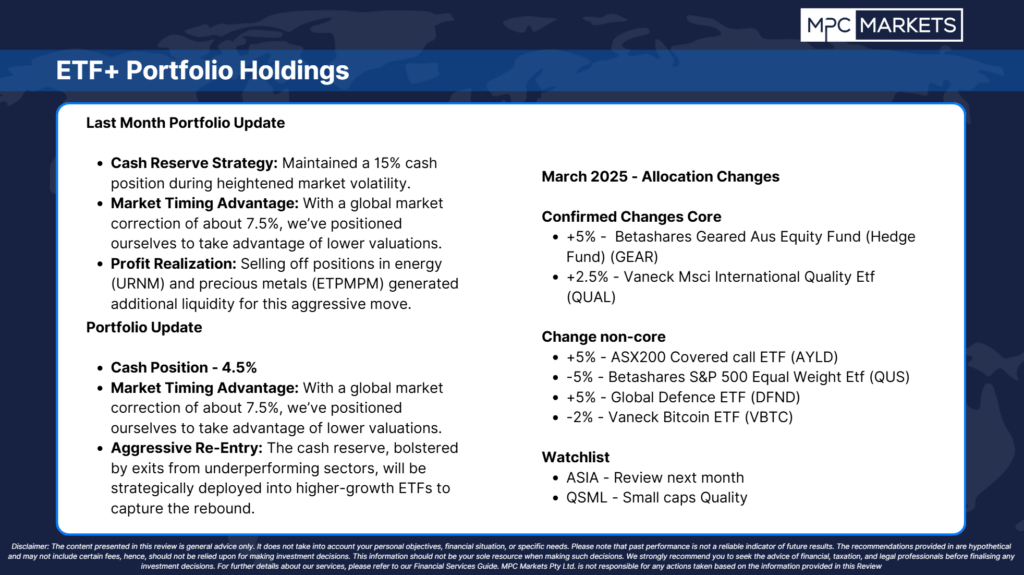

Cash Allocation: Currently, 15% of the portfolio is in cash, which has helped in avoiding losses during market downturns. This strategic move saved about 6% across the board on 15% of the portfolio.

Strategic Adjustments

Rebalancing: There is a need to rebalance the portfolio to meet the mandate of maintaining a beta between 0.8 and 1.0. Currently, the portfolio is under-allocated, meaning it only rises by 0.8% for every 1% increase in the market.

Proposed Additions: Proposals include adding more to GEAR and Qual, an Asian tech tigers ETF, and potentially increasing the allocation to Q Yield, a high-dividend ETF.

Geopolitical Considerations: Given geopolitical tensions, particularly with Trump’s policies, there is a consideration to add a geopolitical hedge. Initially, gold miners were suggested, but defense stocks are now being considered as a more logical play due to increased defense spending in Europe.

Specific Asset Discussions

Bitcoin: The portfolio holds a 2.5% allocation to Bitcoin, which is under review due to negative technical indicators. There is a proposal to reduce this allocation to 1% or sell it entirely, awaiting better entry points.

QUS and QOL: QUS, an equal-weighted ETF, is slated for removal and consolidation with QOL, which is considered a better index.

Q Yield vs. A Yield: There is a discussion about adding more to A Yield, an Australian dividend-focused ETF, while maintaining the current Q Yield allocation. A Yield offers a slightly higher distribution yield and is seen as a stable option.

Market Outlook and Strategy

Market Volatility: The market remains volatile, with concerns about potential downturns, particularly in the NASDAQ. The strategy involves maintaining some cash on hand to capitalize on future opportunities.

Covered Call Strategy: There is interest in exploring a covered call strategy in the Australian market, which could provide protection and income during market fluctuations.

Geopolitical Risks: The geopolitical situation, especially with Trump’s influence, suggests a need for defense stocks as a hedge. European defense stocks are highlighted as potential investments due to increased spending needs.

In summary, MPC Markets is navigating a cautious yet opportunistic strategy with its ETF Elite Portfolio. The focus is on maintaining a balanced risk profile while capitalizing on market opportunities, particularly through active management and strategic asset allocation. The geopolitical landscape and market volatility continue to influence investment decisions, with a keen eye on potential hedges and high-yield investments.

Disclaimer: The recommendation given is general advice only. It does not take into account your personal objectives, financial situation, or specific needs. This information should not be your sole resource when making such decisions. We strongly recommend you to seek the advice of financial, taxation, and legal professionals before finalising any investment decisions.