The 2025 Australian Federal Budget, was delivered by Treasurer Jim Chalmers overnight with the focus definitely high on trigger issues for election “sound-bites”, but as per usual in politics these days, low on significant policy and reform.

summary of the winners and losers from the 2025 Australian federal budget in bullet points:

Winners

All Workers: Tax cuts will benefit every worker, with savings of up to $268 in the first year and $536 by mid-2027.

Low-Income Households: Increased Medicare levy low-income thresholds will exempt more households from paying the levy or reduce their rate.

Patients: Reduced prescription medicine costs, increased bulk billing incentives for GPs, and more Medicare urgent care clinics.

Aged Care Nurses: Additional funding for pay rises.

Students: University student loan balances reduced by 20%, increased funding for schools, and expanded free TAFE.

Home Buyers: Expanded Help to Buy scheme and incentives for modular homes.

Tradies: Increased incentives for apprentices and a national licensing scheme for electricians.

Internet Users: National Broadband Network upgrade funding.

Musicians: Extended funding for live music venues.

Australian Producers: Advertising campaign to promote Australian-made goods.

Pacific Islands: Increased aid and loans to support regional security and development.

Losers

Multinationals: Increased crackdown on tax avoidance.

Consultants: Reduced access to government contracts.

ASIC: Budget cuts for hiring outside lawyers.

Illicit Tobacco Traders: Increased efforts to disrupt the illicit tobacco trade.

Supermarkets: Enhanced ACCC investigations into price practices.

NDIS Fraudsters: Increased efforts to combat fraud.

Foreign Home Buyers: Temporary ban on buying existing homes.

Russians and Belarussians: Extended tariffs on goods from Russia and Belarus.

Context

Economic Outlook

The budget will also provide key economic forecasts, including inflation projections. Treasury has previously forecast inflation to moderate below 3% per annum, supported by measures like the Energy Price Relief Plan. However, global factors, including the impact of US tariffs and economic trends in major trading partners like China, will play a significant role in shaping Australia’s economic outlook.

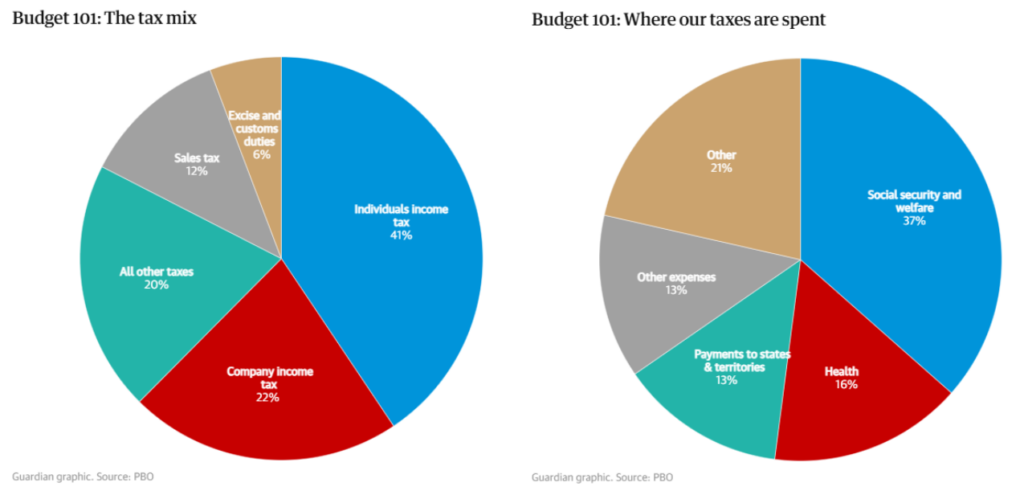

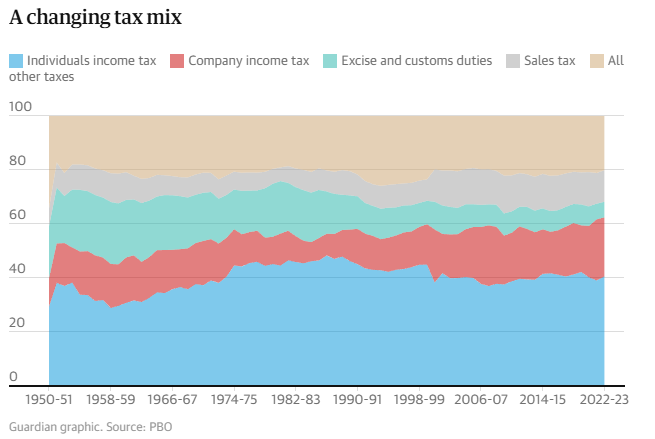

Revenue Sources

The revenue for these initiatives will primarily come from a combination of tax receipts, commodity prices, and borrowing. The government’s net debt is expected to remain stable as a percentage of GDP, between 20 and 22% over the forward estimates. Key revenue streams include tax incentives for critical minerals production and hydrogen production, as well as tax compliance measures targeting large businesses and high-wealth individuals.

ASK A QUESTION

Got questions? Ask one of our experienced advisors about this article

GENERAL ADVICE WARNING:

Recommendations and reports managed and presented by MPC Markets Pty Ltd (ABN 33 668 234 562), as a Corporate Authorised Representative of LeMessurier Securities Pty Ltd (ABN 43 111 931 849) (LemSec), holder of Australian Financial Services Licence No. 296877, offers insights and analyses formulated in good faith and

Opinions and recommendations made by MPC Markets are GENERAL ADVICE ONLY and DO NOT TAKE INTO ACCOUNT YOUR PERSONAL CIRCUMSTANCES, always consult a financial professional before making any decisions.